Metals Acquisition Corp SPAC Presentation Deck

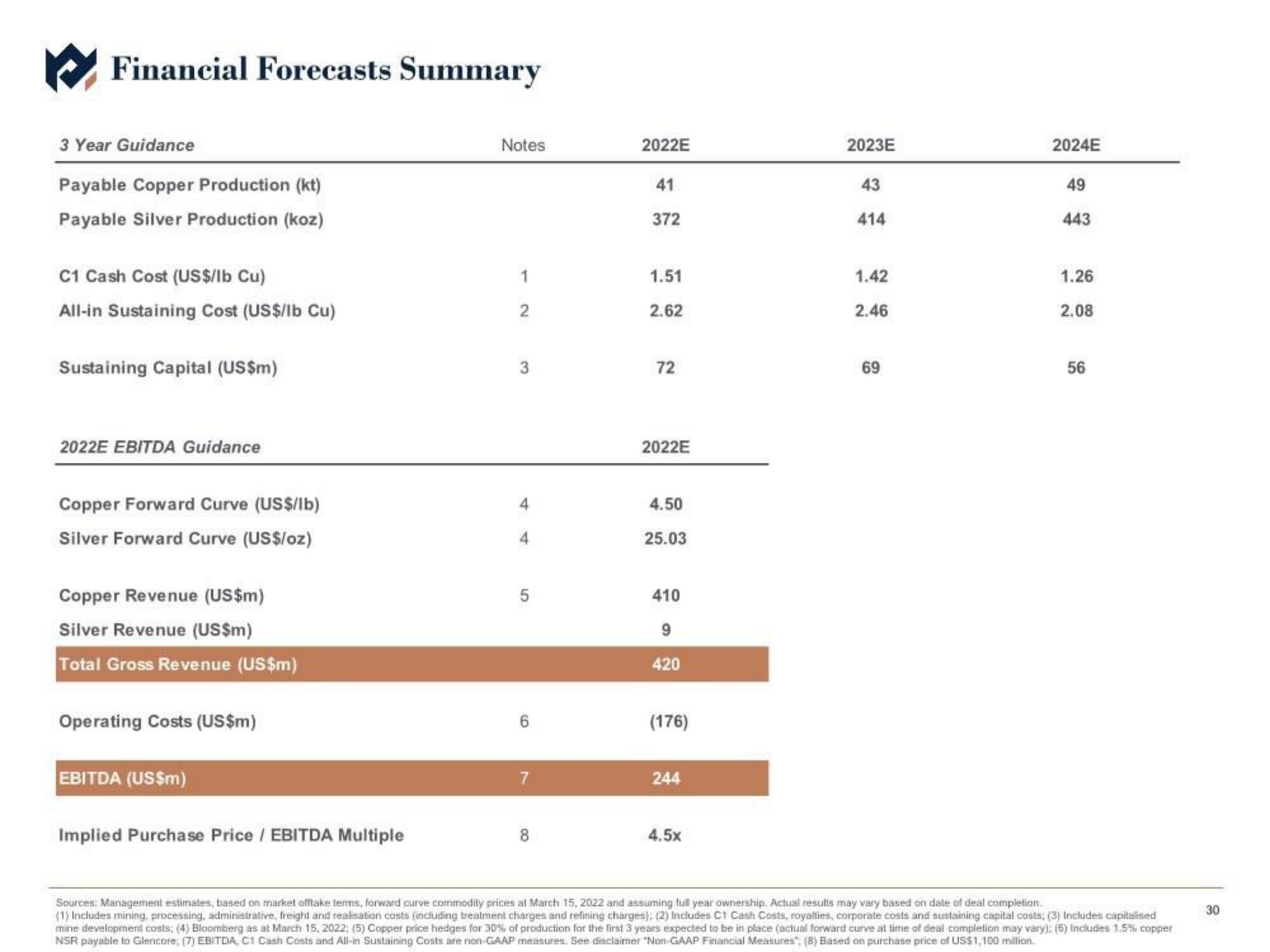

Financial Forecasts Summary

3 Year Guidance

Payable Copper Production (kt)

Payable Silver Production (koz)

C1 Cash Cost (US$/lb Cu)

All-in Sustaining Cost (US$/lb Cu)

Sustaining Capital (US$m)

2022E EBITDA Guidance

Copper Forward Curve (US$/lb)

Silver Forward Curve (US$/oz)

Copper Revenue (US$m)

Silver Revenue (US$m)

Total Gross Revenue (US$m)

Operating Costs (US$m)

EBITDA (US$m)

Implied Purchase Price / EBITDA Multiple

Notes

12

3

4

4

5

7

8

2022E

41

372

1.51

2.62

72

2022E

4.50

25.03

410

9

420

(176)

244

4.5x

2023E

43

414

1.42

2.46

69

2024E

49

443

1.26

2.08

56

Sources: Management estimates, based on market offlake terms, forward curve commodity prices at March 15, 2022 and assuming full year ownership. Actual results may vary based on date of deal completion.

(1) Includes mining, processing, administrative, freight and realisation costs (including treatment charges and refining charges); (2) Includes C1 Cash Costs, royalties, corporate costs and sustaining capital costs; (3) Includes capitalised

mine development costs; (4) Bloomberg as at March 15, 2022; (5) Copper price hedges for 30% of production for the first 3 years expected to be in place (actual forward curve at time of deal completion may vary): (5) Includes 1.5% copper

NSR payable to Glencore, (7) EBITDA, C1 Cash Costs and All-in Sustaining Costs are non-GAAP measures. See disclaimer "Non-GAAP Financial Measures"; (8) Based on purchase price of US$1,100 million.

30View entire presentation