Flutter Results Presentation Deck

Financial Review

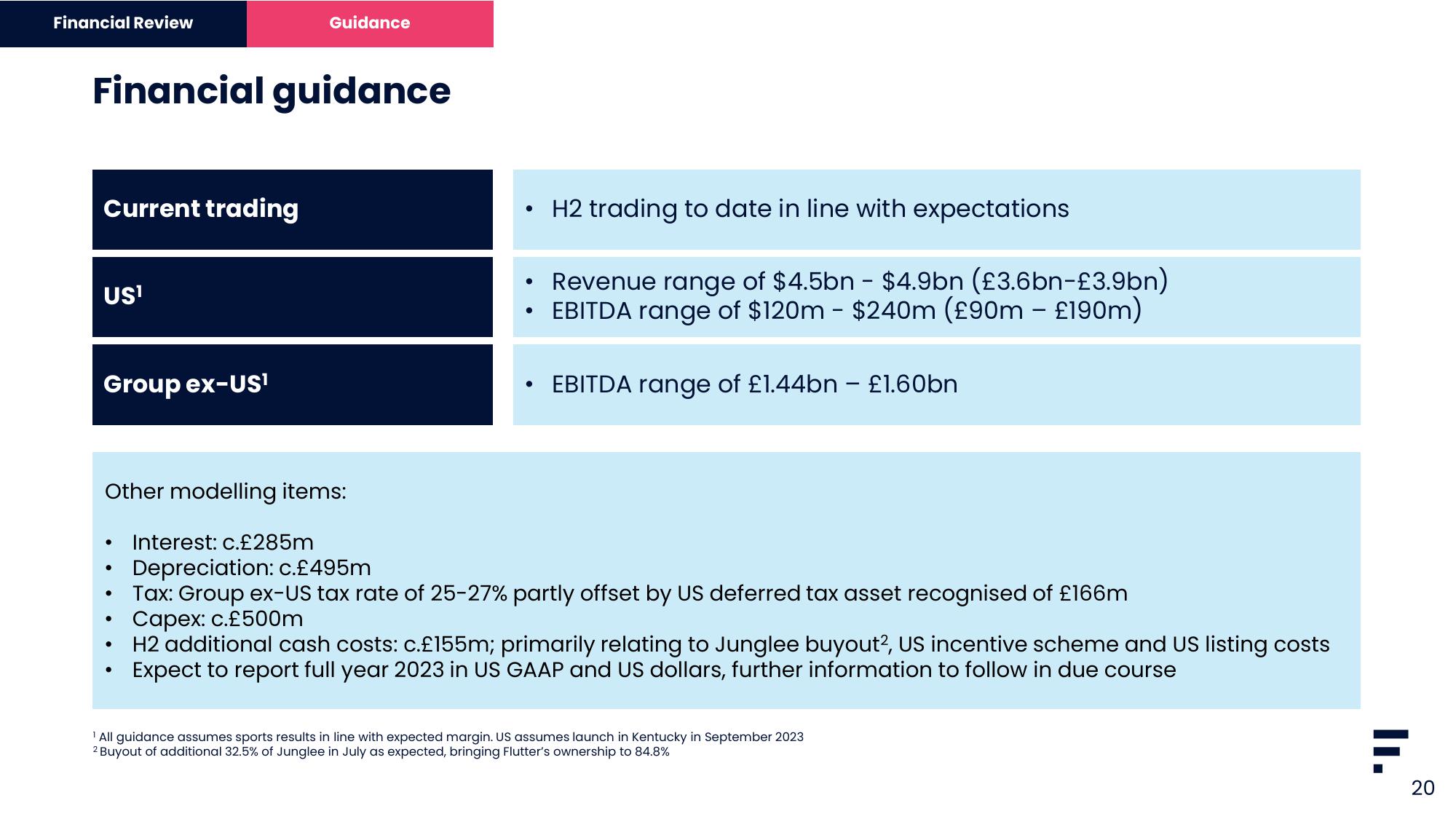

Financial guidance

Current trading

US¹

Group ex-US¹

Other modelling items:

●

●

●

Guidance

●

●

• H2 trading to date in line with expectations

Revenue range of $4.5bn - $4.9bn (£3.6bn-£3.9bn)

EBITDA range of $120m - $240m (£90m - £190m)

●

●

• EBITDA range of £1.44bn - £1.60bn

Interest: c.£285m

Depreciation: c.£495m

Tax: Group ex-US tax rate of 25-27% partly offset by US deferred tax asset recognised of £166m

Capex: c.£500m

H2 additional cash costs: c.£155m; primarily relating to Junglee buyout², US incentive scheme and US listing costs

Expect to report full year 2023 in US GAAP and US dollars, further information to follow in due course

¹ All guidance assumes sports results in line with expected margin. US assumes launch in Kentucky in September 2023

2 Buyout of additional 32.5% of Junglee in July as expected, bringing Flutter's ownership to 84.8%

II.

F

20View entire presentation