SpringOwl Activist Presentation Deck

Key Drivers to

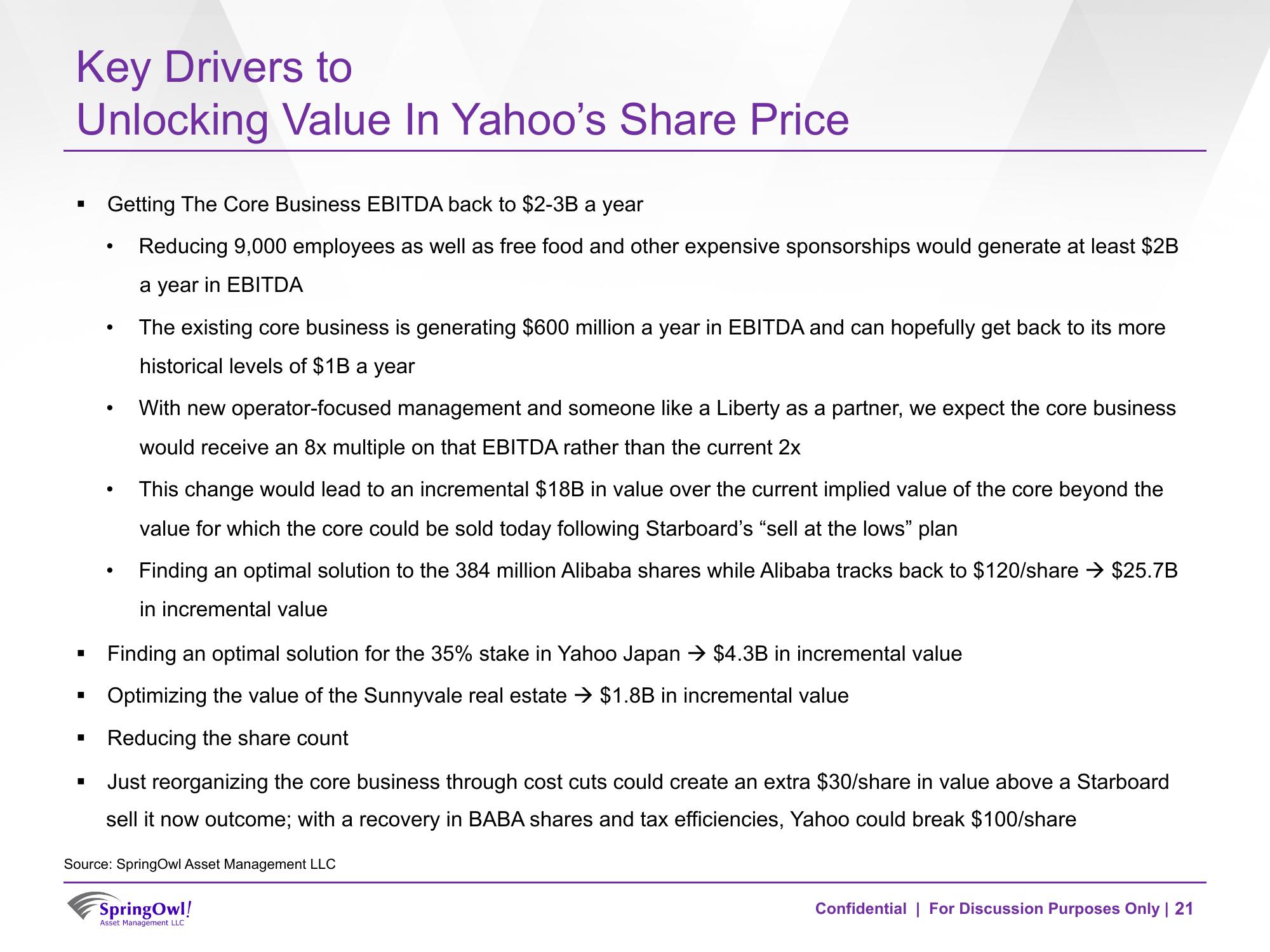

Unlocking Value In Yahoo's Share Price

■

■

■

■

Getting The Core Business EBITDA back to $2-3B a year

Reducing 9,000 employees as well as free food and other expensive sponsorships would generate at least $2B

a year in EBITDA

●

●

The existing core business is generating $600 million a year in EBITDA and can hopefully get back to its more

historical levels of $1B a year

With new operator-focused management and someone like a Liberty as a partner, we expect the core business

would receive an 8x multiple on that EBITDA rather than the current 2x

This change would lead to an incremental $18B in value over the current implied value of the core beyond the

value for which the core could be sold today following Starboard's "sell at the lows" plan

Finding an optimal solution to the 384 million Alibaba shares while Alibaba tracks back to $120/share → $25.7B

in incremental value

Finding an optimal solution for the 35% stake in Yahoo Japan → $4.3B in incremental value

Optimizing the value of the Sunnyvale real estate → $1.8B in incremental value

Reducing the share count

Just reorganizing the core business through cost cuts could create an extra $30/share in value above a Starboard

sell it now outcome; with a recovery in BABA shares and tax efficiencies, Yahoo could break $100/share

Source: Spring Owl Asset Management LLC

SpringOwl!

Asset Management LLC

Confidential | For Discussion Purposes Only | 21View entire presentation