Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

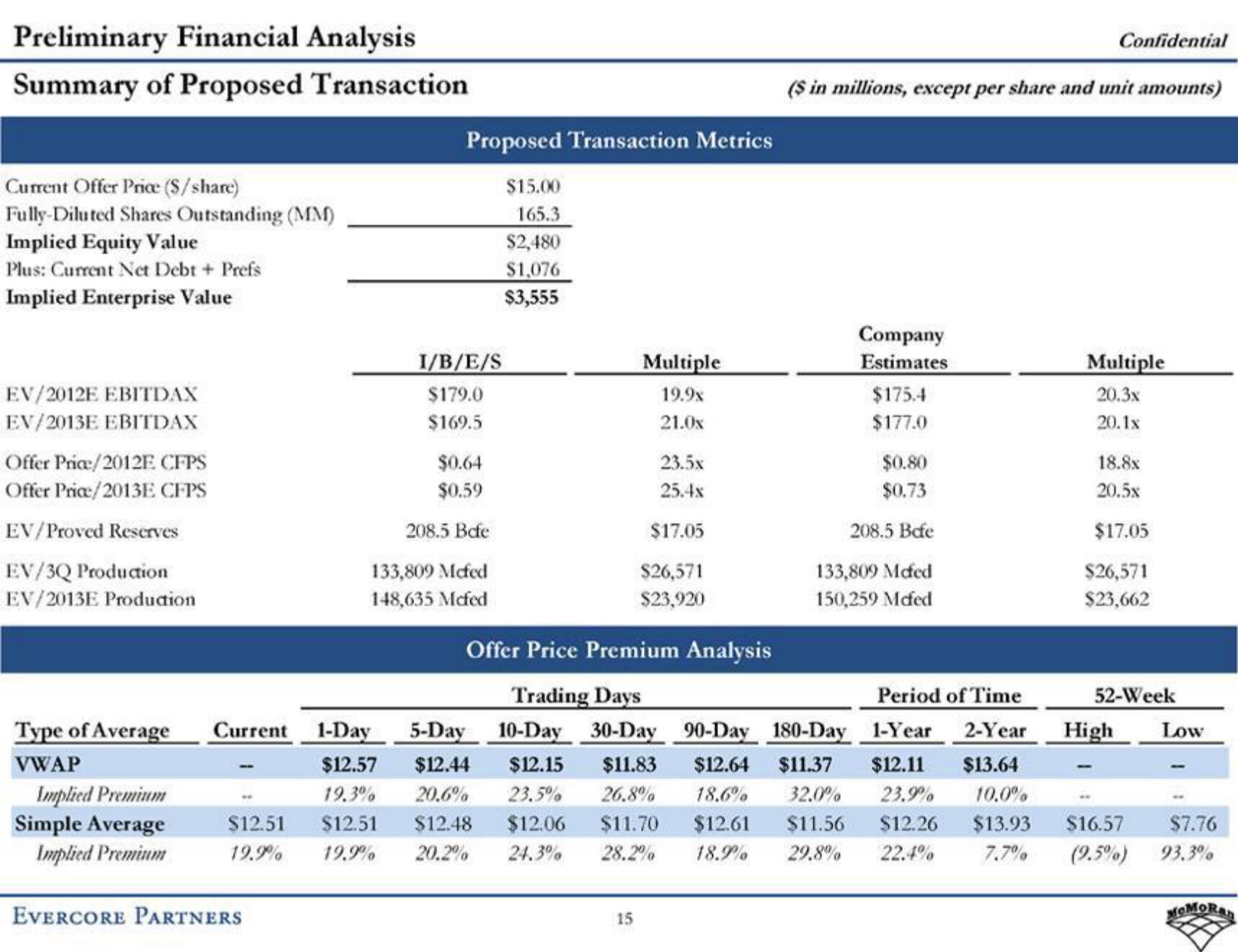

Summary of Proposed Transaction

Current Offer Price ($/share)

Fully-Diluted Shares Outstanding (MM)

Implied Equity Value

Plus: Current Net Debt + Prefs

Implied Enterprise Value

EV/2012E EBITDAX

EV/2013E EBITDAX

Offer Price/2012E. CFPS

Offer Price/2013E CFPS

EV/Proved Reserves

EV/3Q Production

EV/2013E Production

Type of Average

VWAP

Implied Premium

Simple Average

Implied Premium

Proposed Transaction Metrics

$15.00

165.3

$2,480

$1,076

$3,555

$12.51

19.9% 19.9%

EVERCORE PARTNERS

I/B/E/S

$179.0

$169.5

$0.64

$0.59

208.5 Befe

133,809 Mcfed

148,635 Mcfed

Multiple

19.9x

21.0x

15

23,5x

25.4x

$17.05

$26,571

$23,920

($ in millions, except per share and unit amounts)

Company

Estimates

$175.4

$177.0

$0.80

$0.73

208.5 Befe

133,809 Mcfed

150,259 Mafed

Offer Price Premium Analysis

Trading Days

Period of Time

Current 1-Day

$12.57

5-Day 10-Day 30-Day 90-Day 180-Day 1-Year 2-Year High

$12.44 $12.15 $11.83 $12.64 $11.37 $12.11 $13.64

19.3% 20.6% 23.5% 26.8% 18.6% 32.0% 23.9% 10.0%

$12.51 $12.48 $12.06 $11.70 $12.61 $11.56 $12.26

20.2% 24.3% 28.2%

18.9%

29.8%

22.4%

Confidential

Multiple

20.3x

20.1x

18.8x

20.5x

$17.05

$26,571

$23,662

52-Week

Low

$13.93 $16.57 $7.76

7.7% (9.5%) 93.3%

MOMORANView entire presentation