Embracer Group Mergers and Acquisitions Presentation Deck

Key transaction terms

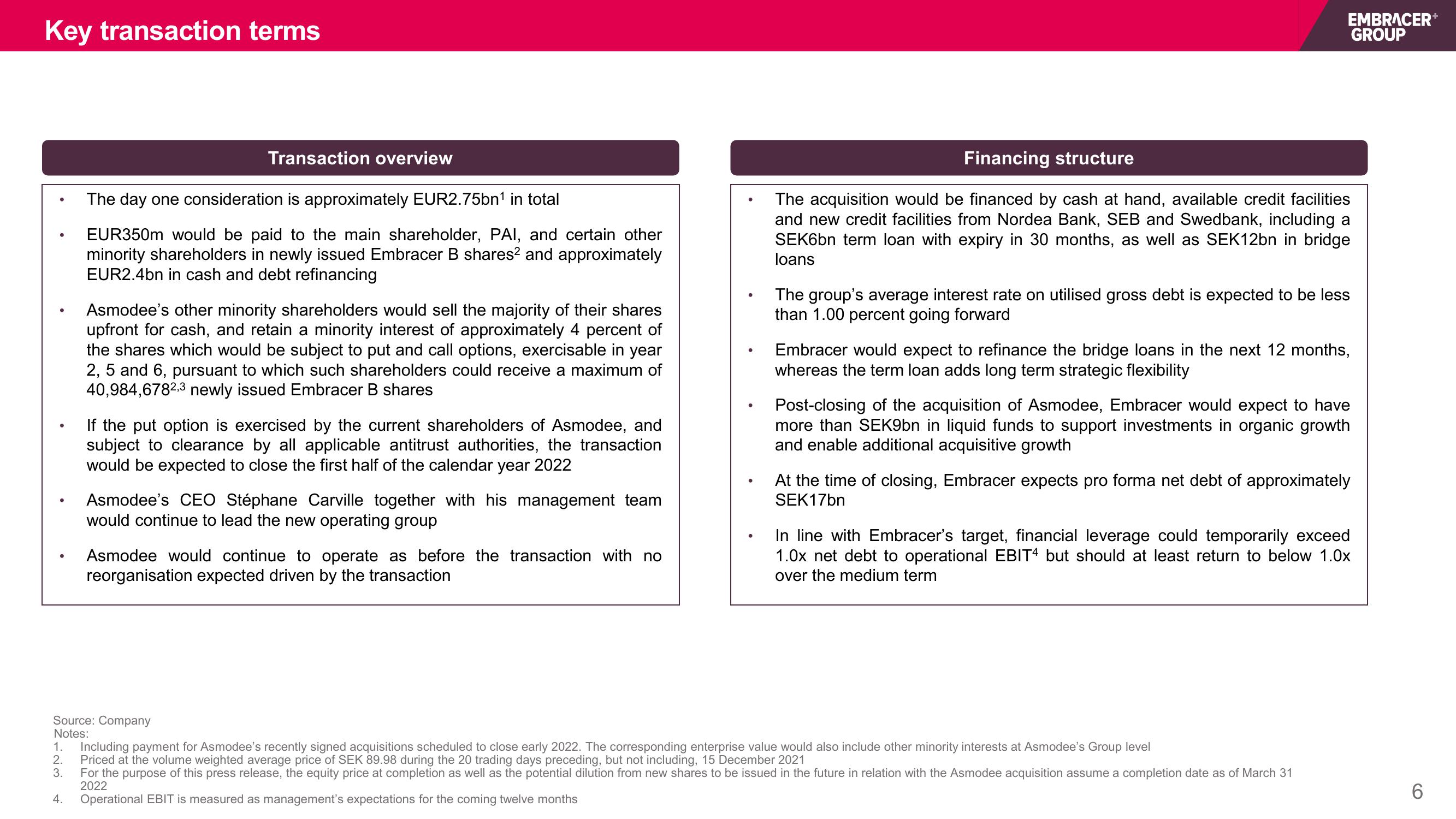

Transaction overview

The day one consideration is approximately EUR2.75bn¹ in total

EUR350m would be paid to the main shareholder, PAI, and certain other

minority shareholders in newly issued Embracer B shares² and approximately

EUR2.4bn in cash and debt refinancing

4.

Asmodee's other minority shareholders would sell the majority of their shares

upfront for cash, and retain a minority interest of approximately 4 percent of

the shares which would be subject to put and call options, exercisable in year

2, 5 and 6, pursuant to which such shareholders could receive a maximum of

40,984,6782,3 newly issued Embracer B shares

If the put option is exercised by the current shareholders of Asmodee, and

subject to clearance by all applicable antitrust authorities, the transaction

would be expected to close the first half of the calendar year 2022

Asmodee's CEO Stéphane Carville together with his management team

would continue to lead the new operating group

Source: Company

Notes:

Asmodee would continue to operate as before the transaction with no

reorganisation expected driven by the transaction

EMBRACER+

GROUP

Financing structure

The acquisition would be financed by cash at hand, available credit facilities

and new credit facilities from Nordea Bank, SEB and Swedbank, including a

SEK6bn term loan with expiry in 30 months, as well as SEK12bn in bridge

loans

The group's average interest rate on utilised gross debt is expected to be less

than 1.00 percent going forward

Embracer would expect to refinance the bridge loans in the next 12 months,

whereas the term loan adds long term strategic flexibility

Post-closing of the acquisition of Asmodee, Embracer would expect to have

more than SEK9bn in liquid funds to support investments in organic growth

and enable additional acquisitive growth

At the time of closing, Embracer expects pro forma net debt of approximately

SEK17bn

1. Including payment for Asmodee's recently signed acquisitions scheduled to close early 2022. The corresponding enterprise value would also include other minority interests at Asmodee's Group level

2. Priced at the volume weighted average price of SEK 89.98 during the 20 trading days preceding, but not including, 15 December 2021

3.

For the purpose of this press release, the equity price at completion as well as the potential dilution from new shares to be issued in the future in relation with the Asmodee acquisition assume a completion date as of March 31

2022

Operational EBIT is measured as management's expectations for the coming twelve months

In line with Embracer's target, financial leverage could temporarily exceed

1.0x net debt to operational EBIT4 but should at least return to below 1.0x

over the medium term

6View entire presentation