Credit Suisse Investment Banking Pitch Book

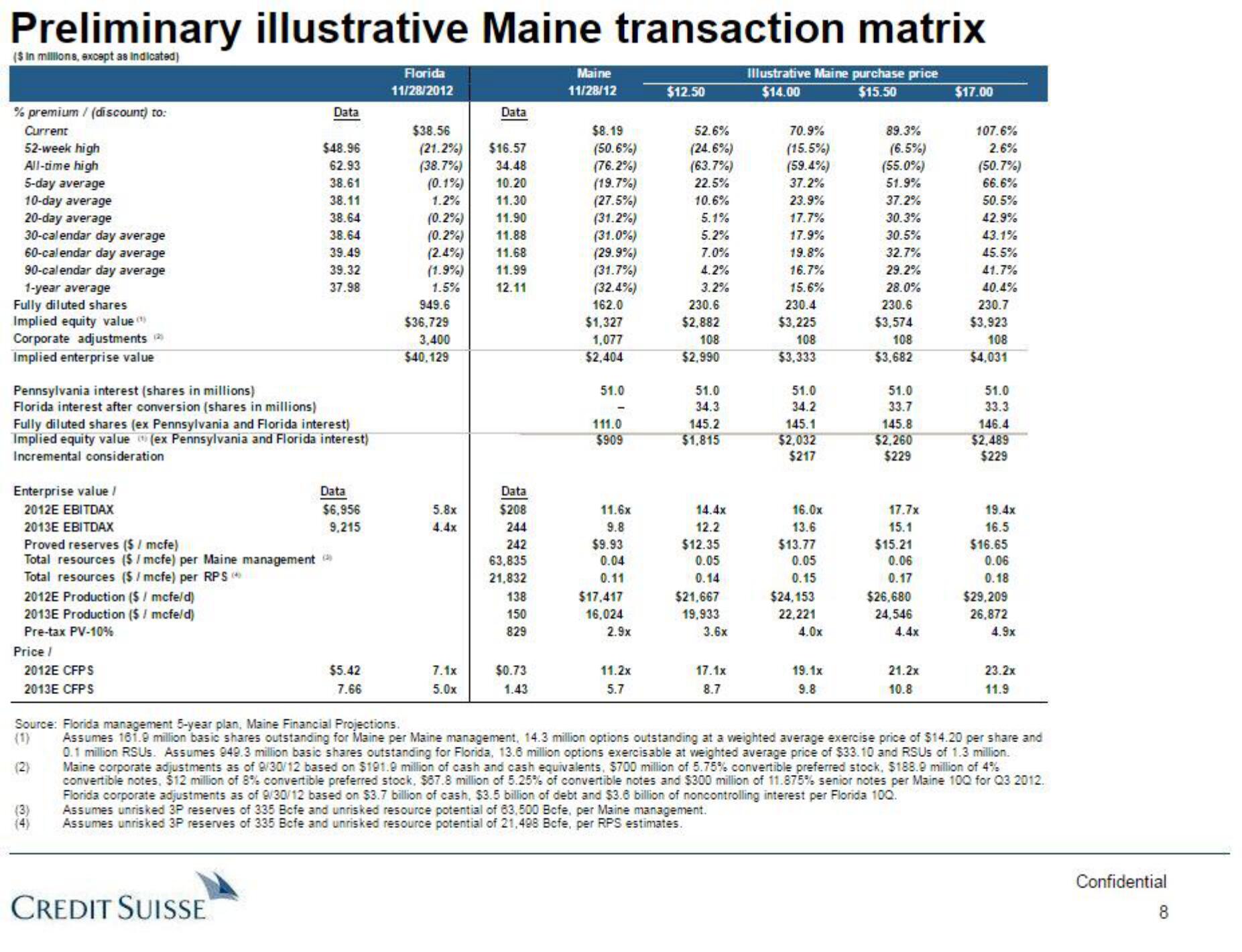

Preliminary illustrative Maine transaction matrix

($ in millions, except as indicated)

% premium / (discount) to:

Current

52-week high

All-time high

5-day average

10-day average

20-day average

30-calendar day average

60-calendar day average

90-calendar day average

1-year average

Fully diluted shares

Implied equity value (¹)

Corporate adjustments (2)

Implied enterprise value

Pennsylvania interest (shares in millions)

Florida interest after conversion (shares in millions)

Enterprise value /

2012E EBITDAX

Fully diluted shares (ex Pennsylvania and Florida interest)

Implied equity value (ex Pennsylvania and Florida interest)

Incremental consideration

2012E Production ($/ mcfe/d)

2013E Production ($ / mcfe/d)

Pre-tax PV-10%

2013E EBITDAX

Proved reserves ($ / mcfe)

Total resources ($/ mcfe) per Maine management (

Total resources ($/mcfe) per RPS →

Price /

2012E CFPS

2013E CFPS

Data

$48.96

62.93

38.61

38.11

38.64

38.64

39.49

39.32

37.98

(3)

CREDIT SUISSE

Data

$6,956

9,215

$5.42

7.66

Florida

11/28/2012

$38.56

(21.2%) $16.57

(38.7%)

34.48

10.20

(0.1%)

1.2%

11.30

(0.2%)

11.90

(0.2%)

11.88

(2.4%) 11.68

(1.9%)

11.99

12.11

1.5%

949.6

$36,729

3,400

$40,129

5.8x

4.4x

Data

7.1x

5.0x

Data

$208

244

242

63,835

21,832

138

150

829

$0.73

1.43

Maine

11/28/12

$8.19

(50.6%)

(76.2%)

(19.7%)

(27.5%)

(31.2%)

(31.0%)

(29.9%)

(31.7%)

(32.4%)

162.0

$1,327

1,077

$2,404

51.0

111.0

$909

11.6x

9.8

$9.93

0.04

0.11

$17,417

16,024

2.9x

11.2x

5.7

$12.50

52.6%

(24.6%)

(63.7%)

22.5%

10.6%

5.1%

5.2%

7.0%

4.2%

3.2%

230.6

$2,882

108

$2,990

51.0

34.3

145.2

$1,815

14.4x

12.2

$12.35

0.05

0.14

$21,667

19,933

3.6x

17.1x

8.7

Illustrative Maine purchase price

$14.00

$15.50

70.9%

(15.5%)

(59.4%)

37.2%

23.9%

17.7%

17.9%

19.8%

16.7%

15.6%

230.4

$3,225

108

$3,333

51.0

34.2

145.1

$2,032

$217

16.0x

13.6

$13.77

0.05

0.15

$24,153

22,221

4.0x

19.1x

9.8

89.3%

(6.5%)

(55.0%)

51.9%

37.2%

30.3%

30.5%

32.7%

29.2%

28.0%

230.6

$3,574

108

$3,682

51.0

33.7

145.8

$2,260

$229

17.7x

15.1

$15.21

0.06

0.17

$26,680

24,546

4.4x

21.2x

10.8

$17.00

107.6%

2.6%

(50.7%)

66.6%

50.5%

42.9%

43.1%

45.5%

41.7%

40.4%

230.7

$3,923

108

$4,031

51.0

33.3

146.4

$2,489

$229

19.4x

16.5

$16.65

0.06

0.18

$29,209

26,872

4.9x

(2)

Source: Florida management 5-year plan, Maine Financial Projections.

(1) Assumes 161.9 million basic shares outstanding for Maine per Maine management, 14.3 million options outstanding at a weighted average exercise price of $14.20 per share and

0.1 million RSUS. Assumes 949.3 million basic shares outstanding for Florida, 13.6 million options exercisable at weighted average price of $33.10 and RSUS of 1.3 million.

Maine corporate adjustments as of 9/30/12 based on $191.9 million of cash and cash equivalents, $700 million of 5.75% convertible preferred stock, $188.9 million of 4%

convertible notes, $12 million of 8% convertible preferred stock, $87.8 million of 5.25% of convertible notes and $300 million of 11.875% senior notes per Maine 100 for Q3 2012.

Florida corporate adjustments as of 9/30/12 based on $3.7 billion of cash, $3.5 billion of debt and $3.6 billion of noncontrolling interest per Florida 100.

Assumes unrisked 3P reserves of 335 Befe and unrisked resource potential of 63,500 Bofe, per Maine management.

Assumes unrisked 3P reserves of 335 Bcfe and unrisked resource potential of 21,498 Bcfe, per RPS estimates.

23.2x

11.9

Confidential

8View entire presentation