Avantor Investor Conference Presentation Deck

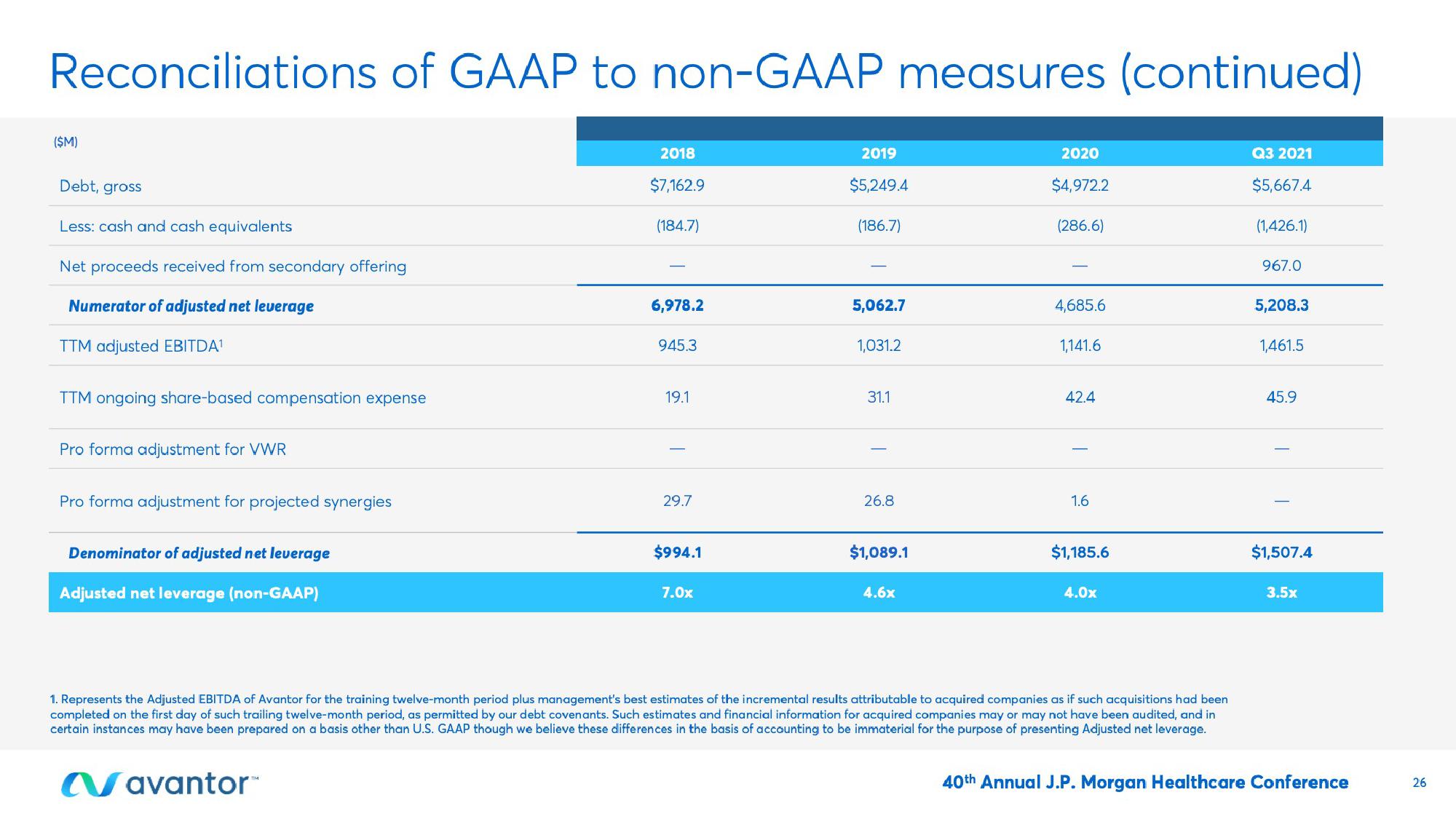

Reconciliations of GAAP to non-GAAP measures (continued)

($M)

Debt, gross

Less: cash and cash equivalents

Net proceeds received from secondary offering

Numerator of adjusted net leverage

TTM adjusted EBITDA¹

TTM ongoing share-based compensation expense

Pro forma adjustment for VWR

Pro forma adjustment for projected synergies

Denominator of adjusted net leverage

Adjusted net leverage (non-GAAP)

2018

$7,162.9

(184.7)

6,978.2

945.3

19.1

29.7

$994.1

7.0x

2019

$5,249.4

(186.7)

5,062.7

1,031.2

31.1

26.8

$1,089.1

4.6x

2020

$4,972.2

(286.6)

4,685.6

1,141.6

42.4

1.6

$1,185.6

4.0x

1. Represents the Adjusted EBITDA of Avantor for the training twelve-month period plus management's best estimates of the incremental results attributable to acquired companies as if such acquisitions had been

completed on the first day of such trailing twelve-month period, as permitted by our debt covenants. Such estimates and financial information for acquired companies may or may not have been audited, and in

certain instances may have been prepared on a basis other than U.S. GAAP though we believe these differences in the basis of accounting to be immaterial for the purpose of presenting Adjusted net leverage.

Navantor™

Q3 2021

$5,667.4

(1,426.1)

967.0

5,208.3

1,461.5

45.9

$1,507.4

3.5x

40th Annual J.P. Morgan Healthcare Conference

26View entire presentation