Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

10.8

46.0

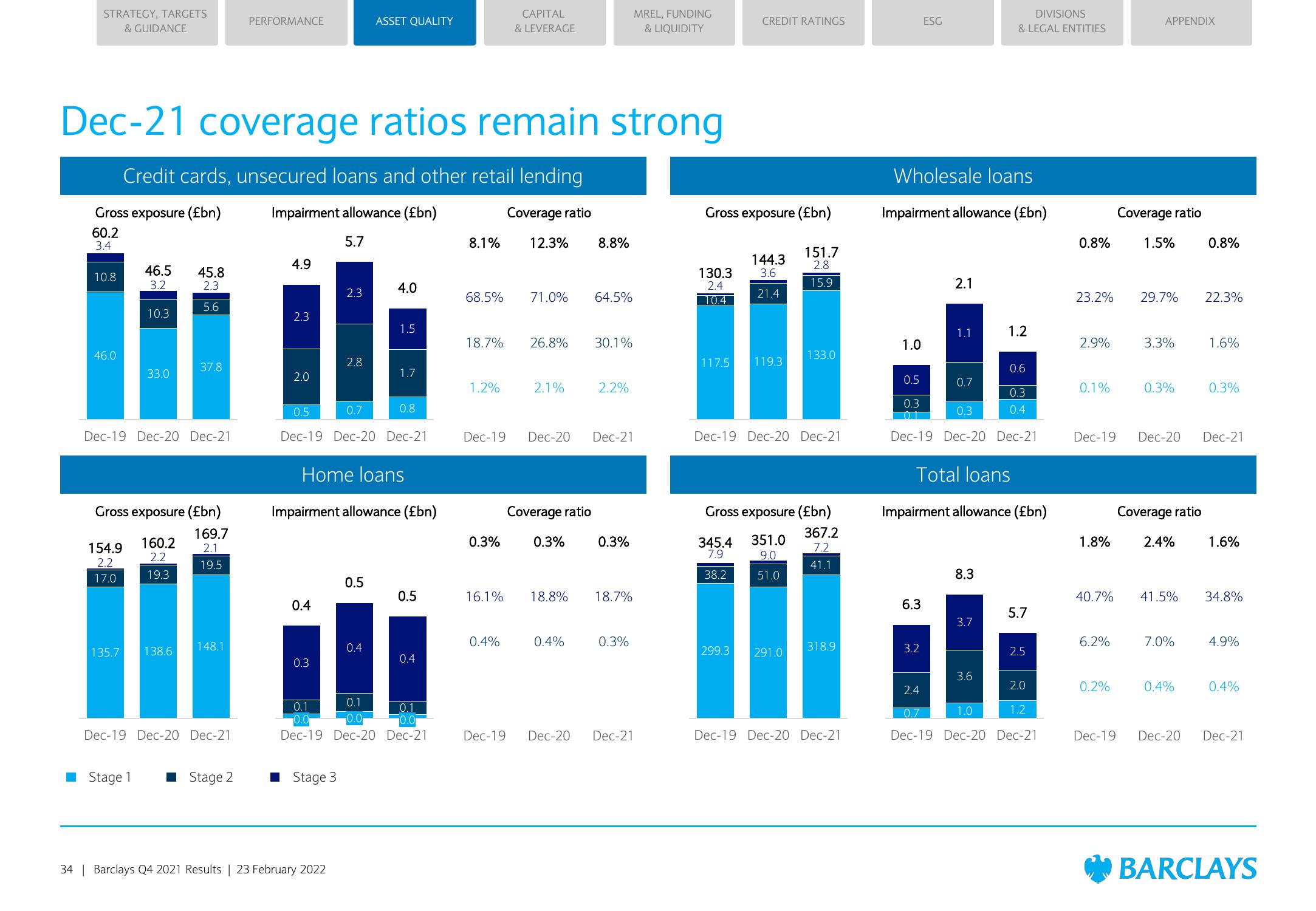

Dec-21 coverage ratios remain strong

Credit cards, unsecured loans and other retail lending

Gross exposure (£bn)

Impairment allowance (£bn)

60.2

Coverage ratio

12.3% 8.8%

3.4

5.7

154.9

2.2

46.5 45.8

3.2

2.3

5.6

Dec-19 Dec-20 Dec-21

17.0

10.3

33.0

Stage 1

37.8

160.2

2.2

Dec-19 Dec-20 Dec-21

PERFORMANCE

Stage 2

4.9

Gross exposure (£bn)

169.7

2.1

19.5

19.3

0.4

illa

148.1

135.7 138.6

0.3

2.3

2.0

2.3

2.8

■ Stage 3

34 | Barclays Q4 2021 Results | 23 February 2022

ASSET QUALITY

0.5

0.7

Dec-19 Dec-20 Dec-21

0.5

Home loans

Impairment allowance (£bn)

0.4

4.0

0.1

1.5

1.7

0.8

0.5

0.1

0.1

0.0

0.0

Dec-19 Dec-20 Dec-21

0.4

8.1%

68.5%

18.7%

1.2%

0.3%

CAPITAL

& LEVERAGE

16.1%

0.4%

71.0%

26.8% 30.1%

2.1%

Dec-19 Dec-20 Dec-21

Coverage ratio

0.3%

18.8%

64.5%

0.4%

Dec-19 Dec-20

2.2%

0.3%

18.7%

0.3%

MREL, FUNDING

& LIQUIDITY

Dec-21

Gross exposure (£bn)

151.7

2.8

15.9

130.3

2.4

10.4

CREDIT RATINGS

117.5

144.3

3.6

21.4

119.3

Dec-19 Dec-20 Dec-21

133.0

Gross exposure (£bn)

367.2

7.2

41.1

345.4 351.0

7.9

9.0

38.2

51.0

299.3 291.0

318.9

Dec-19 Dec-20 Dec-21

1.0

Wholesale loans

Impairment allowance (£bn)

ESG

6.3

2.1

3.2

1.1

0.5

0.3

0.3

OT

Dec-19 Dec-20 Dec-21

0.7

Total loans

Impairment allowance (£bn)

8.3

DIVISIONS

& LEGAL ENTITIES

3.7

3.6

1.2

0.6

0.3

0.4

1.0

5.7

2.5

2.4

2.0

1.2

0.7

Dec-19 Dec-20 Dec-21

0.8%

2.9%

0.1%

23.2% 29.7%

1.8%

APPENDIX

Coverage ratio

6.2%

1.5%

0.2%

3.3%

0.3%

Dec-19 Dec-20 Dec-21

Coverage ratio

40.7% 41.5%

2.4%

7.0%

0.4%

0.8%

Dec-19 Dec-20

22.3%

1.6%

0.3%

1.6%

34.8%

4.9%

0.4%

Dec-21

BARCLAYSView entire presentation