Oatly Results Presentation Deck

Production

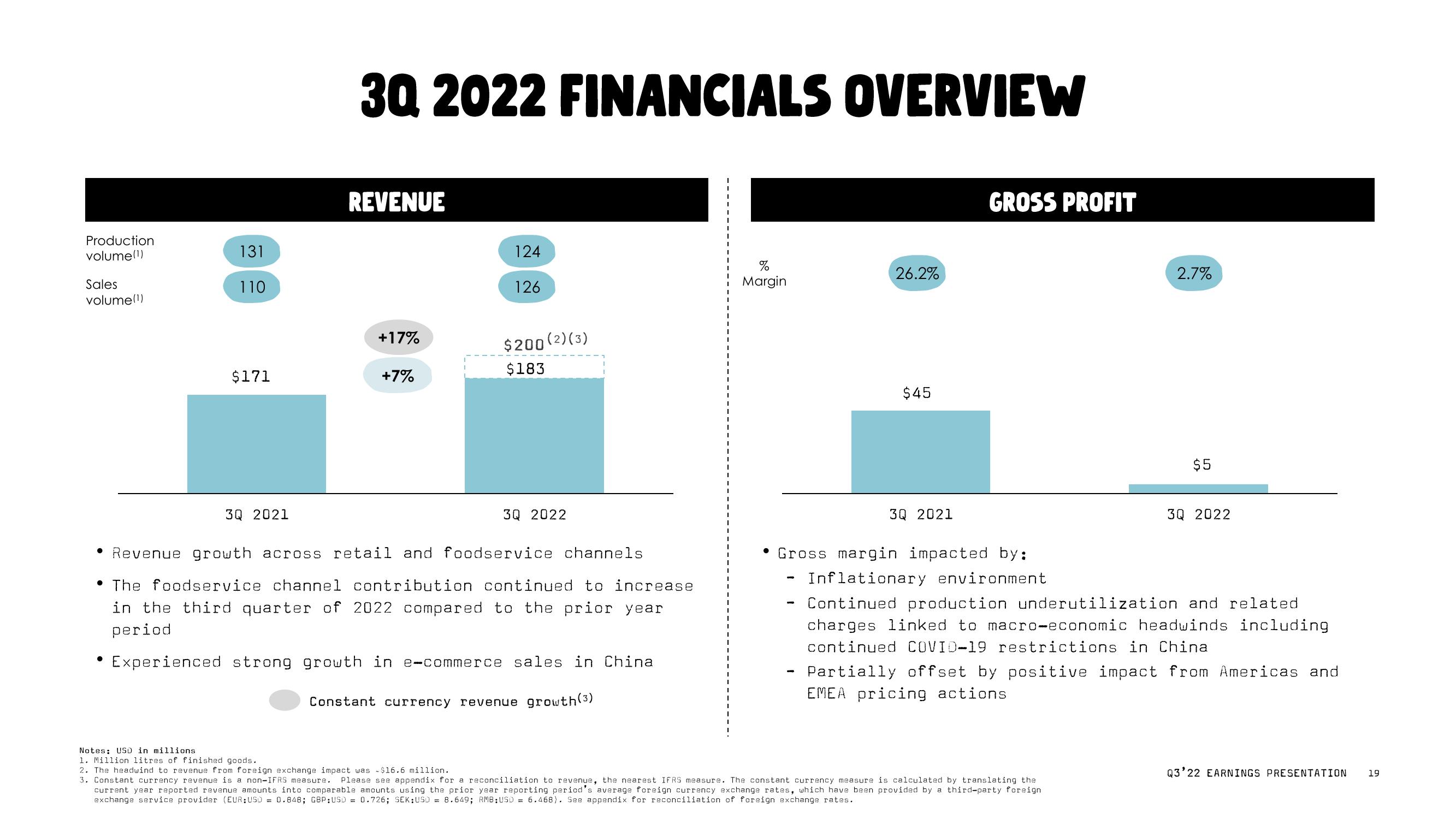

volume(1)

Sales

volume(¹)

●

131

110

$171

3Q 2021

3Q

30 2022 FINANCIALS OVERVIEW

REVENUE

+17%

+7%

124

126

$200 (2) (3)

$183

3Q 2022

Revenue growth across retail and foodservice channels

The foodservice channel contribution continued to increase

in the third quarter of 2022 compared to the prior year

period

Experienced strong growth in e-commerce sales in China

Constant currency revenue growth (³)

%

Margin

26.2%

$45

3Q 2021

GROSS PROFIT

Gross margin impacted by:

Inflationary environment

2.7%

Notes: USD in millions.

1. Million litres of finished goods.

2. The headwind to revenue from foreign exchange impact was $16.6 million.

3. Constant currency revenue is a non-IFRS measure. Please see appendix for a reconciliation to revenue, the nearest IFRS measure. The constant currency measure is calculated by translating the

current year reported revenue amounts into comparable amounts using the prior year reporting period's average foreign currency exchange rates, which have been provided by a third-party foreign

exchange service provider (EUR:USD = 0.848; GBP:USD = 0.726; SEK:USD = 8.649; RMB:USD = 6.468). See appendix for reconciliation of foreign exchange rates.

$5

3Q 2022

Continued production underutilization and related

charges linked to macro-economic headwinds including

continued COVID-19 restrictions in China

Partially offset by positive impact from Americas and

EMEA pricing actions

Q3'22 EARNINGS PRESENTATION

19View entire presentation