Kinnevik Results Presentation Deck

Intro

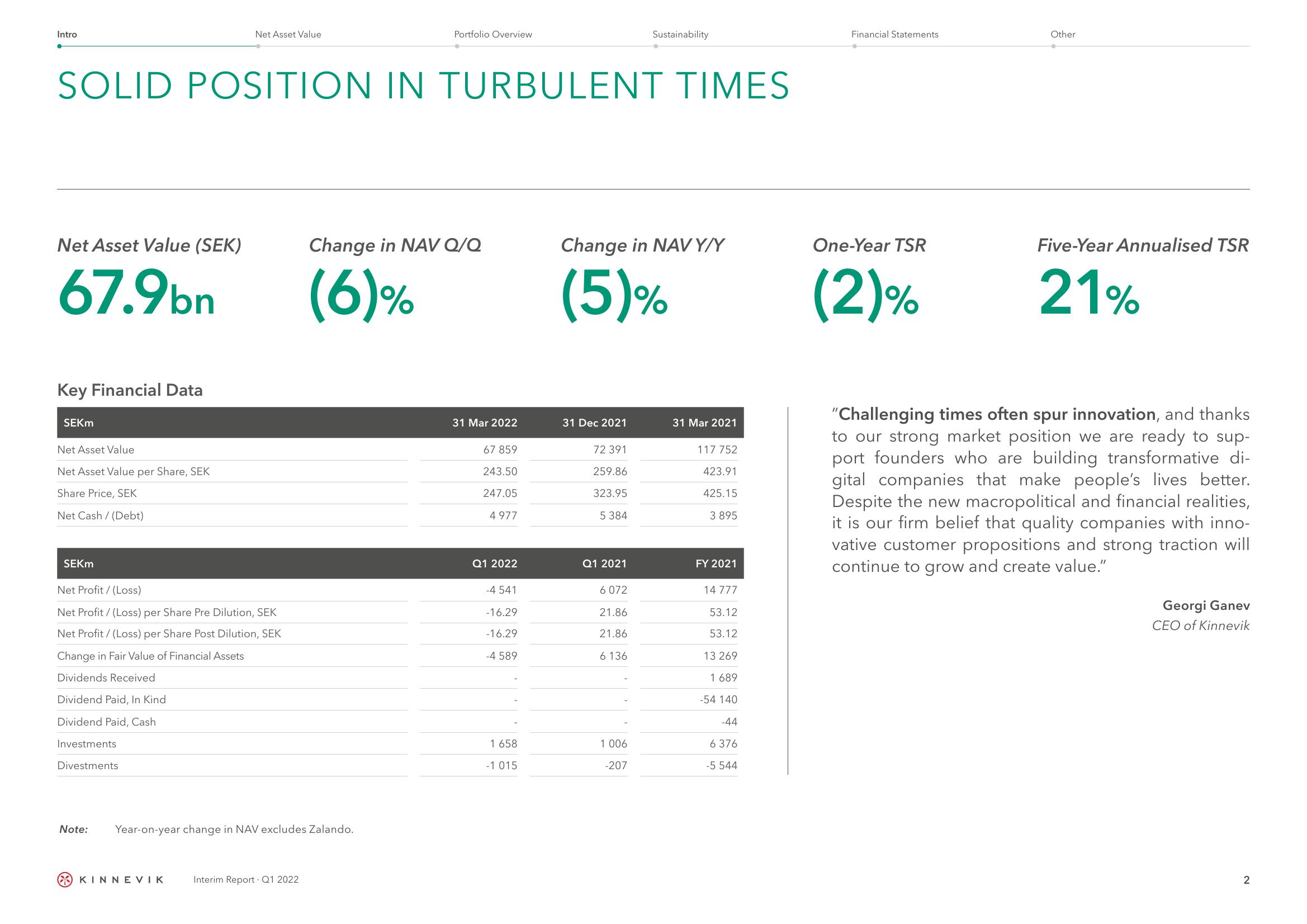

Net Asset Value (SEK)

67.9bn

Key Financial Data

SOLID POSITION IN TURBULENT TIMES

SEKM

Net Asset Value

Net Asset Value per Share, SEK

Share Price, SEK

Net Cash/ (Debt)

SEKM

Net Asset Value

Net Profit/(Loss)

Net Profit / (Loss) per Share Pre Dilution, SEK

Net Profit / (Loss) per Share Post Dilution, SEK

Change in Fair Value of Financial Assets

Dividends Received

Dividend Paid, In Kind

Dividend Paid, Cash

Investments

Divestments

Note:

Portfolio Overview

Year-on-year change in NAV excludes Zalando.

Ο ΚΙΝΝEVIK Interim Report Q1 2022

Change in NAV Q/Q

(6)%

31 Mar 2022

67 859

243.50

247.05

4 977

Q1 2022

-4541

-16.29

-16.29

-4 589

1 658

-1 015

Change in NAVY/Y

(5)%

31 Dec 2021

72 391

259.86

323.95

5 384

Q1 2021

Sustainability

6 072

21.86

21.86

6 136

1 006

-207

31 Mar 2021

117 752

423.91

425.15

3 895

FY 2021

14 777

53.12

53.12

13 269

1 689

-54 140

-44

6 376

-5 544

Financial Statements

One-Year TSR

(2)%

Other

Five-Year Annualised TSR

21%

"Challenging times often spur innovation, and thanks

to our strong market position we are ready to sup-

port founders who are building transformative di-

gital companies that make people's lives better.

Despite the new macropolitical and financial realities,

it is our firm belief that quality companies with inno-

vative customer propositions and strong traction will

continue to grow and create value."

Georgi Ganev

CEO of Kinnevik

2View entire presentation