Summer 2023 Solar Industry Update

Direct Payment of Tax Credits Guidance

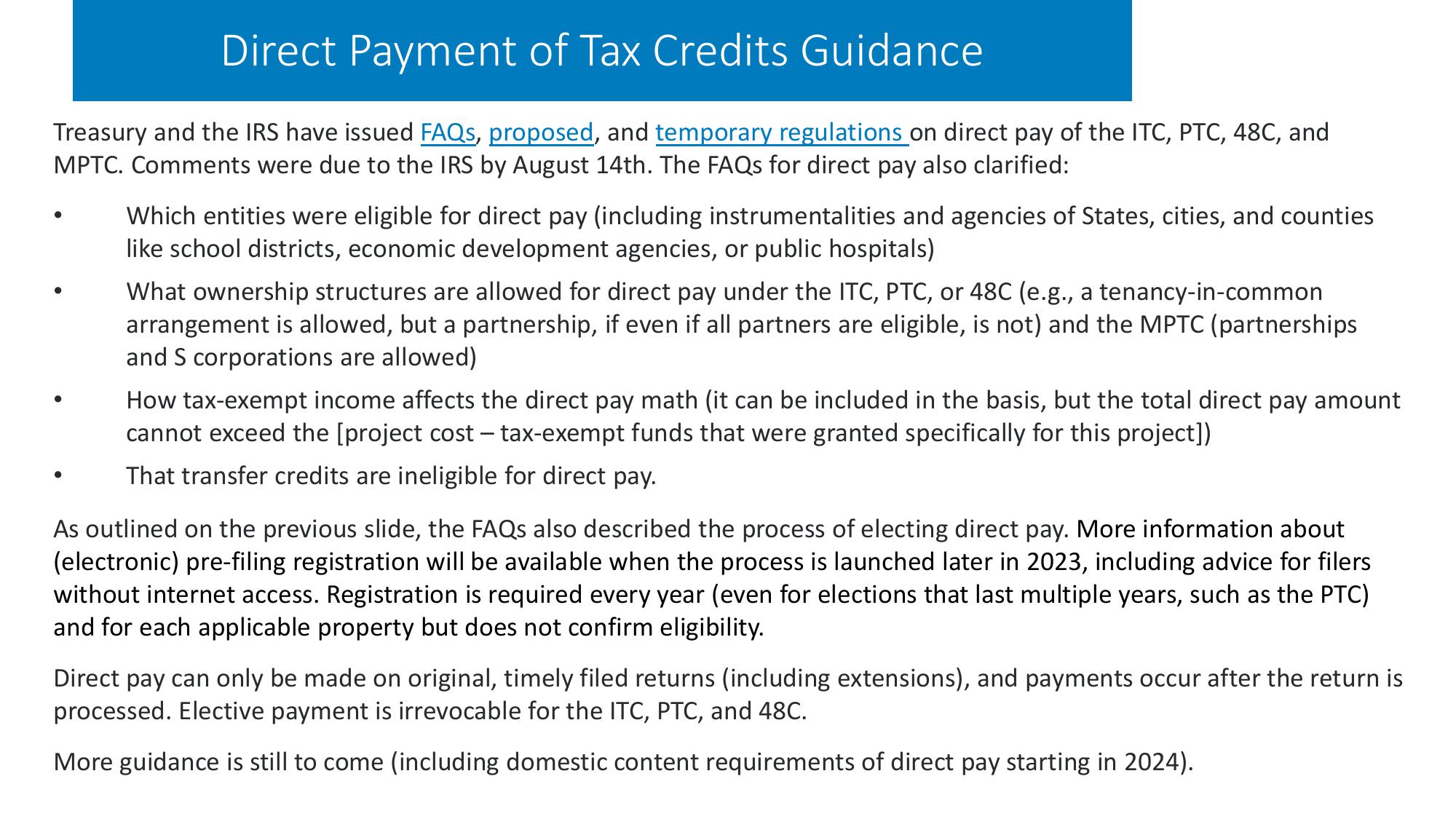

Treasury and the IRS have issued FAQs, proposed, and temporary regulations on direct pay of the ITC, PTC, 48C, and

MPTC. Comments were due to the IRS by August 14th. The FAQs for direct pay also clarified:

Which entities were eligible for direct pay (including instrumentalities and agencies of States, cities, and counties

like school districts, economic development agencies, or public hospitals)

What ownership structures are allowed for direct pay under the ITC, PTC, or 48C (e.g., a tenancy-in-common

arrangement is allowed, but a partnership, if even if all partners are eligible, is not) and the MPTC (partnerships

and S corporations are allowed)

How tax-exempt income affects the direct pay math (it can be included in the basis, but the total direct pay amount

cannot exceed the [project cost - tax-exempt funds that were granted specifically for this project])

That transfer credits are ineligible for direct pay.

As outlined on the previous slide, the FAQs also described the process of electing direct pay. More information about

(electronic) pre-filing registration will be available when the process is launched later in 2023, including advice for filers

without internet access. Registration is required every year (even for elections that last multiple years, such as the PTC)

and for each applicable property but does not confirm eligibility.

Direct pay can only be made on original, timely filed returns (including extensions), and payments occur after the return is

processed. Elective payment is irrevocable for the ITC, PTC, and 48C.

More guidance is still to come (including domestic content requirements of direct pay starting in 2024).View entire presentation