Evercore Investment Banking Pitch Book

Executive Summary (cont'd)

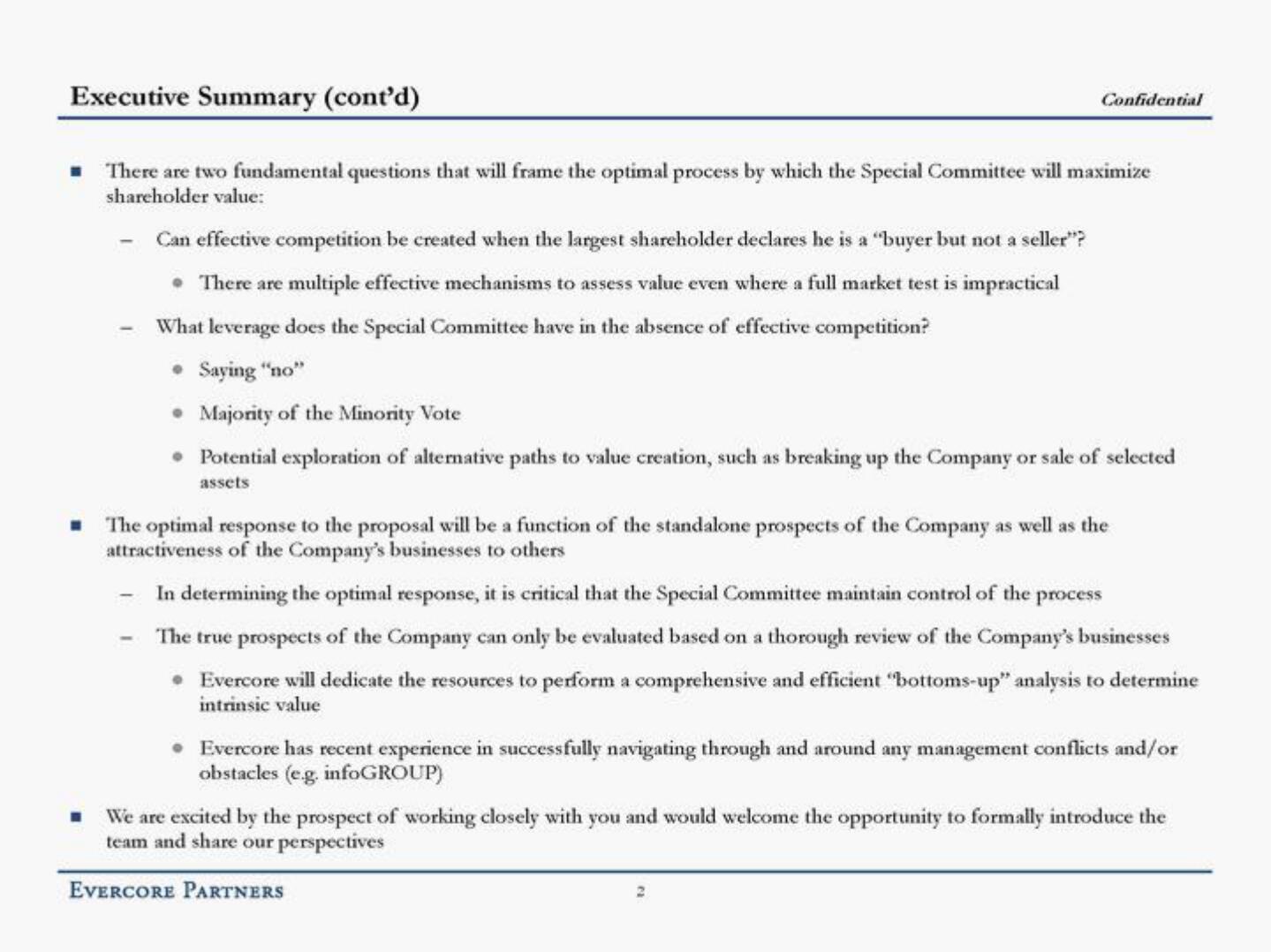

There are two fundamental questions that will frame the optimal process by which the Special Committee will maximize

shareholder value:

Can effective competition be created when the largest shareholder declares he is a "buyer but not a seller"?

There are multiple effective mechanisms to assess value even where a full market test is impractical

What leverage does the Special Committee have in the absence of effective competition?

Confidential

• Saying "no"

Majority of the Minority Vote

• Potential exploration of alternative paths to value creation, such as breaking up the Company or sale of selected

assets

■ The optimal response to the proposal will be a function of the standalone prospects of the Company as well as the

attractiveness of the Company's businesses to others

- In determining the optimal response, it is critical that the Special Committee maintain control of the process

The true prospects of the Company can only be evaluated based on a thorough review of the Company's businesses

• Evercore will dedicate the resources to perform a comprehensive and efficient "bottoms-up" analysis to determine

intrinsic value

• Evercore has recent experience in successfully navigating through and around any management conflicts and/or

obstacles (e.g.infoGROUP)

We are excited by the prospect of working closely with you and would welcome the opportunity to formally introduce the

team and share our perspectives

EVERCORE PARTNERSView entire presentation