FlexJet SPAC Presentation Deck

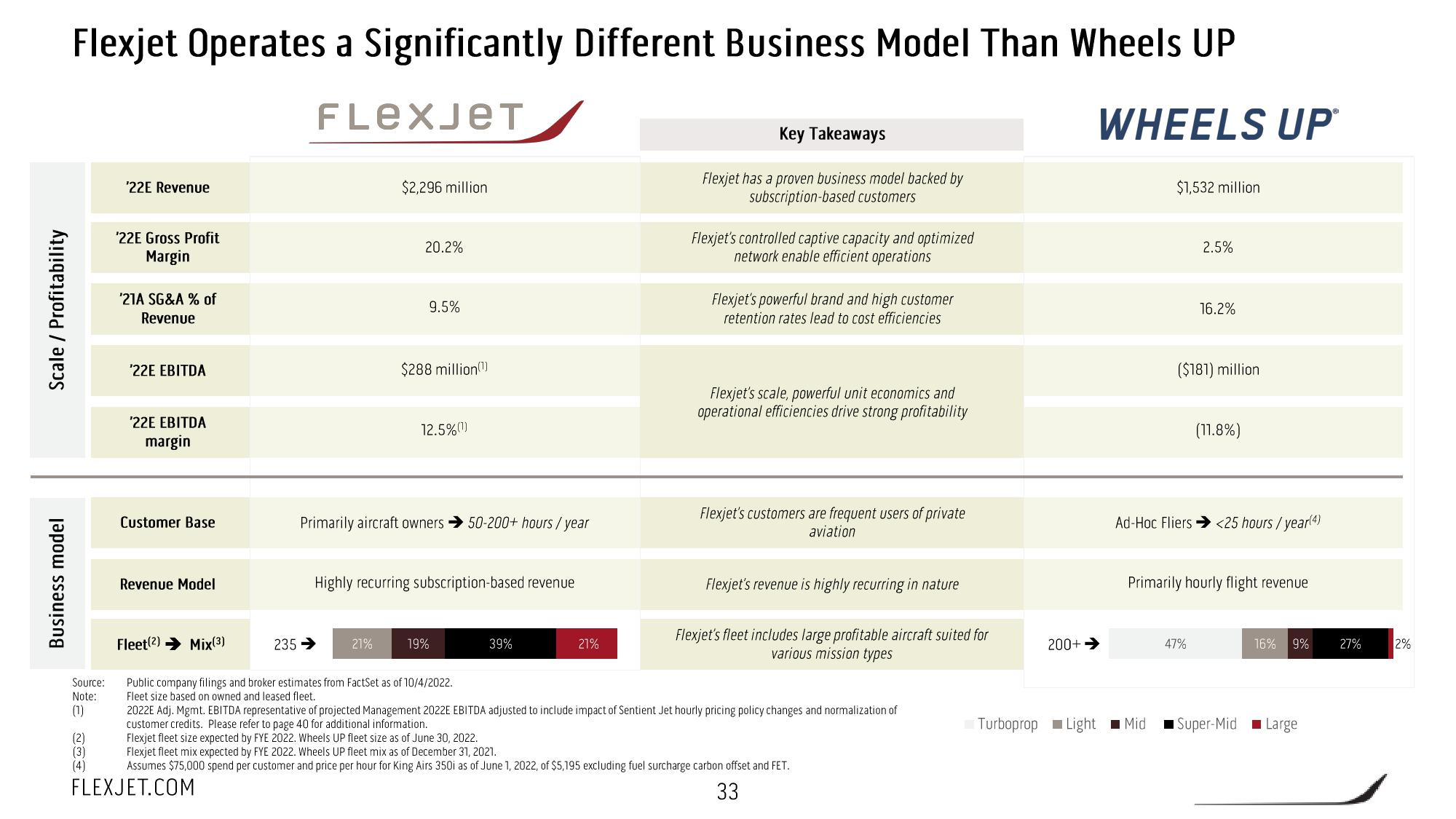

Scale/ Profitability

Business model

Flexjet Operates a Significantly Different Business Model Than Wheels UP

FLexJeT

WHEELS UPⓇ

Source:

Note:

(1)

¹22E Revenue

(2)

(3)

(4)

'22E Gross Profit

Margin

'21A SG&A % of

Revenue

'22E EBITDA

'22E EBITDA

margin

Customer Base

Revenue Model

Fleet(2) Mix(3)

235 →

$2,296 million

20.2%

21%

9.5%

$288 million(1)

Primarily aircraft owners 50-200+ hours/year

12.5%(1)

Highly recurring subscription-based revenue

19%

Public company filings and broker estimates from FactSet as of 10/4/2022.

Fleet size based on owned and leased fleet.

39%

21%

Key Takeaways

Flexjet has a proven business model backed by

subscription-based customers

Flexjet's controlled captive capacity and optimized

network enable efficient operations

Flexjet's powerful brand and high customer

retention rates lead to cost efficiencies

Flexjet's scale, powerful unit economics and

operational efficiencies drive strong profitability

Flexjet's customers are frequent users of private

aviation

Flexjet's revenue is highly recurring in nature

Flexjet's fleet includes large profitable aircraft suited for

various mission types

2022E Adj. Mgmt. EBITDA representative of projected Management 2022E EBITDA adjusted to include impact of Sentient Jet hourly pricing policy changes and normalization of

customer credits. Please refer to page 40 for additional information.

Flexjet fleet size expected by FYE 2022. Wheels UP fleet size as of June 30, 2022.

Flexjet fleet mix expected by FYE 2022. Wheels UP fleet mix as of December 31, 2021.

Assumes $75,000 spend per customer and price per hour for King Airs 350i as of June 1, 2022, of $5,195 excluding fuel surcharge carbon offset and FET.

FLEXJET.COM

33

200+

Turboprop Light

$1,532 million

Mid

2.5%

16.2%

($181) million

Ad-Hoc Fliers → <25 hours / year(4)

47%

(11.8%)

Primarily hourly flight revenue

16% 9%

Super-Mid Large

27%

2%View entire presentation