Owens&Minor Investor Day Presentation Deck

92

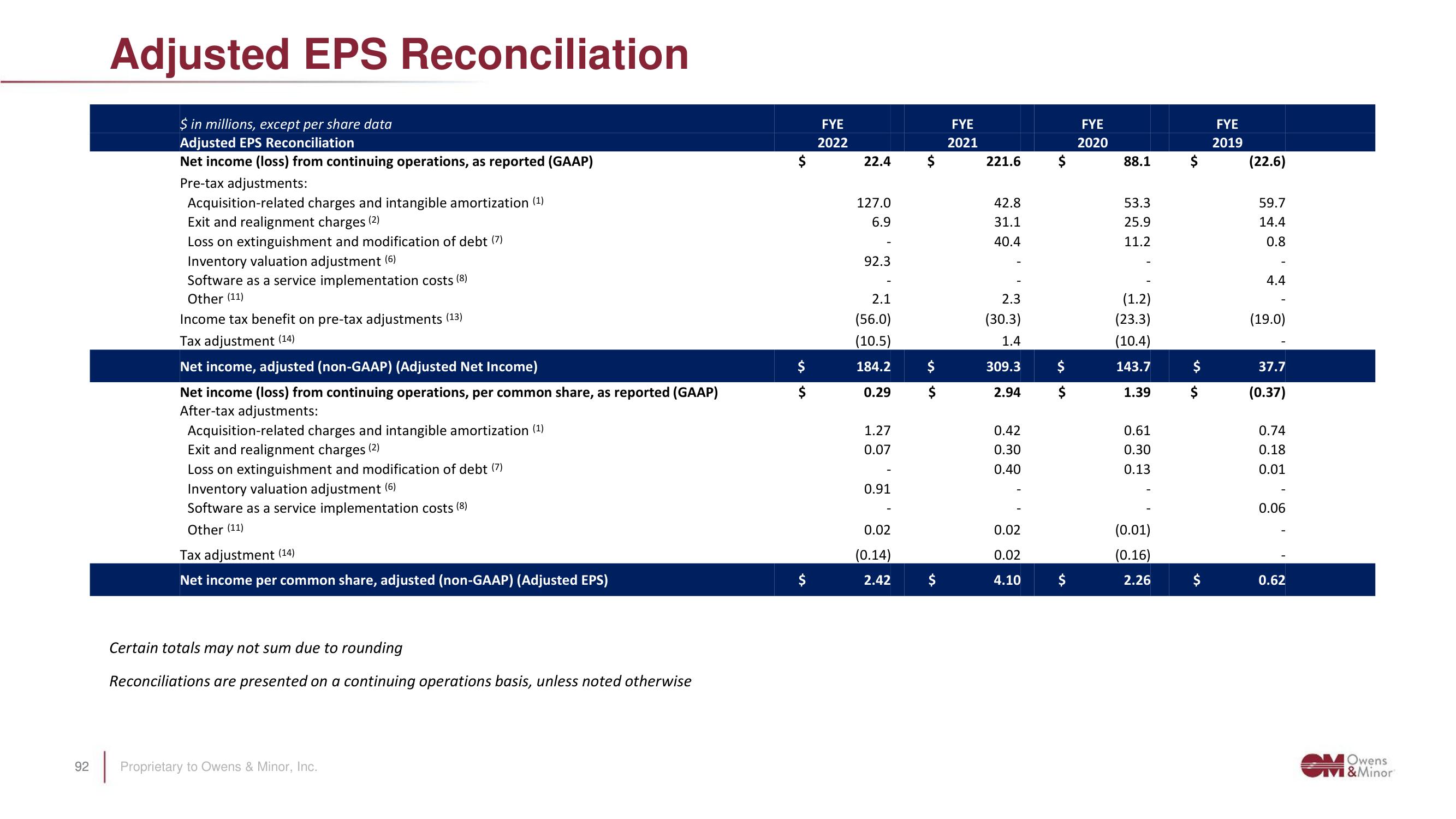

Adjusted EPS Reconciliation

$ in millions, except per share data

Adjusted EPS Reconciliation

Net income (loss) from continuing operations, as reported (GAAP)

Pre-tax adjustments:

Acquisition-related charges and intangible amortization (1)

Exit and realignment charges (2)

Loss on extinguishment and modification of debt (7)

Inventory valuation adjustment (6)

Software as a service implementation costs (8)

Other (11)

Income tax benefit on pre-tax adjustments (13)

Tax adjustment (14)

Net income, adjusted (non-GAAP) (Adjusted Net Income)

Net income (loss) from continuing operations, per common share, as reported (GAAP)

After-tax adjustments:

Acquisition-related charges and intangible amortization (¹)

Exit and realignment charges (2)

Loss on extinguishment and modification of debt (7)

Inventory valuation adjustment (6)

Software as a service implementation costs (8)

Other (11)

Tax adjustment (14)

Net income per common share, adjusted (non-GAAP) (Adjusted EPS)

Certain totals may not sum due to rounding

Reconciliations are presented on a continuing operations basis, unless noted otherwise

Proprietary to Owens & Minor, Inc.

$

$

FYE

2022

22.4

127.0

6.9

92.3

2.1

(56.0)

(10.5)

184.2

0.29

1.27

0.07

0.91

0.02

(0.14)

2.42

$

$

FYE

2021

221.6

42.8

31.1

40.4

2.3

(30.3)

1.4

309.3

2.94

0.42

0.30

0.40

0.02

0.02

4.10

$

$

$

FYE

2020

88.1

53.3

25.9

11.2

(1.2)

(23.3)

(10.4)

143.7

1.39

0.61

0.30

0.13

(0.01)

(0.16)

2.26

$

$

$

FYE

2019

(22.6)

59.7

14.4

0.8

4.4

(19.0)

37.7

(0.37)

0.74

0.18

0.01

0.06

0.62

MOwens

M&MinorView entire presentation