DTE Electric Investor Presentation Deck

Maintaining strong cash flow, balance sheet and credit profile

DTE

$1.3

Convertible

equity

units

2022

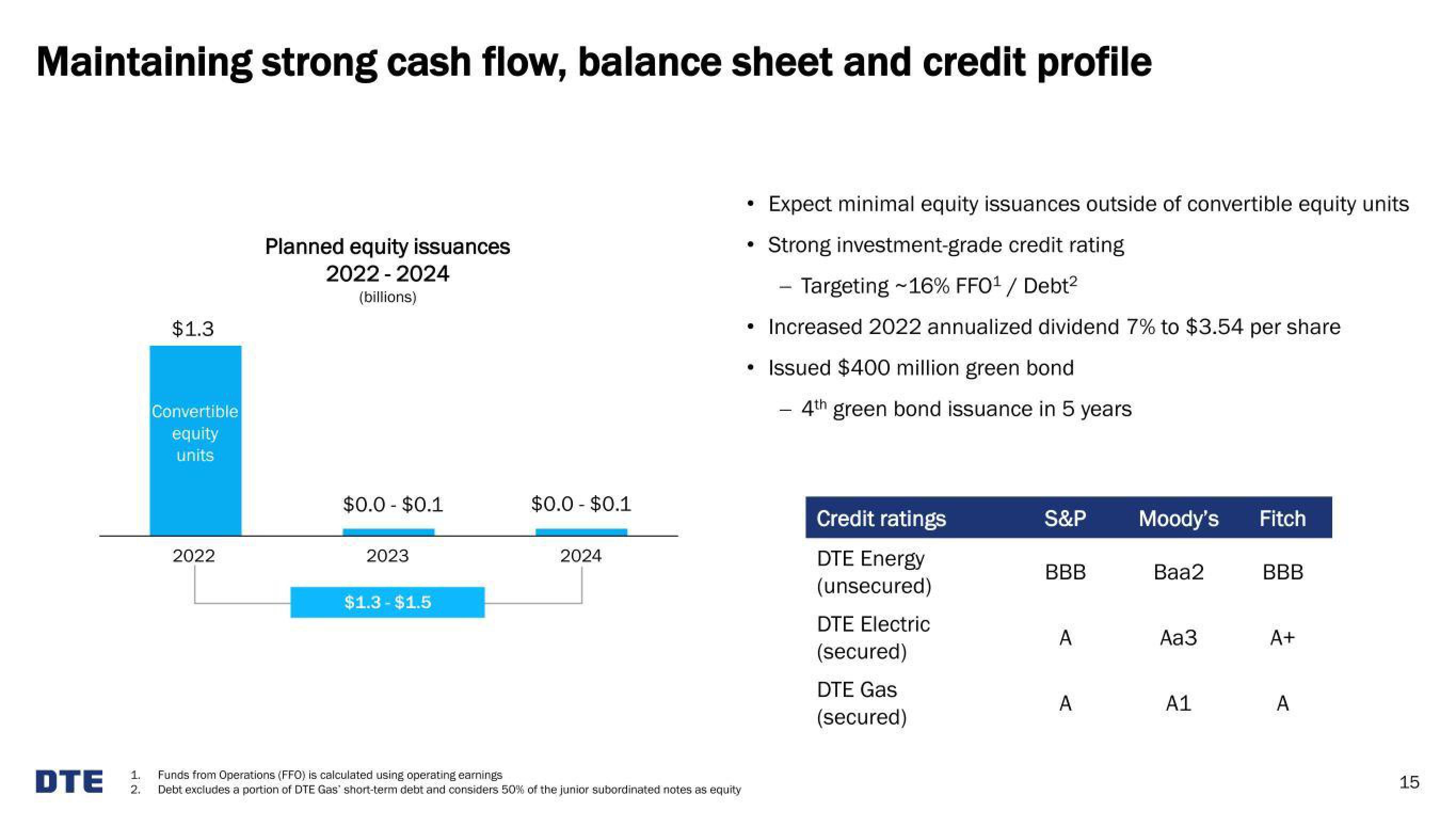

Planned equity issuances

2022-2024

(billions)

$0.0 - $0.1

2023

$1.3 $1.5

$0.0 - $0.1

2024

1.

Funds from Operations (FFO) is calculated using operating earnings

2. Debt excludes a portion of DTE Gas' short-term debt and considers 50% of the junior subordinated notes as equity

●

Expect minimal equity issuances outside of convertible equity units

Strong investment-grade credit rating

- Targeting -16% FFO¹ / Debt²

Increased 2022 annualized dividend 7% to $3.54 per share

Issued $400 million green bond

4th green bond issuance in 5 years

Credit ratings

DTE Energy

(unsecured)

DTE Electric

(secured)

DTE Gas

(secured)

S&P

BBB

A

A

Moody's Fitch

Baa2

Aa3

A1

BBB

A+

A

15View entire presentation