Engine No. 1 Activist Presentation Deck

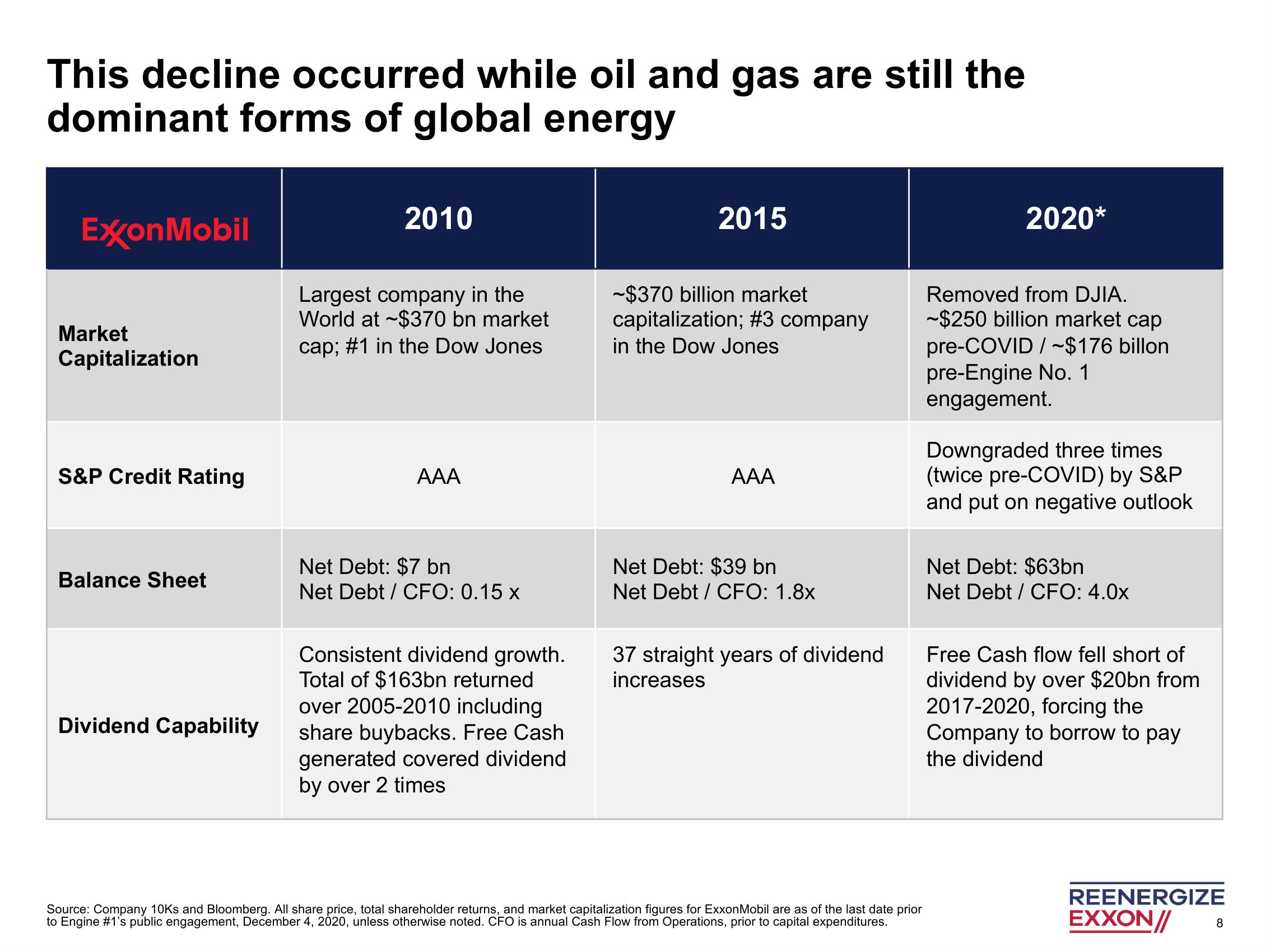

This decline occurred while oil and gas are still the

dominant forms of global energy

ExxonMobil

Market

Capitalization

S&P Credit Rating

Balance Sheet

Dividend Capability

2010

Largest company in the

World at -$370 bn market

cap; #1 in the Dow Jones

AAA

Net Debt: $7 bn

Net Debt / CFO: 0.15 x

Consistent dividend growth.

Total of $163bn returned

over 2005-2010 including

share buybacks. Free Cash

generated covered dividend

by over 2 times

2015

-$370 billion market

capitalization; #3 company

in the Dow Jones

AAA

Net Debt: $39 bn

Net Debt / CFO: 1.8x

37 straight years of dividend

increases

Source: Company 10Ks and Bloomberg. All share price, total shareholder returns, and market capitalization figures for ExxonMobil are as of the last date prior

to Engine #1's public engagement, December 4, 2020, unless otherwise noted. CFO is annual Cash Flow from Operations, prior to capital expenditures.

2020*

Removed from DJIA.

-$250 billion market cap

pre-COVID/-$176 billon

pre-Engine No. 1

engagement.

Downgraded three times

(twice pre-COVID) by S&P

and put on negative outlook

Net Debt: $63bn

Net Debt / CFO: 4.0x

Free Cash flow fell short of

dividend by over $20bn from

2017-2020, forcing the

Company to borrow to pay

the dividend

REENERGIZE

EXXON//

8View entire presentation