Third Quarter 2022 Earnings Conference Call

Average deposits

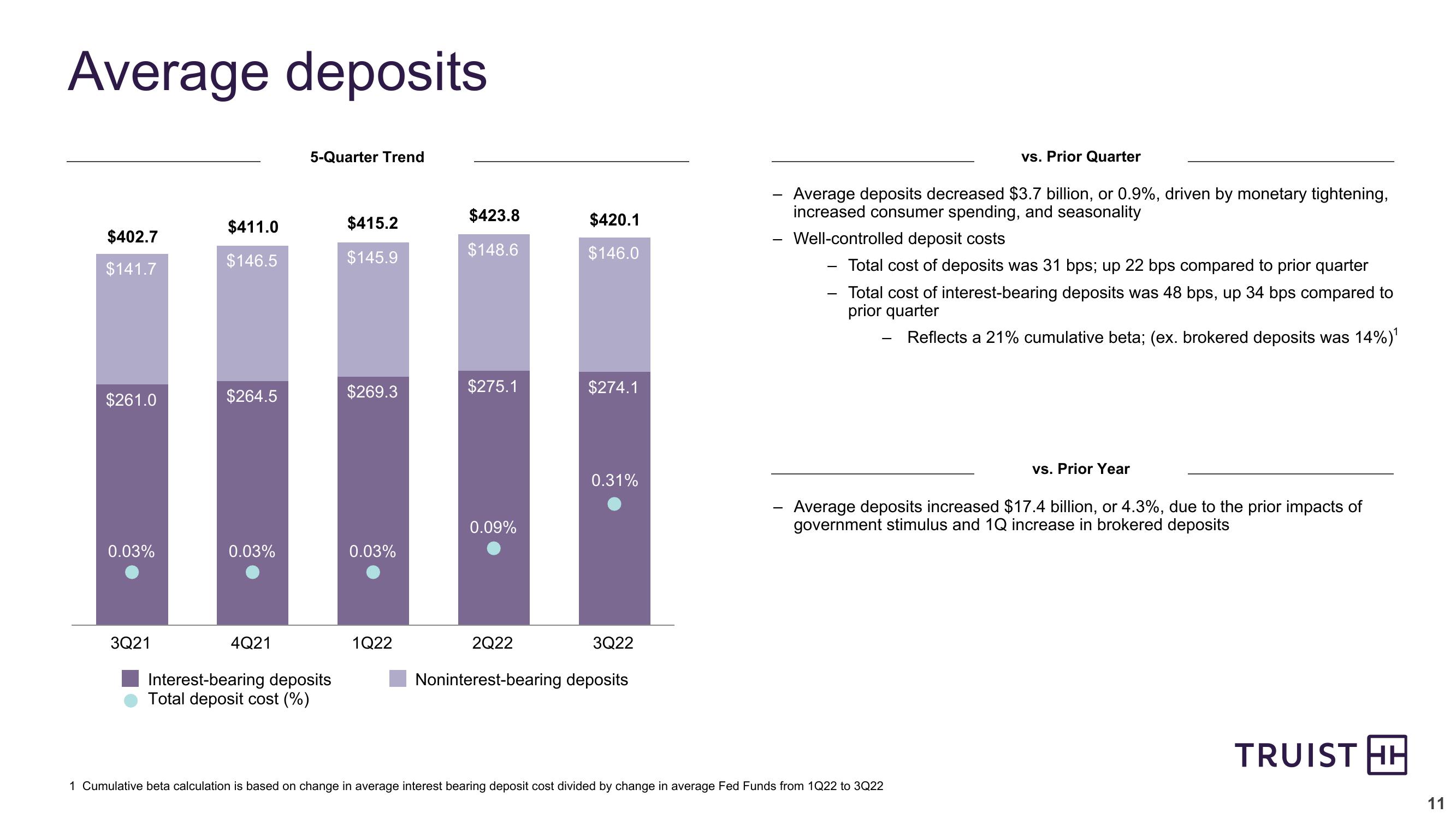

5-Quarter Trend

$423.8

$411.0

$415.2

$420.1

$402.7

$148.6

$146.5

$145.9

$146.0

$141.7

$261.0

$264.5

$269.3

$275.1

$274.1

0.31%

0.09%

0.03%

0.03%

0.03%

3Q21

4Q21

Interest-bearing deposits

Total deposit cost (%)

1Q22

3Q22

2Q22

Noninterest-bearing deposits

-

vs. Prior Quarter

Average deposits decreased $3.7 billion, or 0.9%, driven by monetary tightening,

increased consumer spending, and seasonality

Well-controlled deposit costs

Total cost of deposits was 31 bps; up 22 bps compared to prior quarter

Total cost of interest-bearing deposits was 48 bps, up 34 bps compared to

prior quarter

-

Reflects a 21% cumulative beta; (ex. brokered deposits was 14%)1

vs. Prior Year

Average deposits increased $17.4 billion, or 4.3%, due to the prior impacts of

government stimulus and 1Q increase in brokered deposits

1 Cumulative beta calculation is based on change in average interest bearing deposit cost divided by change in average Fed Funds from 1Q22 to 3Q22

TRUIST HH

11View entire presentation