Netstreit Investor Presentation Deck

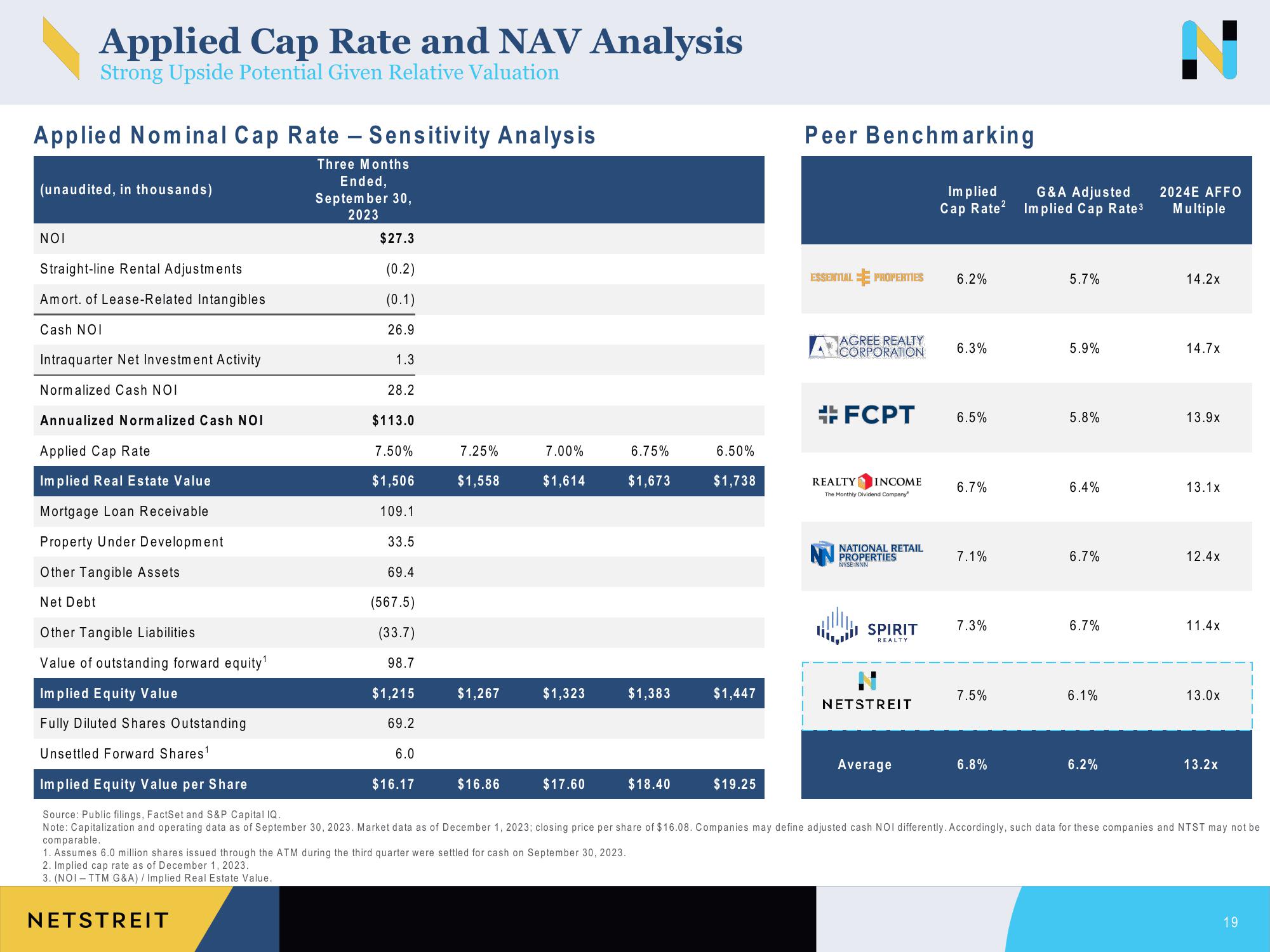

Applied Cap Rate and NAV Analysis

Strong Upside Potential Given Relative Valuation

Applied Nominal Cap Rate - Sensitivity Analysis

Three Months

Ended,

September 30,

2023

(unaudited, in thousands)

NOI

Straight-line Rental Adjustments

Amort. of Lease-Related Intangibles

Cash NOI

Intraquarter Net Investment Activity

Normalized Cash NOI

Annualized Normalized Cash NOI

Applied Cap Rate

Implied Real Estate Value

Mortgage Loan Receivable

Property Under Development

Other Tangible Assets

Net Debt

Other Tangible Liabilities

Value of outstanding forward equity¹

Implied Equity Value

Fully Diluted Shares Outstanding

Unsettled Forward Shares¹

1

$27.3

(0.2)

(0.1)

26.9

NETSTREIT

1.3

28.2

$113.0

7.50%

$1,506

109.1

33.5

69.4

(567.5)

(33.7)

98.7

$1,215

69.2

6.0

$16.17

7.25%

$1.558

$1,267

$16.86

7.00%

$1,614

$1,323

$17.60

6.75%

$1,673

$1,383

$18.40

6.50%

$1,738

$1,447

$19.25

Peer Benchmarking

ESSENTIAL PROPERTIES

AGREE REALTY

CORPORATION

#FCPT

REALTY INCOME

The Monthly Dividend Company

NATIONAL RETAIL

PROPERTIES

NYSE:NNN

REALTY

N

NETSTREIT

Average

Implied G&A Adjusted

Cap Rate² Implied Cap Rate³

6.2%

6.3%

6.5%

6.7%

7.1%

7.3%

7.5%

6.8%

5.7%

5.9%

5.8%

6.4%

6.7%

6.7%

6.1%

6.2%

2024E AFFO

Multiple

14.2x

14.7x

13.9x

13.1x

12.4x

11.4x

13.0x

Implied Equity Value per Share

Source: Public filings, FactSet and S&P Capital IQ.

Note: Capitalization and operating data as of September 30, 2023. Market data as of December 1, 2023; closing price per share of $16.08. Companies may define adjusted cash NOI differently. Accordingly, such data for these companies and NTST may not be

comparable.

1. Assumes 6.0 million shares issued through the ATM during the third quarter were settled for cash on September 30, 2023.

2. Implied cap rate as of December 1, 2023.

3. (NOI-TTM G&A) / Implied Real Estate Value.

13.2x

19View entire presentation