Ford Investor Conference Presentation Deck

U.S. RETAIL SECURITIZATION

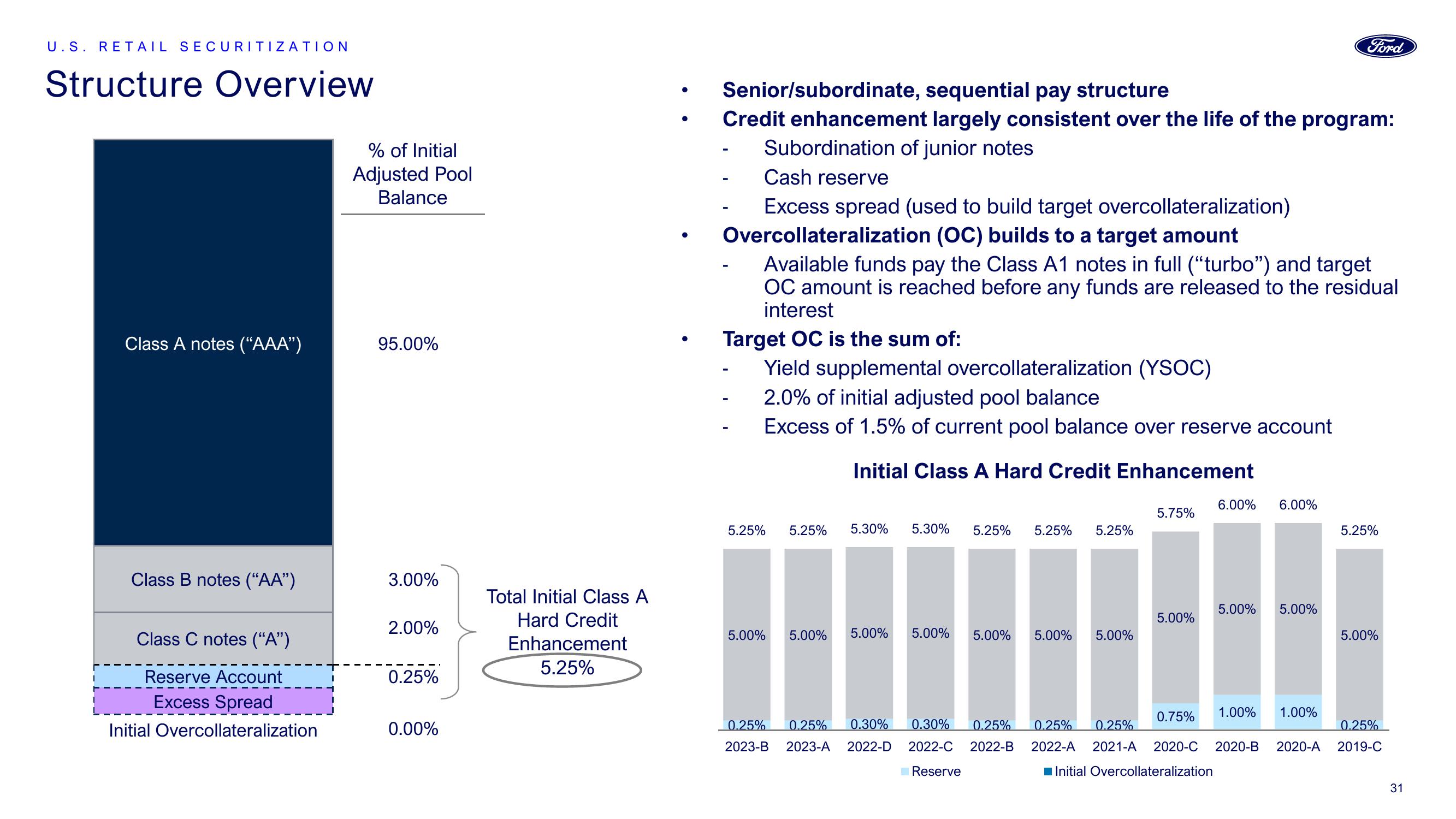

Structure Overview

I

I

Class A notes ("AAA")

Class B notes (“AA”)

Class C notes ("A")

Reserve Account

Excess Spread

Initial Overcollateralization

% of Initial

Adjusted Pool

Balance

95.00%

3.00%

2.00%

0.25%

0.00%

Total Initial Class A

Hard Credit

Enhancement

5.25%

●

●

Senior/subordinate, sequential pay structure

Credit enhancement largely consistent over the life of the program:

Subordination of junior notes

Cash reserve

Excess spread (used to build target overcollateralization)

Overcollateralization (OC) builds to a target amount

Available funds pay the Class A1 notes in full ("turbo") and target

OC amount is reached before any funds are released to the residual

interest

Target OC is the sum of:

Yield supplemental overcollateralization (YSOC)

2.0% of initial adjusted pool balance

Excess of 1.5% of current pool balance over reserve account

Initial Class A Hard Credit Enhancement

-

5.25%

5.25% 5.30% 5.30% 5.25% 5.25% 5.25%

5.00% 5.00%

5.00%

5.00% 5.00% 5.00% 5.00%

0.25% 0.25% 0.30% 0.30% 0.25%

2023-B 2023-A 2022-D 2022-C 2022-B

Reserve

5.75%

5.00%

0.75%

6.00% 6.00%

Initial Overcollateralization

5.00% 5.00%

Ford

1.00% 1.00%

0.25% 0.25%

2022-A 2021-A 2020-C 2020-B 2020-A

5.25%

5.00%

0.25%

2019-C

31View entire presentation