Frontier IPO Presentation Deck

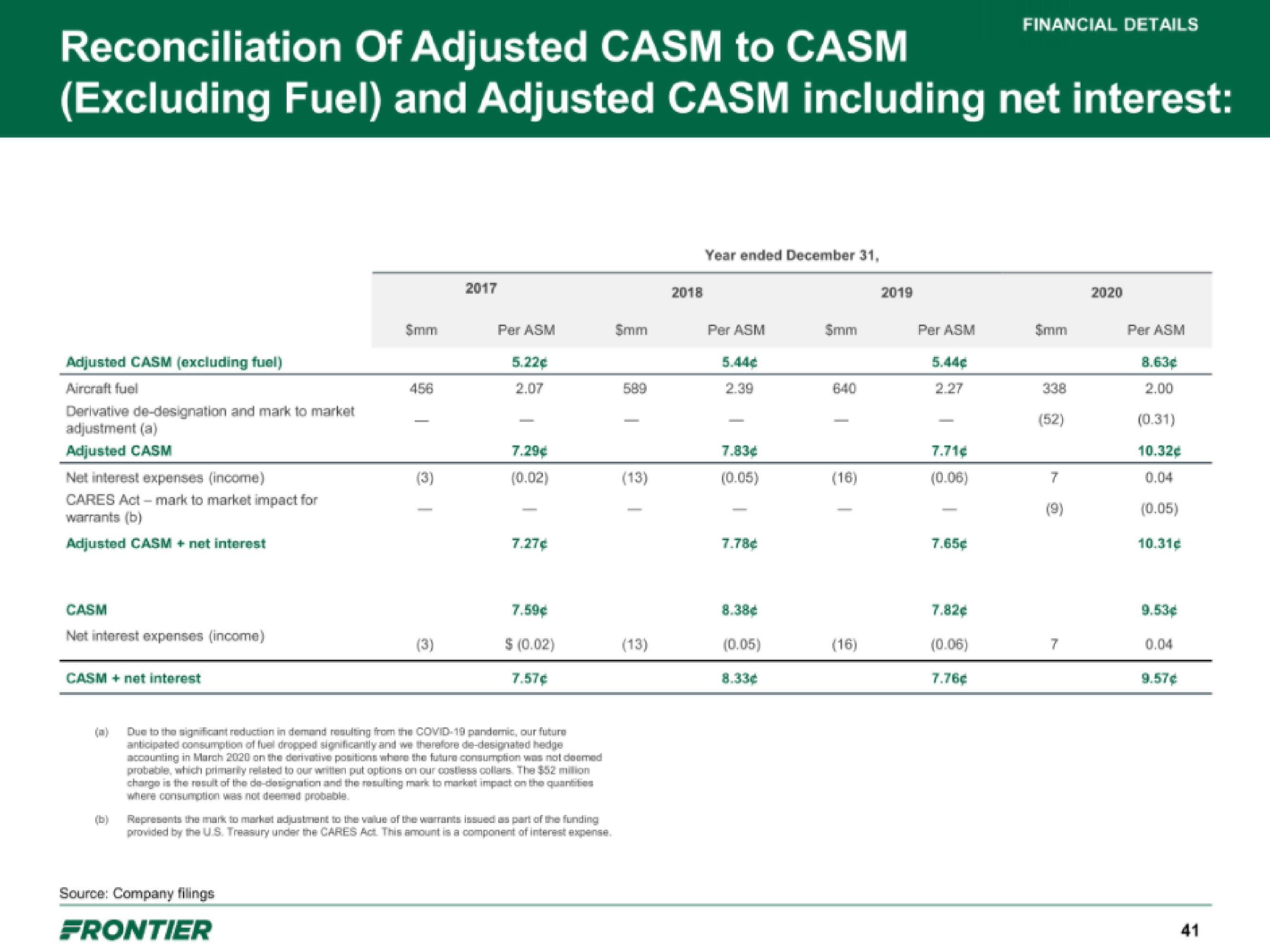

Reconciliation Of Adjusted CASM to CASM

(Excluding Fuel) and Adjusted CASM including net interest:

Adjusted CASM (excluding fuel)

Aircraft fuel

Derivative de-designation and mark to market

adjustment (a)

Adjusted CASM

Net interest expenses (income)

CARES Act-mark to market impact for

warrants (b)

Adjusted CASM + net interest

CASM

Net interest expenses (income)

CASM + net interest

$mm

456

Source: Company filings

FRONTIER

2017

Per ASM

5.22€

2.07

7.29€

(0.02)

7.27€

7.59€

$ (0.02)

7.57€

Due to the significant reduction in demand resulting from the COVID-19 pandemic, our future

anticipated consumption of fuel dropped significantly and we therefore de-designated hedge

accounting in March 2020 on the derivative positions where the future consumption was not deemed

probable, which primarily related to our written put options on our costless collars. The $52 million

charge is the result of the de-designation and the resulting mark to market impact on the quantities

where consumption was not deemed probable.

Represents the mark to market adjustment to the value of the warrants issued as part of the funding

provided by the U.S. Treasury under the CARES Act. This amount is a component of interest expense.

$mm

589

(13)

1

(13)

2018

Year ended December 31,

Per ASM

5.44¢

2.39

7.83

(0.05)

7.78¢

8.38€

(0.05)

8.33€

Smm

640

(16)

1

(16)

2019

Per ASM

7.71€

(0.06)

7.65€

FINANCIAL DETAILS

7.82€

(0.06)

7.76€

$mm

338

(52)

7

7

2020

Per ASM

8.63€

2.00

(0.31)

10.32€

0.04

(0.05)

10.31¢

9.53€

0.04

9.57€

41View entire presentation