Nexters Investor Presentation Deck

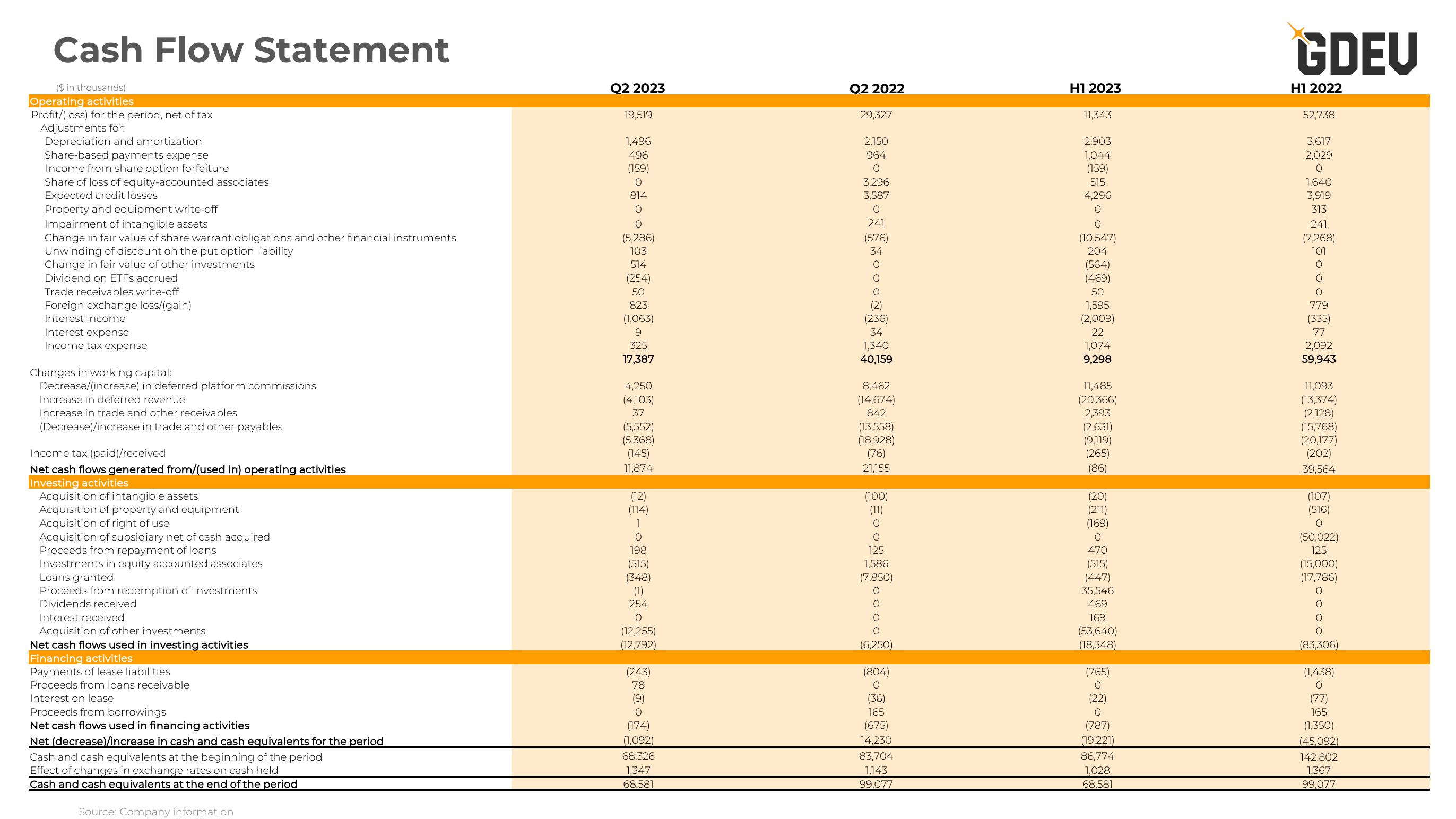

Cash Flow Statement

($ in thousands)

Operating activities

Profit/(loss) for the period, net of tax

Adjustments for:

Depreciation and amortization.

Share-based payments expense

Income from share option forfeiture

Share of loss of equity-accounted associates

Expected credit losses

Property and equipment write-off

Impairment of intangible assets

Change in fair value of share warrant obligations and other financial instruments

Unwinding of discount on the put option liability

Change in fair value of other investments

Dividend on ETFs accrued

Trade receivables write-off

Foreign exchange loss/(gain)

Interest income

Interest expense

Income tax expense

Changes in working capital:

Decrease/(increase) in deferred platform commissions

Increase in deferred revenue

Increase in trade and other receivables

(Decrease)/increase in trade and other payables

Income tax (paid)/received

Net cash flows generated from/(used in) operating activities

Investing activities

Acquisition of intangible assets

Acquisition of property and equipment

Acquisition of right of use

Acquisition of subsidiary net of cash acquired

Proceeds from repayment of loans

Investments in equity accounted associates

Loans granted

Proceeds from redemption of investments

Dividends received

Interest received

Acquisition of other investments

Net cash flows used in investing activities

Financing activities

Payments of lease liabilities

Proceeds from loans receivable

Interest on lease

Proceeds from borrowings

Net cash flows used in financing activities

Net (decrease)/increase in cash and cash equivalents for the period

Cash and cash equivalents at the beginning of the period

Effect of changes in exchange rates on cash held

Cash and cash equivalents at the end of the period

Source: Company information

Q2 2023

19,519

1,496

496

(159)

O

814

O

O

(5,286)

103

514

(254)

50

823

(1,063)

9

325

17,387

4,250

(4,103)

37

(5,552)

(5,368)

(145)

11,874

(12)

(114)

1

O

198

(515)

(348)

(1)

254

O

(12,255)

(12,792)

(243)

78

(9)

O

(174)

(1,092)

68,326

1,347

68,581

Q2 2022

29,327

2,150

964

O

3,296

3,587

O

241

(576)

34

O

O

O

(2)

(236)

34

1,340

40,159

8,462

(14,674)

842

(13,558)

(18,928)

(76)

21,155

(100)

(11)

Coo

125

1,586

(7,850)

Oooo

(6,250)

(804)

O

(36)

165

(675)

14,230

83,704

1,143

99,077

H1 2023

11,343

2,903

1,044

(159)

515

4,296

00

(10,547)

204

(564)

(469)

50

1,595

(2,009)

22

1,074

9,298

11,485

(20,366)

2,393

(2,631)

(9,119)

(265)

(86)

(20)

(211)

(169)

O

470

(515)

(447)

35,546

469

169

(53,640)

(18,348)

(765)

O

(22)

O

(787)

(19,221)

86,774

1,028

68,581

GDEU

H1 2022

52,738

3,617

2,029

0

1,640

3,919

313

241

(7,268)

101

O O

0

779

(335)

77

2,092

59,943

11,093

(13,374)

(2,128)

(15,768)

(20,177)

(202)

39,564

(107)

(516)

O

(50,022)

125

(15,000)

(17,786)

Oood

(83,306)

(1,438)

O

(77)

165

(1,350)

(45,092)

142,802

1,367

99,077View entire presentation