Squarespace Investor Day Presentation Deck

INVESTOR DAY

November 2021

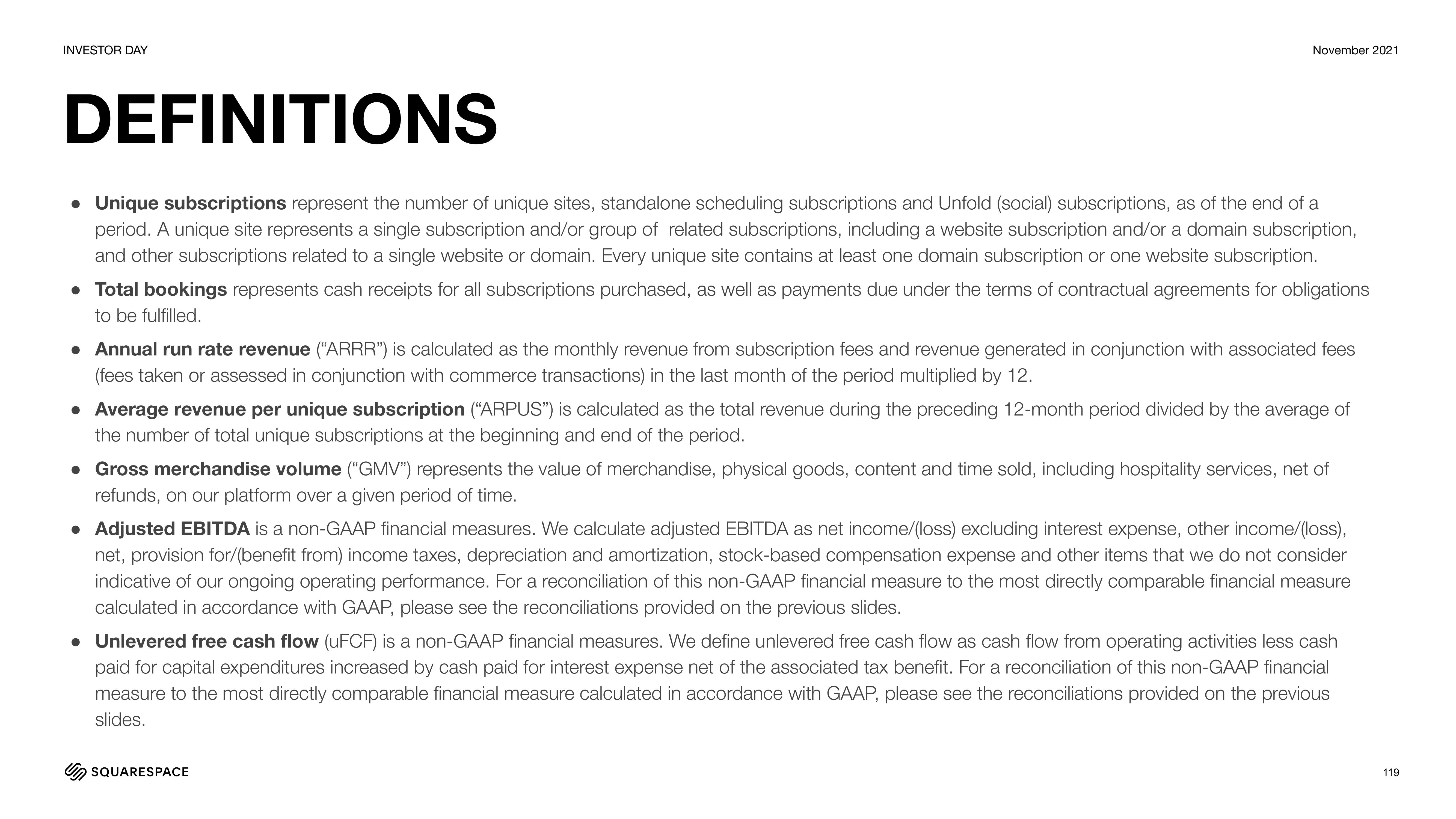

DEFINITIONS

Unique subscriptions represent the number of unique sites, standalone scheduling subscriptions and Unfold (social) subscriptions, as of the end of a

period. A unique site represents a single subscription and/or group of related subscriptions, including a website subscription and/or a domain subscription,

and other subscriptions related to a single website or domain. Every unique site contains at least one domain subscription or one website subscription.

• Total bookings represents cash receipts for all subscriptions purchased, as well as payments due under the terms of contractual agreements for obligations

to be fulfilled.

• Annual run rate revenue ("ARRR") is calculated as the monthly revenue from subscription fees and revenue generated in conjunction with associated fees

(fees taken or assessed in conjunction with commerce transactions) in the last month of the period multiplied by 12.

• Average revenue per unique subscription ("ARPUS") is calculated as the total revenue during the preceding 12-month period divided by the average of

the number of total unique subscriptions at the beginning and end of the period.

• Gross merchandise volume ("GMV") represents the value of merchandise, physical goods, content and time sold, including hospitality services, net of

refunds, on our platform over a given period of time.

• Adjusted EBITDA is a non-GAAP financial measures. We calculate adjusted EBITDA as net income/(loss) excluding interest expense, other income/(loss),

net, provision for/(benefit from) income taxes, depreciation and amortization, stock-based compensation expense and other items that we do not consider

indicative of our ongoing operating performance. For a reconciliation of this non-GAAP financial measure to the most directly comparable financial measure

calculated in accordance with GAAP, please see the reconciliations provided on the previous slides.

• Unlevered free cash flow (UFCF) is a non-GAAP financial measures. We define unlevered free cash flow as cash flow from operating activities less cash

paid for capital expenditures increased by cash paid for interest expense net of the associated tax benefit. For a reconciliation of this non-GAAP financial

measure to the most directly comparable financial measure calculated in accordance with GAAP, please see the reconciliations provided on the previous

slides.

SQUARESPACE

119View entire presentation