Bank of America Investment Banking Pitch Book

Appendix

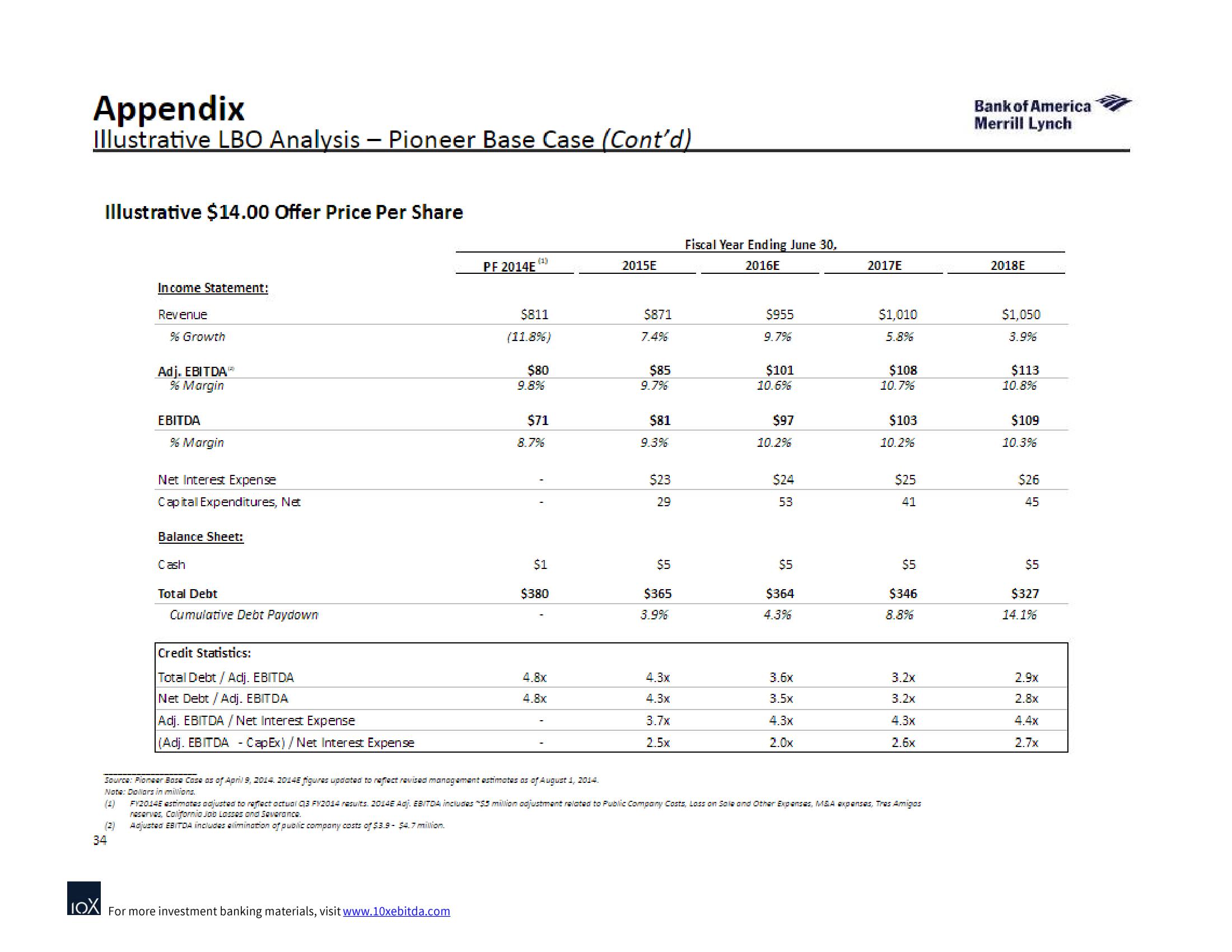

Illustrative LBO Analysis - Pioneer Base Case (Cont'd)

Illustrative $14.00 Offer Price Per Share

Income Statement:

Revenue

% Growth

Adj. EBITDAⓇ

% Margin

EBITDA

% Margin

Net Interest Expense

Capital Expenditures, Net

Balance Sheet:

Cash

Total Debt

Cumulative Debt Paydown

Credit Statistics:

Total Debt / Adj. EBITDA

Net Debt / Adj. EBITDA

Adj. EBITDA / Net Interest Expense

(Adj. EBITDA - CapEx)/ Net Interest Expense

PF 2014E

$811

(11.8%)

IOX For more investment banking materials, visit www.10xebitda.com

$80

9.8%

$71

8.7%

$1

$380

4.8x

4.8x

Source: Pioneer Base Casa as of April 9, 2014. 20145 figures updated to reflect revised management estimates as of August 1, 2014.

Note: Dollars in milions.

2015E

$871

$85

9.7%

$81

9.3%

$23

2.9

$5

$365

3.9%

4.3x

4.3x

3.7x

2.5x

Fiscal Year Ending June 30,

2016E

$955

9.7%

$101

10.6%

$97

10.2%

$24

53

$5

$364

4.3%

3.6x

3.5x

4.3x

2.0x

2017E

$1,010

5.8%

$108

10.7%

$103

10.2%

$25

41

$5

$346

8.8%

3.2x

3.2x

4.3x

2.6x

FY2014E estimates adjusted to reflect actual 3 FY2014 results. 2014E Adj. EBITDA includes $5 million adjustment related to Public Company Costs, Loss on Sale and Other Expenses, M&A expansas, Tras Amigas

reserves, California Job Lasses and Saverance.

(2) Adjusted EBITDA includes alimination of public company costs of $3.9- $4.7 million.

34

Bank of America

Merrill Lynch

2018E

$1,050

3.9%

$113

10.8%

$109

10.3%

$26

45

$5

$327

14.1%

2.9x

2.8x

4.4x

2.7xView entire presentation