Sportradar IPO Presentation Deck

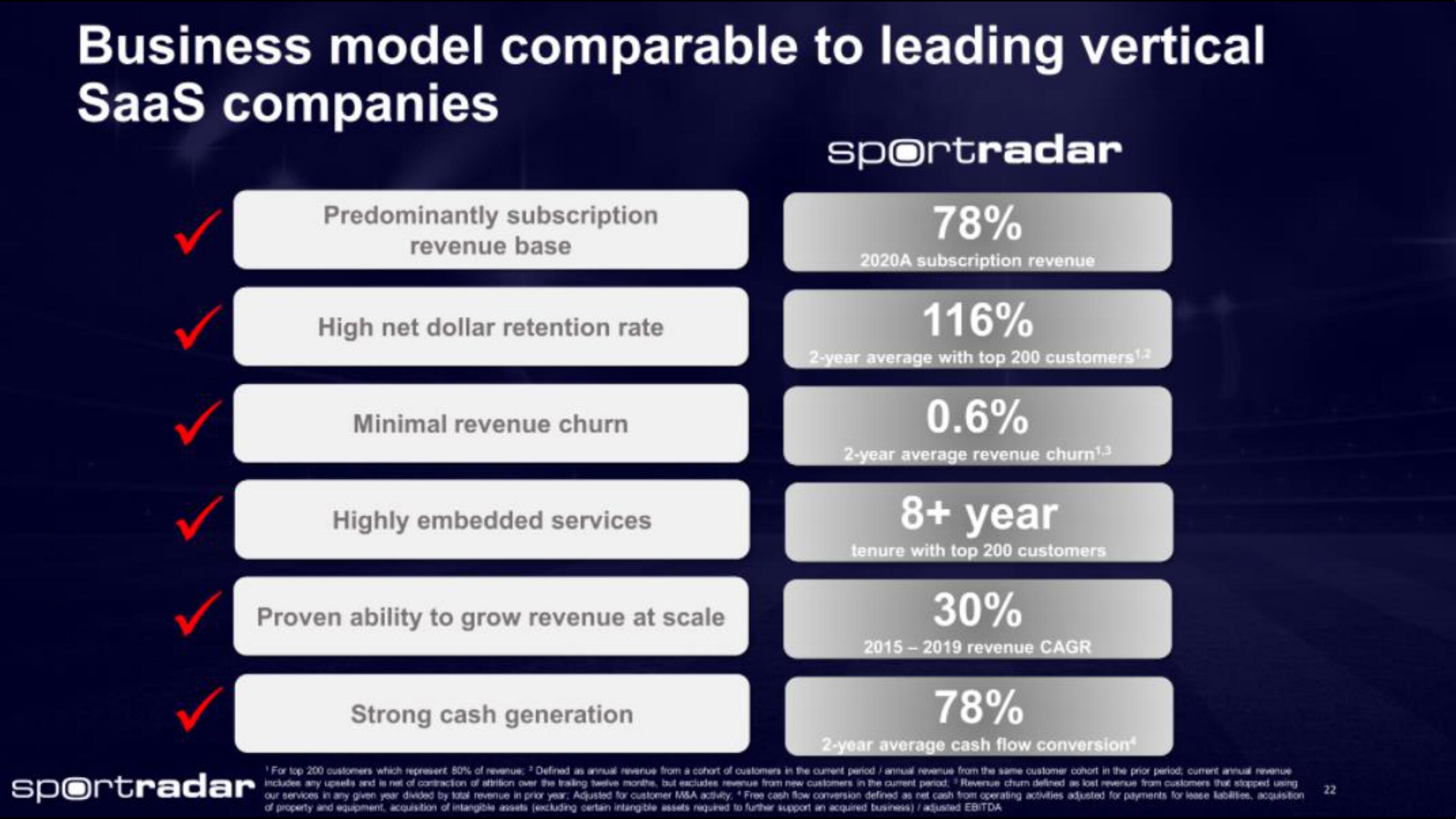

Business model comparable

SaaS companies

Predominantly subscription

revenue base

High net dollar retention rate

Minimal revenue churn

Highly embedded services

Proven ability to grow revenue at scale

to leading vertical

sportradar

78%

2020A subscription revenue

sportradarietes any costs and an et of contaction of station her the braing bathe is be

116%

2-year average with top 200 customers 1.2

0.6%

2-year average revenue churn¹.3

8+ year

tenure with top 200 customers

30%

2015-2019 revenue CAGR

Strong cash generation

78%

2-year average cash flow conversion

For top 200 customers which represent 80% of revenue: Defined as annual revenue from a cohort of customers in the current period / annual revenue from the same customer cohort in the prior period, current annual revenue

t excludes revenue from new customers in the current period. Revenue chum defined as lost revenue from customers that stopped using

our services in any given year divided by total revenue in prior year: Adjusted for customer M&A activity. Free cash flow conversion defined as net cash from operating activities adjusted for payments for lease abilities, acquisition

of property and equipment, acquisition of intangible assets (excluding certain intangible assets required to further support an acquired business) / adjusted EBITDA

22View entire presentation