AMD Results Presentation Deck

20

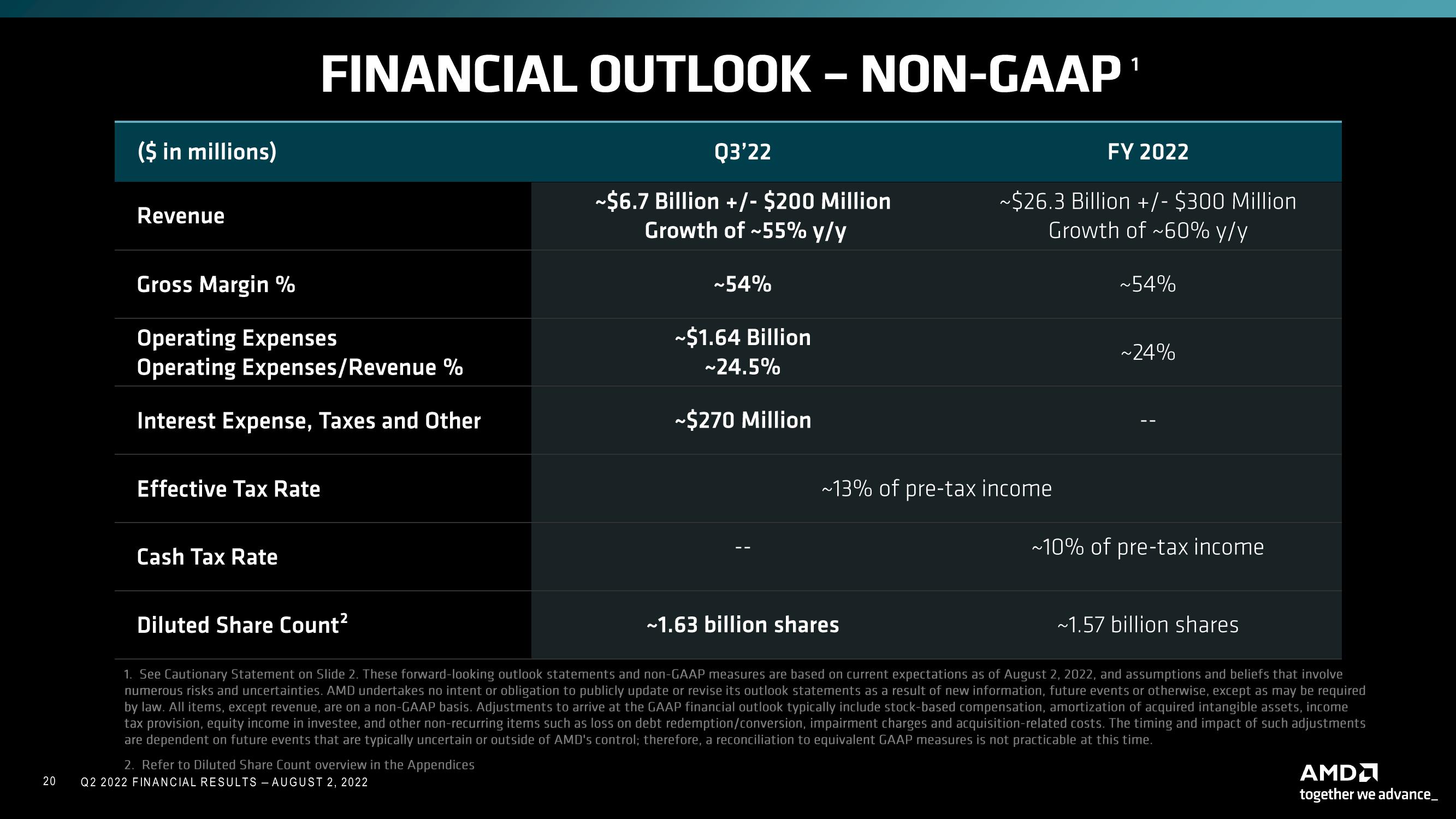

($ in millions)

Revenue

FINANCIAL OUTLOOK - NON-GAAP¹

Gross Margin %

Operating Expenses

Operating Expenses/Revenue %

Interest Expense, Taxes and Other

Effective Tax Rate

Cash Tax Rate

2. Refer to Diluted Share Count overview in the Appendices

Q3'22

~$6.7 Billion +/- $200 Million

Growth of ~55% y/y

Q2 2022 FINANCIAL RESULTS - AUGUST 2, 2022

~54%

~$1.64 Billion

~24.5%

~$270 Million

FY 2022

~$26.3 Billion +/- $300 Million

Growth of ~60% y/y

~13% of pre-tax income

~54%

~24%

Diluted Share Count²

~1.63 billion shares

1. See Cautionary Statement on Slide 2. These forward-looking outlook statements and non-GAAP measures are based on current expectations as of August 2, 2022, and assumptions and beliefs that involve

numerous risks and uncertainties. AMD undertakes no intent or obligation to publicly update or revise its outlook statements as a result of new information, future events or otherwise, except as may be required

by law. All items, except revenue, are on a non-GAAP basis. Adjustments to arrive at the GAAP financial outlook typically include stock-based compensation, amortization of acquired intangible assets, income

tax provision, equity income in investee, and other non-recurring items such as loss on debt redemption/conversion, impairment charges and acquisition-related costs. The timing and impact of such adjustments

are dependent on future events that are typically uncertain or outside of AMD's control; therefore, a reconciliation to equivalent GAAP measures is not practicable at this time.

~10% of pre-tax income

~1.57 billion shares

AMD

together we advance_View entire presentation