Allwyn Results Presentation Deck

Q3 2023 financial highlights

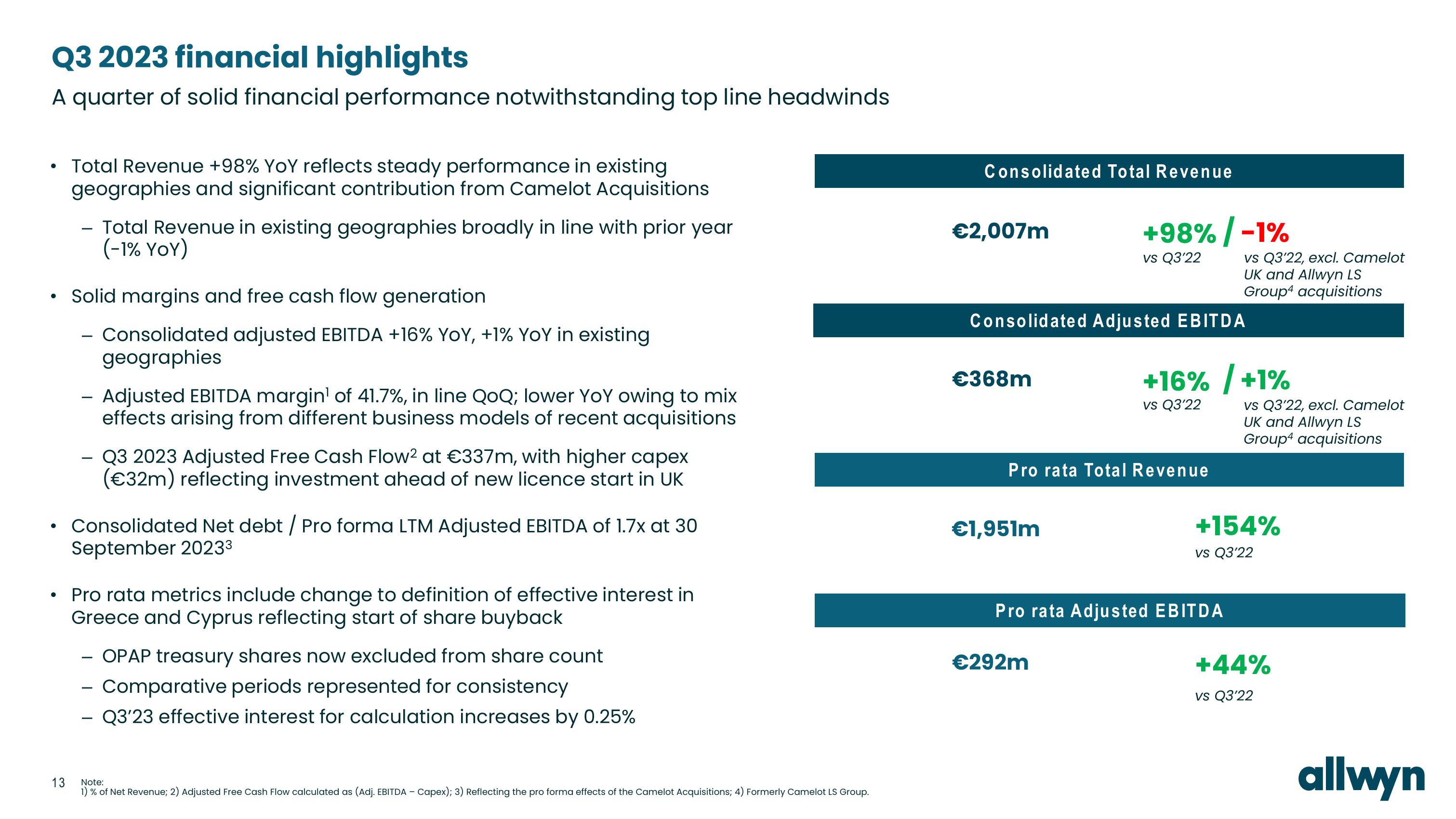

A quarter of solid financial performance notwithstanding top line headwinds

●

●

Total Revenue +98% YoY reflects steady performance in existing

geographies and significant contribution from Camelot Acquisitions

- Total Revenue in existing geographies broadly in line with prior year

(-1% YoY)

Solid margins and free cash flow generation

Consolidated adjusted EBITDA +16% YOY, +1% YoY in existing

geographies

-

Adjusted EBITDA margin¹ of 41.7%, in line QoQ; lower YoY owing to mix

effects arising from different business models of recent acquisitions

Q3 2023 Adjusted Free Cash Flow² at €337m, with higher capex

(€32m) reflecting investment ahead of new licence start in UK

Consolidated Net debt / Pro forma LTM Adjusted EBITDA of 1.7x at 30

September 20233

• Pro rata metrics include change to definition of effective interest in

Greece and Cyprus reflecting start of share buyback

OPAP treasury shares now excluded from share count

Comparative periods represented for consistency

Q3'23 effective interest for calculation increases by 0.25%

13

Note:

1) % of Net Revenue; 2) Adjusted Free Cash Flow calculated as (Adj. EBITDA - Capex); 3) Reflecting the pro forma effects of the Camelot Acquisitions; 4) Formerly Camelot LS Group.

Consolidated Total Revenue

€2,007m

€368m

Consolidated Adjusted EBITDA

+98% / -1%

vs Q3'22

€1,951m

Pro rata Total Revenue

€292m

vs Q3'22, excl. Camelot

UK and Allwyn LS

Group4 acquisitions

+16% / +1%

vs Q3'22

Pro rata Adjusted EBITDA

vs Q3'22, excl. Camelot

UK and Allwyn LS

Group4 acquisitions

+154%

vs Q3'22

+44%

vs Q3'22

allwynView entire presentation