Experian ESG Presentation Deck

Executive Summary Improving Financial Health

Employees

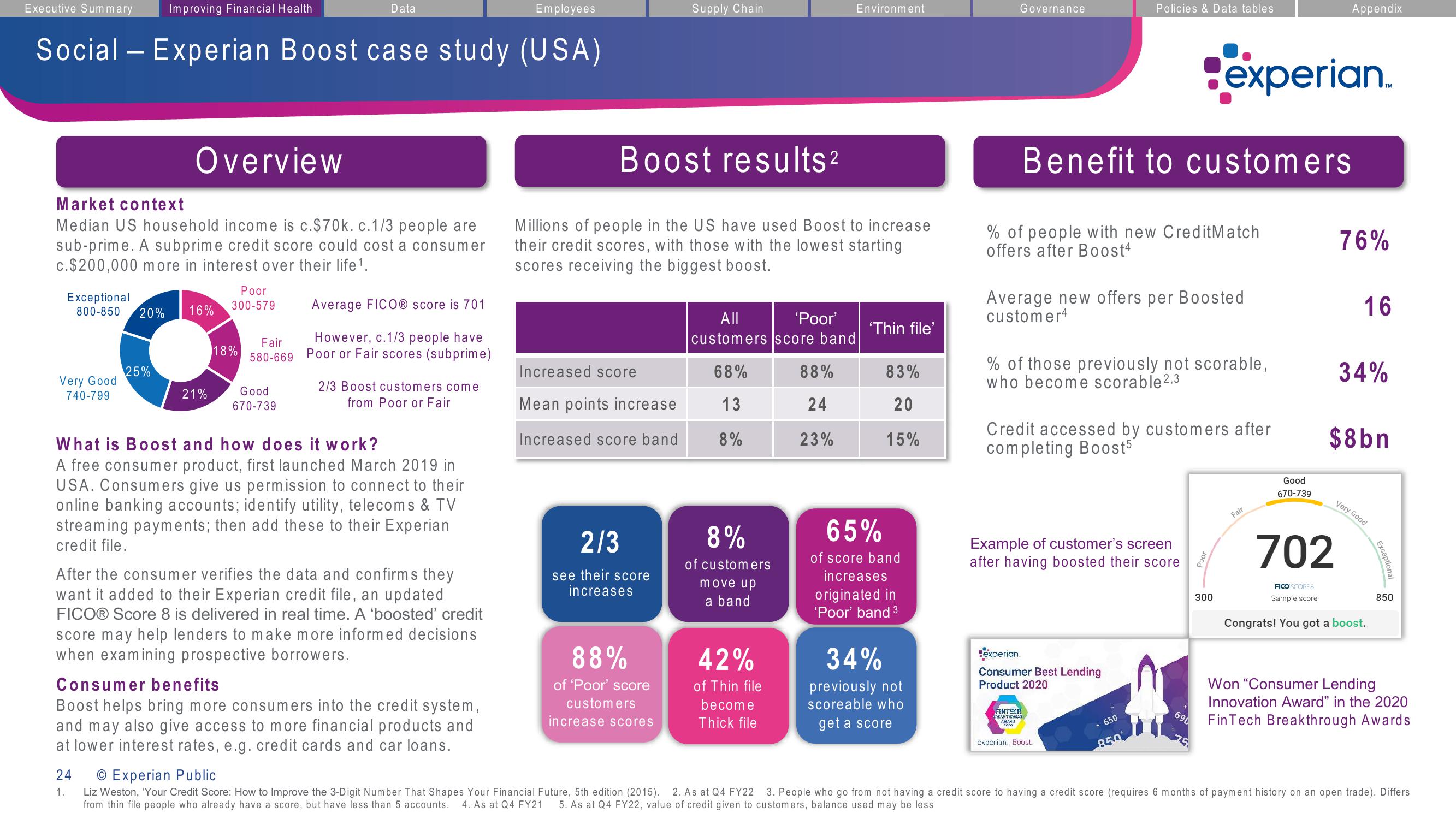

Social - Experian Boost case study (USA)

Overview

Market context

Median US household income is c.$70k. c.1/3 people are

sub-prime. A subprime credit score could cost a consumer

c.$200,000 more in interest over their life ¹.

Exceptional

800-850

Very Good

740-799

20%

25%

16%

24

1.

21%

Poor

300-579

18%

Fair

580-669

Data

Good

670-739

Average FICO® score is 701

However, c.1/3 people have

Poor or Fair scores (subprime)

2/3 Boost customers come

from Poor or Fair

What is Boost and how does it work?

A free consumer product, first launched March 2019 in

USA. Consumers give us permission to connect to their

online banking accounts; identify utility, telecoms & TV

streaming payments; then add these to their Experian

credit file.

After the consumer verifies the data and confirms they

want it added to their Experian credit file, an updated

FICO® Score 8 is delivered in real time. A 'boosted' credit

score may help lenders to make more informed decisions

when examining prospective borrowers.

Consumer benefits

Boost helps bring more consumers into the credit system,

and may also give access to more financial products and

at lower interest rates, e.g. credit cards and car loans.

Increased score

Mean points increase

Increased score band

Boost results²

Millions of people in the US have used Boost to increase

their credit scores, with those with the lowest starting

scores receiving the biggest boost.

2/3

see their score

increases

Supply Chain

88%

of 'Poor' score

customers

increase scores

All

'Poor'

customers score band

68%

13

8%

8%

of customers

move up

a band

42%

of Thin file

become

Thick file

Environment

88%

24

23%

'Thin file'

83%

20

15%

65%

of score band

increases

originated in

'Poor' band ³

34%

previously not

scoreable who

get a score

Governance

Benefit to customers

% of people with new CreditMatch

offers after Boost4

Average new offers per Boosted

customer4

Policies & Data tables

% of those previously not scorable,

who become scorable 2,3

Credit accessed by customers after

completing Boost5

Example of customer's screen

after having boosted their score

experian

Consumer Best Lending

Product 2020

FINTSCH

REAKTIGHOUCH

ΑΝΑΖΗ

experian. Boost

* 650

experian

850

690

300

Fair

Appendix

Good

670-739

76%

16

TM

34%

$8bn

Very Good

702

FICO SCORE 8

Sample score

Congrats! You got a boost.

Exceptional

850

Won "Consumer Lending

Innovation Award" in the 2020

FinTech Breakthrough Awards

O Experian Public

Liz Weston, 'Your Credit Score: How to Improve the 3-Digit Number That Shapes Your Financial Future, 5th edition (2015). 2. As at Q4 FY22 3. People who go from not having a credit score to having a credit score (requires 6 months of payment history on an open trade). Differs

from thin file people who already have a score, but have less than 5 accounts. 4. As at Q4 FY21 5. As at Q4 FY22, value of credit given to customers, balance used may be lessView entire presentation