Credit Suisse Investment Banking Pitch Book

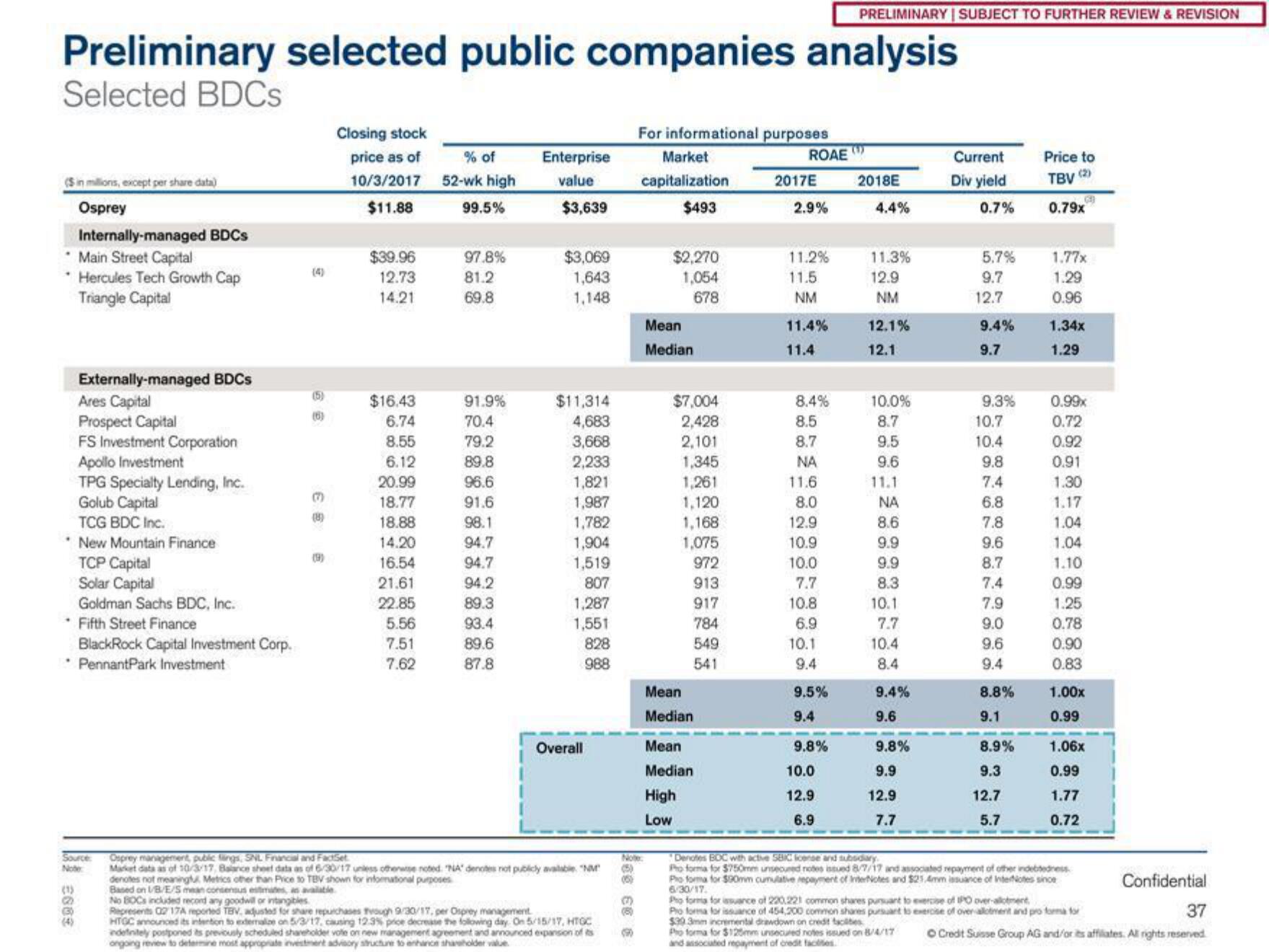

Preliminary selected public companies analysis

Selected BDCs

(Sin millions, except per share data)

Osprey

Internally-managed BDCs

Main Street Capital

* Hercules Tech Growth Cap

Triangle Capital

.

(1)

B

Externally-managed BDCs

Ares Capital

Prospect Capital

(3)

(4)

FS Investment Corporation

Apollo Investment

TPG Specialty Lending, Inc.

Golub Capital

TCG BDC Inc.

New Mountain Finance

TCP Capital

Solar Capital

Goldman Sachs BDC, Inc.

Source:

Note

Fifth Street Finance

BlackRock Capital Investment Corp.

PennantPark Investment

(8)

(9)

Closing stock

% of

price as of

10/3/2017 52-wk high

$11.88

99.5%

$39.96

12.73

14.21

$16.43

6.74

8.55

6.12

20.99

18.77

18.88

14.20

16.54

21.61

22.85

5.56

7.51

7.62

97.8%

81.2

69.8

91.9%

70.4

79.2

89.8

96.6

91.6

98.1

94.7

94.7

94.2

89.3

93.4

89.6

87.8

Enterprise

value

$3,639

$3,069

1,643

1,148

$11,314

4,683

3,668

2,233

1,821

1,987

1,782

1,904

1,519

807

1,287

1,551

828

988

Overall

Osprey management, public lings, SNL Financial and FactSet

Market data as of 10/3/17, Balance sheet data as of 6/30/17 unless otherwise noted. "NA" denotes not publicly available. "N

denotes not meaninglu Metrics other than Price to TBV shown for informational purposes

Based on 1/B/E/S mean consensus estimates, as available

No BOCs included record any goodwill or intangibles

Represents 02 17A reported TBV. adjusted for share repurchases Tough 9/30/17, per Osprey management

HTGC announced its intention to externalize on 5/3/17, causing 12.3% price decrease the following day. On 5/15/17, HTGC

indefinitely postponed its previously scheduled shareholder vote on new management agreement and announced expansion of its

ongoing review to determine most appropriate investment advisory structure to enhance shareholder value

Note

(5)

(5)

60 6

For informational purposes

Market

ROAE

capitalization

$493

(90

$2,270

1,054

678

Mean

Median

$7,004

2,428

2,101

1,345

1,261

1,120

1,168

1,075

972

913

917

784

549

541

Mean

Median

Mean

Median

High

Low

2017E

2.9%

11.2%

11.5

NM

11.4%

11.4

8.4%

8.5

8.7

NA

11.6

8.0

12.9

10.9

10.0

7.7

10.8

6.9

10.1

9.4

9.5%

9.4

9.8%

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

10.0

12.9

6.9

2018E

4.4%

11.3%

12.9

NM

12.1%

12.1

10.0%

8.7

9.5

9.6

11.1

ΝΑ

8.6

9.9

9.9

8.3

10.1

7.7

10.4

8.4

9.4%

9.6

9.8%

9.9

12.9

7.7

Current

Div yield

0.7%

5.7%

9.7

12.7

9.4%

9.7

9.3%

10.7

10.4

9.8

7.4

6.8

7.8

9.6

8.7

7.4

7.9

9.0

9.6

9.4

8.8%

9.1

8.9%

9.3

12.7

5.7

Price to

TBV (2)

0.79x

1.77x

1.29

0.96

1.34x

1.29

0.99x

0.72

0.92

0.91

1.30

1.17

1.04

1.04

1.10

0.99

1.25

0.78

0.90

0.83

1.00x

0.99

1.06x

0.99

1.77

0.72

Denotes BOC with active S8C license and subsidiary

Pro forma for $750mm unsecured notes issued 8/7/17 and associated repayment of other indebtedness

Pho forma for $90mm cumulative repayment of InterNotes and $21.4mm issuance of InterNotes since

6/30/17.

Pho forma for issuance of 220,221 common shares pursuant to exercise of IPO over-alotment

Pro forma for issuance of 454,200 common shares pursuant to exercise of over allotment and pro forma for

$39 3mm incremental drawdown on credit scles

Pro forma for $125mm unsecured notes issued on 8/4/17

and associated repayment of credit facilities.

Confidential

37

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation