MoneyLion SPAC Presentation Deck

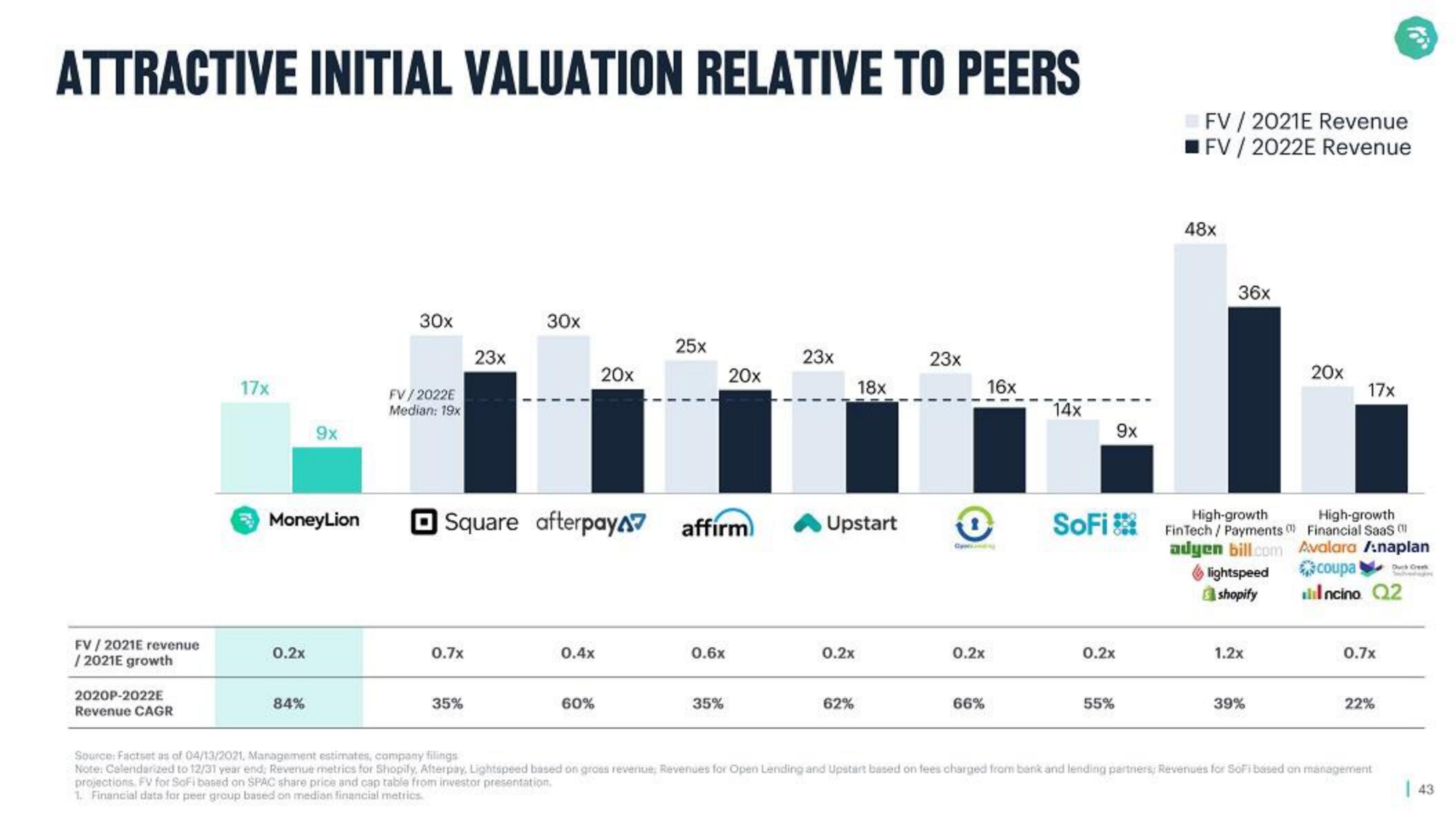

ATTRACTIVE INITIAL VALUATION RELATIVE TO PEERS

FV/2021E revenue

/2021E growth

2020P-2022E

Revenue CAGR

17x

MoneyLion

0.2x

9x

84%

30x

FV/2022E

Median: 19x

0.7x

23x

35%

30x

Square afterpay affirm

0.4x

20x

60%

25x

0.6x

20x

35%

23x

Upstart

0.2x

18x

62%

23x

Op

0.2x

66%

16x

14x

0.2x

9x

55%

FV / 2021E Revenue

■FV / 2022E Revenue

48x

High-growth

SOFI FinTech / Payments

adyen bill.com

36x

lightspeed

shopify

1.2x

39%

20x

17x

High-growth

Financial Saas

Avalara /naplan

coupa!

Incino. Q2

Duck Creek

0.7x

10

22%

Source: Factset as of 04/13/2021, Management estimates, company filings

Note: Calendarized to 12/31 year end; Revenue metrics for Shopily, Afterpay, Lightspeed based on gross revenue, Revenues for Open Lending and Upstart based on fees charged from bank and lending partners; Revenues for SoFi based on management

projections. FV for SoFi based on SPAC share price and cap table from investor presentation.

1. Financial data for peer group based on median financial metrics.

| 43View entire presentation