Axos Financial, Inc. Investor Presentation

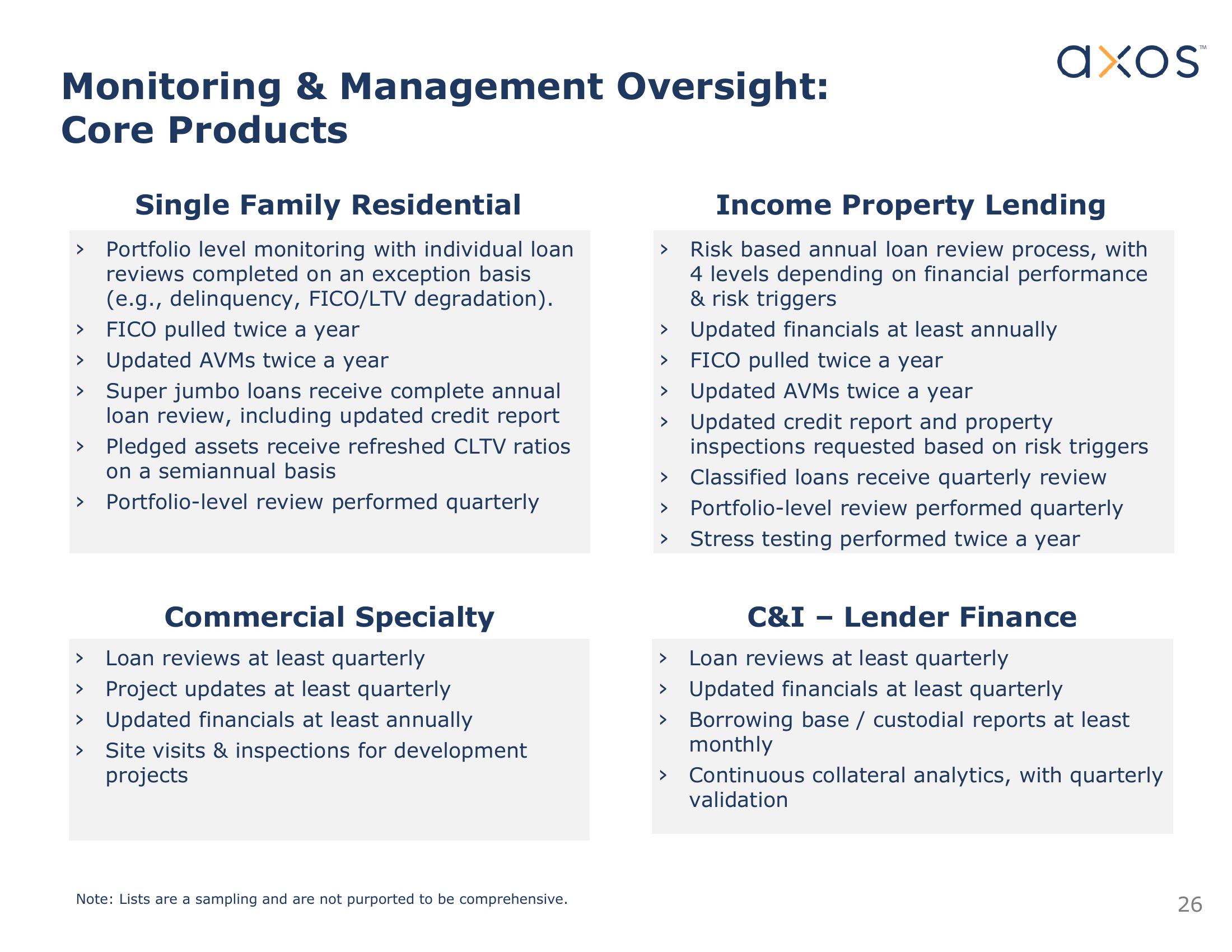

Monitoring & Management Oversight:

Core Products

Single Family Residential

> Portfolio level monitoring with individual loan

reviews completed on an exception basis

(e.g., delinquency, FICO/LTV degradation).

FICO pulled twice a year

> Updated AVMs twice a year

>

Super jumbo loans receive complete annual

loan review, including updated credit report

> Pledged assets receive refreshed CLTV ratios

on a semiannual basis

Portfolio-level review performed quarterly

>

Commercial Specialty

Loan reviews at least quarterly

> Project updates at least quarterly

>

Updated financials at least annually

Site visits & inspections for development

projects

Note: Lists are a sampling and are not purported to be comprehensive.

axos

Income Property Lending

Risk based annual loan review process, with

4 levels depending on financial performance

& risk triggers

> Updated financials at least annually

> FICO pulled twice a year

> Updated AVMs twice a year

Updated credit report and property

inspections requested based on risk triggers

Classified loans receive quarterly review

> Portfolio-level review performed quarterly

> Stress testing performed twice a year

C&I

Loan reviews at least quarterly

> Updated financials at least quarterly

-

Lender Finance

> Borrowing base / custodial reports at least

monthly

Continuous collateral analytics, with quarterly

validation

26View entire presentation