Evercore Investment Banking Pitch Book

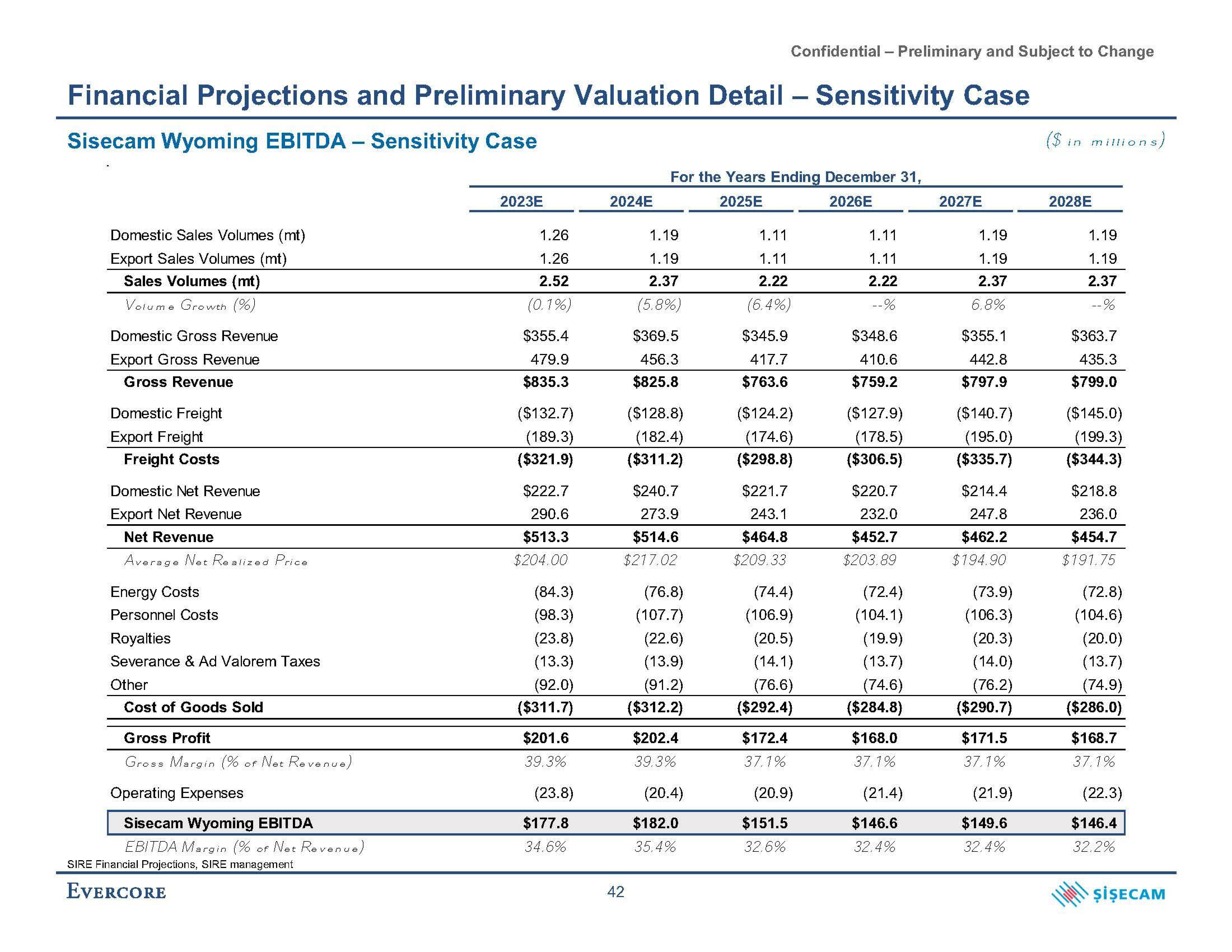

Financial Projections and Preliminary Valuation Detail - Sensitivity Case

Sisecam Wyoming EBITDA - Sensitivity Case

Domestic Sales Volumes (mt)

Export Sales Volumes (mt)

Sales Volumes (mt)

Volume Growth (%)

Domestic Gross Revenue

Export Gross Revenue

Gross Revenue

Domestic Freight

Export Freight

Freight Costs

Domestic Net Revenue

Export Net Revenue

Net Revenue

Average Net Realized Price

Energy Costs

Personnel Costs

Royalties

Severance & Ad Valorem Taxes

Other

Cost of Goods Sold

Gross Profit

Gross Margin (% of Net Revenue)

Operating Expenses

Sisecam Wyoming EBITDA

EBITDA Margin (% of Net Revenue)

SIRE Financial Projections, SIRE management

EVERCORE

2023E

1.26

1.26

2.52

(0.1%)

$355.4

479.9

$835.3

($132.7)

(189.3)

($321.9)

$222.7

290.6

$513.3

$204.00

(84.3)

(98.3)

(23.8)

(13.3)

(92.0)

($311.7)

$201.6

39.3%

(23.8)

$177.8

34.6%

2024E

42

For the Years Ending December 31,

2025E

2026E

1.19

1.19

2.37

(5.8%)

$369.5

456.3

$825.8

($128.8)

(182.4)

($311.2)

$240.7

273.9

$514.6

$217.02

(76.8)

(107.7)

(22.6)

(13.9)

(91.2)

($312.2)

$202.4

39.3%

(20.4)

$182.0

35.4%

1.11

1.11

2.22

(6.4%)

$345.9

417.7

$763.6

Confidential - Preliminary and Subject to Change

($124.2)

(174.6)

($298.8)

$221.7

243.1

$464.8

$209.33

(74.4)

(106.9)

(20.5)

(14.1)

(76.6)

($292.4)

$172.4

37.1%

(20.9)

$151.5

32.6%

1.11

1.11

2.22

--%

$348.6

410.6

$759.2

($127.9)

(178.5)

($306.5)

$220.7

232.0

$452.7

$203.89

(72.4)

(104.1)

(19.9)

(13.7)

(74.6)

($284.8)

$168.0

37.1%

(21.4)

$146.6

32.4%

2027E

1.19

1.19

2.37

6.8%

$355.1

442.8

$797.9

($140.7)

(195.0)

($335.7)

$214.4

247.8

$462.2

$194.90

(73.9)

(106.3)

(20.3)

(14.0)

(76.2)

($290.7)

$171.5

37.1%

(21.9)

$149.6

32.4%

($.

millions)

in m

2028E

1.19

1.19

2.37

--%

$363.7

435.3

$799.0

($145.0)

(199.3)

($344.3)

$218.8

236.0

$454.7

$191.75

(72.8)

(104.6)

(20.0)

(13.7)

(74.9)

($286.0)

$168.7

37.1%

(22.3)

$146.4

32.2%

ŞİŞECAMView entire presentation