A Clear Roadmap for Value Creation

Qualcomm committed to deliver compelling value

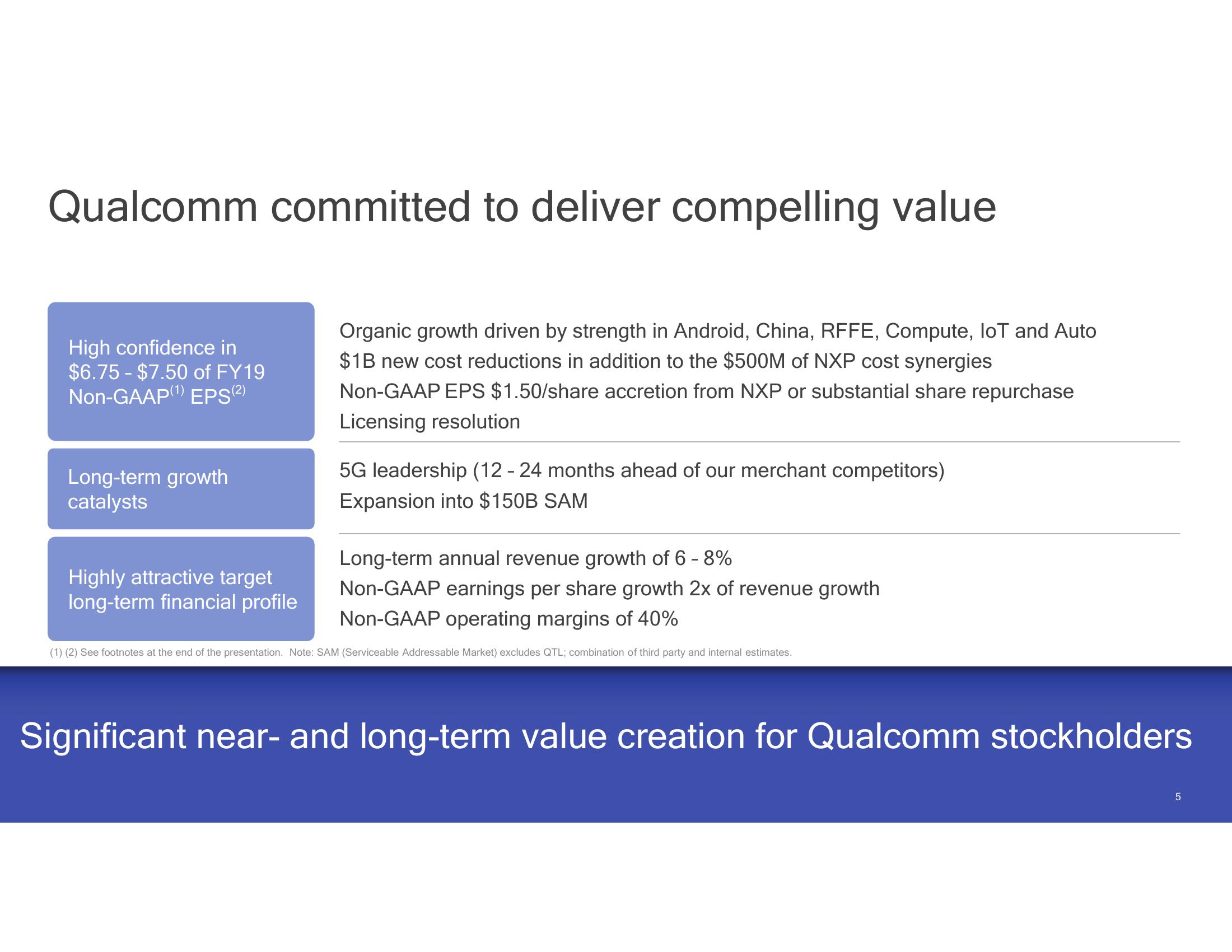

High confidence in

$6.75 - $7.50 of FY19

Non-GAAP(¹) EPS (²)

Long-term growth

catalysts

Highly attractive target

long-term financial profile

Organic growth driven by strength in Android, China, RFFE, Compute, loT and Auto

$1B new cost reductions in addition to the $500M of NXP cost synergies

Non-GAAP EPS $1.50/share accretion from NXP or substantial share repurchase

Licensing resolution

5G leadership (12 - 24 months ahead of our merchant competitors)

Expansion into $150B SAM

Long-term annual revenue growth of 6 - 8%

Non-GAAP earnings per share growth 2x of revenue growth

Non-GAAP operating margins of 40%

(1) (2) See footnotes at the end of the presentation. Note: SAM (Serviceable Addressable Market) excludes QTL; combination of third party and internal estimates.

Significant near- and long-term value creation for Qualcomm stockholders

5View entire presentation