Evercore Investment Banking Pitch Book

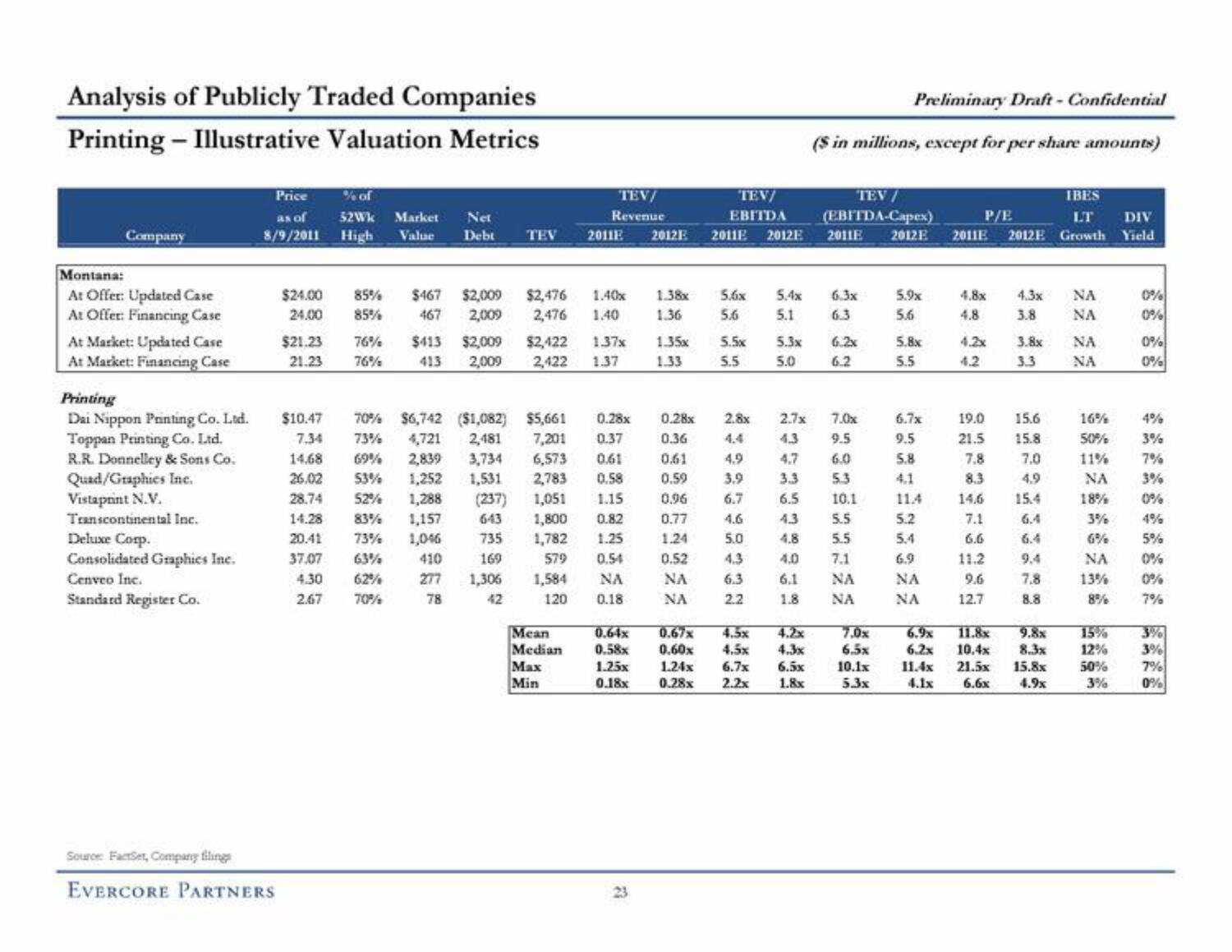

Analysis of Publicly Traded Companies

Printing - Illustrative Valuation Metrics

Company

Montana:

At Offer: Updated Case

At Offer: Financing Case

At Market: Updated Case

At Market: Financing Case

Printing

Dai Nippon Printing Co. Ltd.

Toppan Printing Co. Ltd.

R.R. Donnelley & Sons Co.

Quad/Graphies Inc.

Vistaprint N.V.

Transcontinental Inc.

Deluxe Corp.

Consolidated Graphics Inc.

Cenveo Inc.

Standard Register Co.

Price

as of

8/9/2011

Source: FactSet, Company filings

EVERCORE PARTNERS

$24.00

24.00

$21.23

21.23

$10.47

7.34

14.68

26.02

28.74

14.28

20.41

37.07

4.30

2.67

% of

52Wk Market

High Value

Net

Debt

85%

$467

85% 467 2,009

76% $413 $2,009

76%

413 2,009

TEV

3,734

1,531

$2,009 $2,476 1.40x

70% $6,742 ($1,082) $5,661

73% 4,721 2,481

69% 2,839

53% 1,252

52% 1,288

83% 1,157

73% 1,046

63%

410

62%

277

70%

78

TEV/

Revenue

(237)

643 1,800

735

1,782

169

579

1,306

42

2011E

1,584

120

7,201 0.37

6,573

0.61

2,783

0.58

1,051

1.15

0.82

1.25

0.54

NA

0.18

Mean

Median

Max

Min

1.38x

2,476 1.40

1.36

5.6

$2,422 1.37x 1.35x 5.5x

2,422 1.37 1.33 5.5

0.64x

0.58x

2012E

1.25x

0.18x

TEV/

EBITDA

0.28x 0.28x 2.8x

0.36

0.61

0.59

0.96

0.77

1.24

0.52

NA

NA

33

2011E 2012E

5.6x 5.4x 6.3x

5.1 6.3

5.3x

6.2x

5.0

6.2

4.9

3.9

6.7

4.6

5.0

4.3

6.3

2.2

Preliminary Draft - Confidential

($ in millions, except for per share amounts)

TEV /

(EBITDA-Capex)

0.67x 4.5x

0.60x

4.5x

124x

6.7x 6.5x

0.28x

2.2x

1.8x

2011E

2.7x

7.0x

4.3

9.5

4.7

6.0

3.3

5.3

6.5

10.1

4.3

5.5

4.8

5.5

4.0 7.1

6.1 NA

1.8

ΝΑ

7.0x

6.5x

10.1x

5.3x

2012 E

5.9x

5.6

5.8x

5.5

6.7x

9.5

5.8

4.1

11.4

5.2

5.4

6.9

NA

NA

IBES

LT DIV

2011E 2012E Growth Yield

P/E

4.8x

4.8

4.2x

4.2

4.3x

NA

3.8 NA

6.9x

6.2x 10.4x

11.4x 25

4.1x 6.6x

3.8x

3.3

19.0 15.6

21.5

15.8

7.8

7.0

8.3

4.9

14.6

15.4

7.1

6.4

6.6

6.4

11.2

9.4

9.6

7.8

12.7

8.8

11.8x 9.8x

8.3x

15.8x

4.9x

NA

NA

16%

50%

11%

NA

18%

3%

6%

NA

13%

8%

15%

12%

50%

3%

0%

0%

0%

0%

4%

3%

7%

3%

0%

4%

5%

0%

0%

7%

3%

3%

7%

0%View entire presentation