Telia Company Investor Day Presentation Deck

SWEDEN - Q4 2020

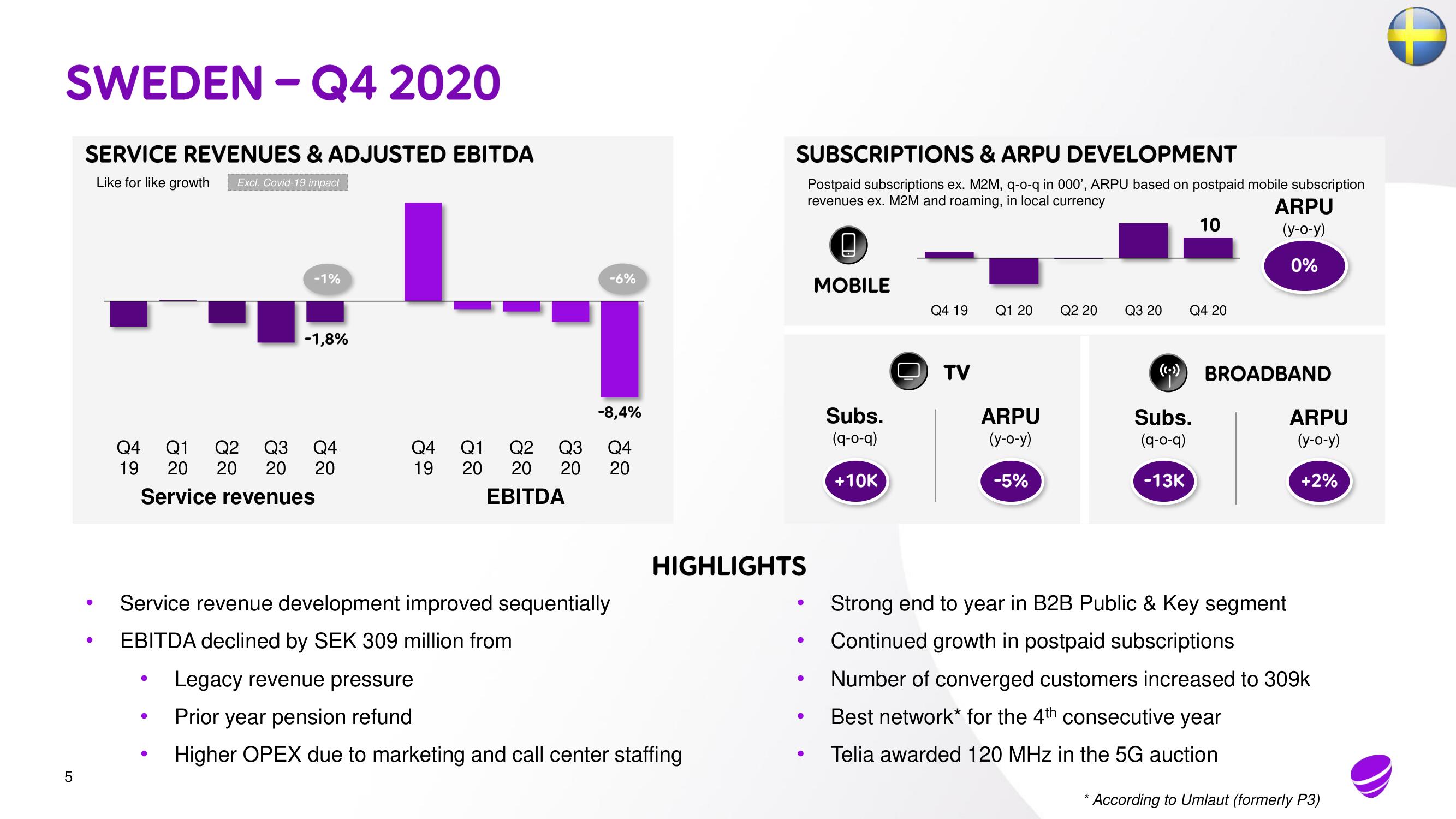

SERVICE REVENUES & ADJUSTED EBITDA

Like for like growth Excl. Covid-19 impact

●

●

-1%

Q4 Q1

Q2 Q3 Q4

19 20 20 20 20

Service revenues

●

-1,8%

●

-6%

Service revenue development improved sequentially

EBITDA declined by SEK 309 million from

-8,4%

Q4

Q1 Q2 Q3 Q4

19 20 20 20 20

EBITDA

SUBSCRIPTIONS & ARPU DEVELOPMENT

Postpaid subscriptions ex. M2M, q-o-q in 000', ARPU based on postpaid mobile subscription

revenues ex. M2M and roaming, in local currency

10

HIGHLIGHTS

Legacy revenue pressure

Prior year pension refund

Higher OPEX due to marketing and call center staffing

●

●

●

●

MOBILE

Subs.

(q-o-q)

+10K

Q4 19

TV

Q1 20

ARPU

(y-o-y)

-5%

Q2 20

Q3 20

Q4 20

ARPU

(y-o-y)

0%

(BROADBAND

Subs.

(q-o-q)

-13K

Strong end to year in B2B Public & Key segment

Continued growth in postpaid subscriptions

ARPU

(y-o-y)

+2%

Number of converged customers increased to 309k

Best network for the 4th consecutive year

Telia awarded 120 MHz in the 5G auction

* According to Umlaut (formerly P3)View entire presentation