Citi Investment Banking Pitch Book

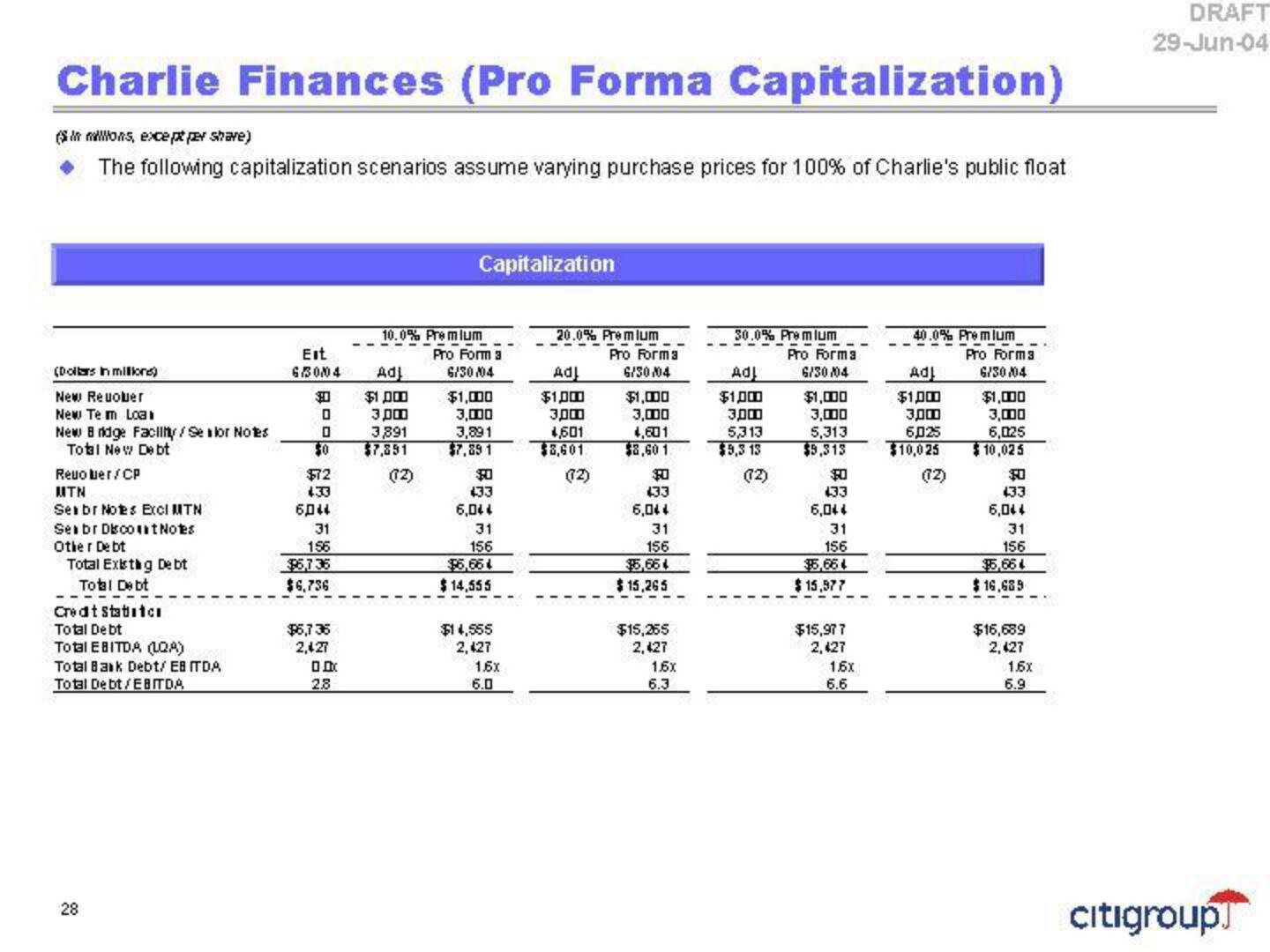

Charlie Finances (Pro Forma Capitalization)

(Simons, excepper share)

The following capitalization scenarios assume varying purchase prices for 100% of Charlie's public float

(Dollars in million)

New Reuoluer

New Te m Loa

New Bridge Facility /Se lor Notes

Total New Debt

Reuoluer / CP

MTN

Sex br Notes Excl MTN

Seabr Discount Notes

Other Debt

Total Exithg De bt

Total Debt

Credt statutc

Total Debt

Total EBITDA (LOA)

Total Bank Debt/ EBITDA

Total Debt/EBITDA

28

Eit

6/30004

$0

0

0

$0

$72

433

6044

31

156

$6,736

$6,736

$5,736

2,427

00

28

10.0% Premium

Ad

$1.000

3,00

3,891

$7,891

Capitalization

(12)

Pro Form 3

6/30/04

$1,000

3,000

3,891

$7,89 1

$0

433

6,044

31

156

$5,664

$14,555

$14,555

2,427

1.5x

6.0

20.0% Premium

Adl

$1,000

3,00

4,601

$8,601

(12)

Pro Forma

6/30/04

$1,000

3,000

4,601

$3,60 1

$0

433

6,044

31

156

$5,664

$15,265

$15,255

2,427

1.6x

6.3

30.0% Premium

Adl

$1,000

3,00

5,313

$9,3 13

(12)

Pro Forma

6/30/04

$1,000

3,000

5,313

$9,313

$0

433

6,044

31

156

$5,664

$ 15,977

$15,977

2,427

1.6x

6.6

40.0% Premium

Adl

$1,000

3,00

6,025

$10,025

(12)

Pro Forma

6/30/04

$1,000

3,000

6,025

$10,025

$0

433

6,044

31

156

$5,664

$16,689

$16,689

2,427

1.5x

6.9

DRAFT

29-Jun-04

Citigroup]View entire presentation