Citi Investment Banking Pitch Book

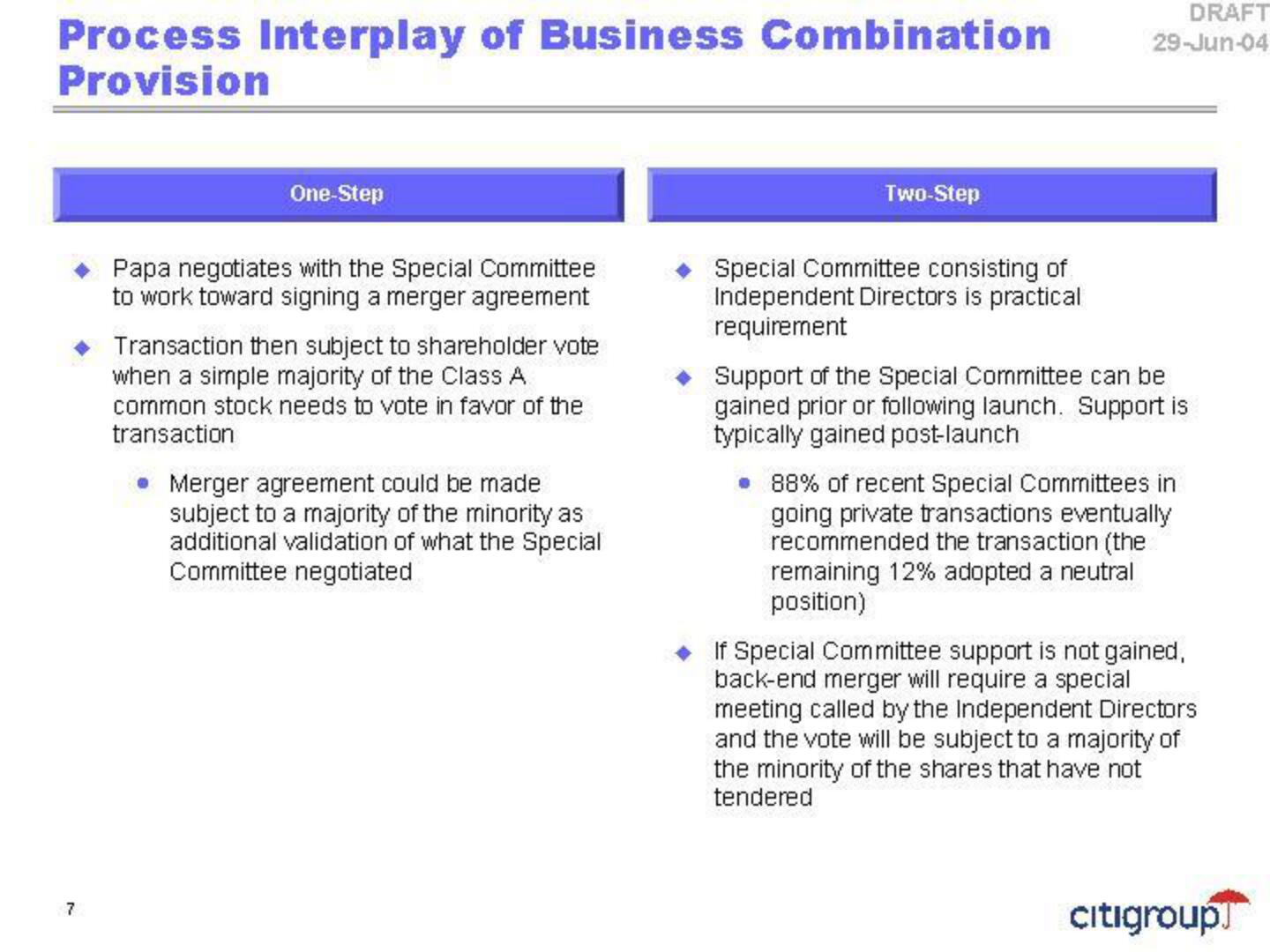

Process Interplay of Business Combination

Provision

7

One-Step

Papa negotiates with the Special Committee

to work toward signing a merger agreement

Transaction then subject to shareholder vote

when a simple majority of the Class A

common stock needs to vote in favor of the

transaction

Merger agreement could be made

subject to a majority of the minority as

additional validation of what the Special

Committee negotiated

Two-Step

Special Committee consisting of

Independent Directors is practical

requirement

DRAFT

29-Jun-04

Support of the Special Committee can be

gained prior or following launch. Support is

typically gained post-launch

• 88% of recent Special Committees in

going private transactions eventually

recommended the transaction (the

remaining 12% adopted a neutral

position)

If Special Committee support is not gained,

back-end merger will require a special

meeting called by the Independent Directors

and the vote will be subject to a majority of

the minority of the shares that have not

tendered

citigroupView entire presentation