AstraZeneca Results Presentation Deck

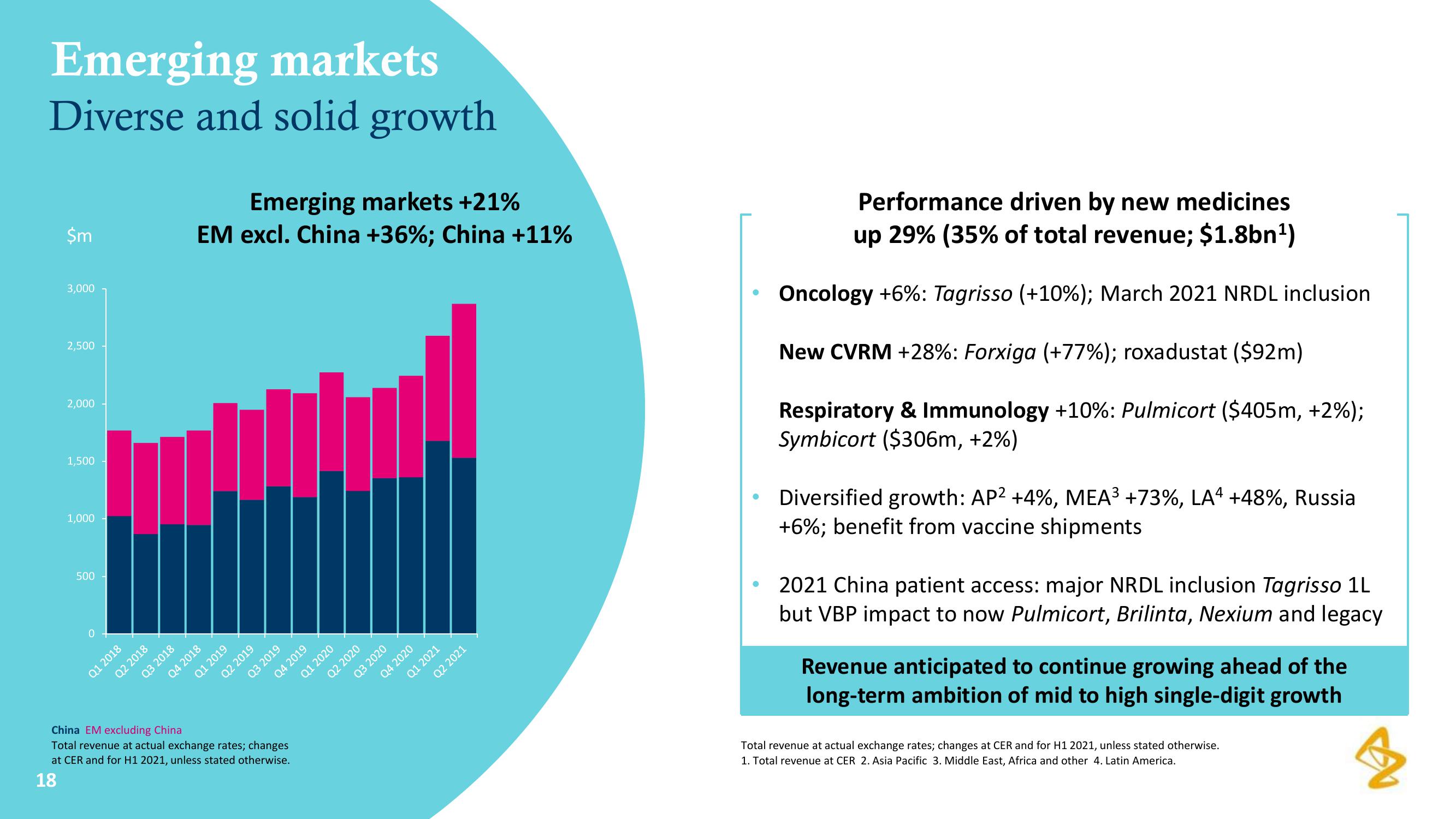

Emerging markets

Diverse and solid growth

$m

3,000

2,500

2,000

1,500

1,000

500

Q1 2018

Q2 2018

Q3 2018

Emerging markets +21%

EM excl. China +36%; China +11%

Q4 2018

Q1 2019

Q2 2019

Q3 2019

China EM excluding China

Total revenue at actual exchange rates; changes

at CER and for H1 2021, unless stated otherwise.

18

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

Performance driven by new medicines

up 29% (35% of total revenue; $1.8bn¹)

Oncology +6%: Tagrisso (+10%) ; March 2021 NRDL inclusion

New CVRM +28%: Forxiga (+77%) ; roxadustat ($92m)

Respiratory & Immunology +10%: Pulmicort ($405m, +2%);

Symbicort ($306m, +2%)

Diversified growth: AP² +4%, MEA³ +73%, LA4¹ +48%, Russia

+6%; benefit from vaccine shipments

2021 China patient access: major NRDL inclusion Tagrisso 1L

but VBP impact to now Pulmicort, Brilinta, Nexium and legacy

Revenue anticipated to continue growing ahead of the

long-term ambition of mid to high single-digit growth

Total revenue at actual exchange rates; changes at CER and for H1 2021, unless stated otherwise.

1. Total revenue at CER 2. Asia Pacific 3. Middle East, Africa and other 4. Latin America.

3View entire presentation