Investor Presentation

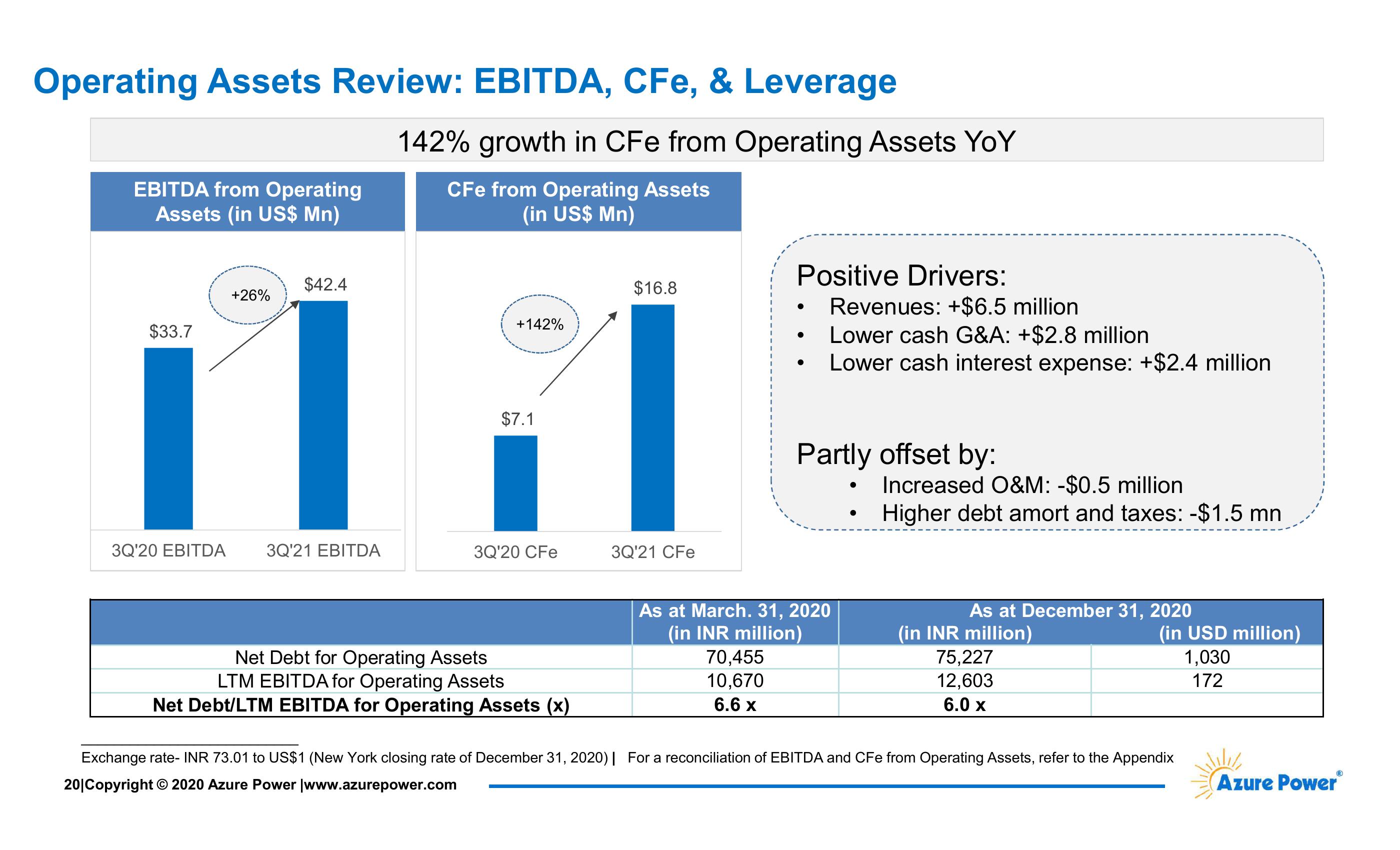

Operating Assets Review: EBITDA, CFe, & Leverage

EBITDA from Operating

Assets (in US$ Mn)

142% growth in CFe from Operating Assets YoY

CFe from Operating Assets

(in US$ Mn)

$42.4

$16.8

+26%

•

+142%

$33.7

$7.1

3Q'20 EBITDA

3Q'21 EBITDA

3Q'20 CFe

3Q'21 CFe

Positive Drivers:

•

Revenues: +$6.5 million

Lower cash G&A: +$2.8 million

Lower cash interest expense: +$2.4 million

Partly offset by:

•

Increased O&M: -$0.5 million

.

Higher debt amort and taxes: -$1.5 mn

Net Debt for Operating Assets

LTM EBITDA for Operating Assets

Net Debt/LTM EBITDA for Operating Assets (x)

As at March. 31, 2020

(in INR million)

70,455

10,670

6.6 x

As at December 31, 2020

(in INR million)

75,227

12,603

6.0 x

(in USD million)

1,030

Exchange rate- INR 73.01 to US$1 (New York closing rate of December 31, 2020) | For a reconciliation of EBITDA and CFe from Operating Assets, refer to the Appendix

20|Copyright © 2020 Azure Power |www.azurepower.com

172

Azure PowerⓇ

®View entire presentation