SoftBank Results Presentation Deck

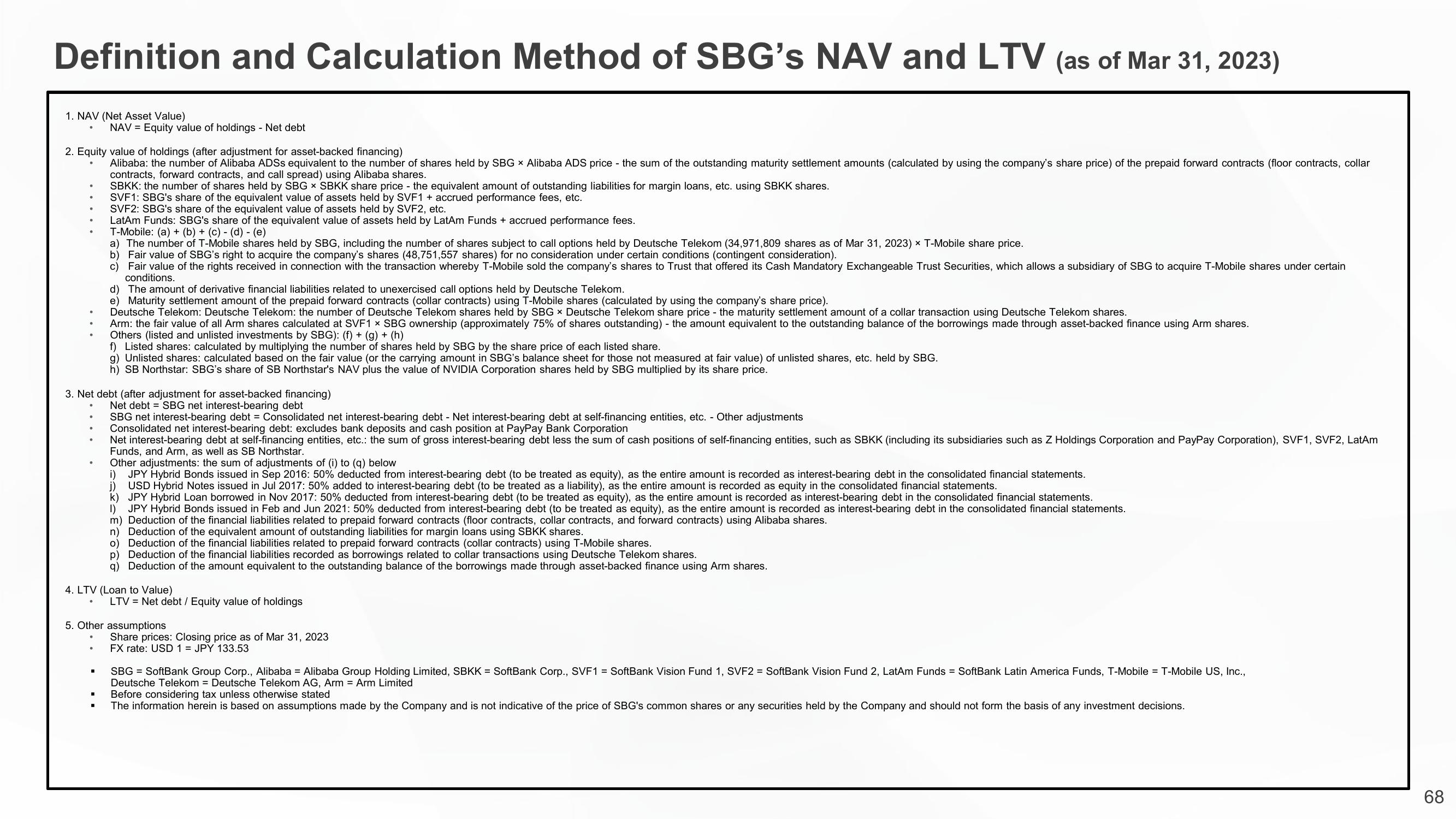

Definition and Calculation Method of SBG's NAV and LTV (as of Mar 31, 2023)

1. NAV (Net Asset Value)

2. Equity value of holdings (after adjustment for asset-backed financing)

Alibaba: the number of Alibaba ADSS equivalent to the number of shares held by SBG x Alibaba ADS price - the sum of the outstanding maturity settlement amounts (calculated by using the company's share price) of the prepaid forward contracts (floor contracts, collar

contracts, forward contracts, and call spread) using Alibaba shares.

SBKK: the number of shares held by SBG × SBKK share price - the equivalent amount of outstanding liabilities for margin loans, etc. using SBKK shares.

SVF1: SBG's share of the equivalent value of assets held by SVF1 + accrued performance fees, etc.

SVF2: SBG's share of the equivalent value of assets held by SVF2, etc.

LatAm Funds: SBG's share of the equivalent value of assets held by LatAm Funds + accrued performance fees.

T-Mobile: (a) + (b) + (c) - (d) -(e)

●

NAV = Equity value of holdings - Net debt

•

a) The number of T-Mobile shares held by SBG, including the number of shares subject to call options held by Deutsche Telekom (34,971,809 shares as of Mar 31, 2023) × T-Mobile share price.

b) Fair value of SBG's right to acquire the company's shares (48,751,557 shares) for no consideration under certain conditions (contingent consideration).

c) Fair value of the rights received in connection with the transaction whereby T-Mobile sold the company's shares to Trust that offered its Cash Mandatory Exchangeable Trust Securities, which allows a subsidiary of SBG to acquire T-Mobile shares under certain

conditions.

d) The amount of derivative financial liabilities related to unexercised call options held by Deutsche Telekom.

e) Maturity settlement amount of the prepaid forward contracts (collar contracts) using T-Mobile shares (calculated by using the company's share price).

Deutsche Telekom: Deutsche Telekom: the number of Deutsche Telekom shares held by SBG x Deutsche Telekom share price - the maturity settlement amount of a collar transaction using Deutsche Telekom shares.

Arm: the fair value of all Arm shares calculated at SVF1 × SBG ownership (approximately 75% of shares outstanding) - the amount equivalent to the outstanding balance of the borrowings made through asset-backed finance using Arm shares.

Others (listed and unlisted investments by SBG): (f) + (g) + (h)

3. Net debt (after adjustment for asset-backed financing)

Net debt SBG net interest-bearing debt

SBG net interest-bearing debt = Consolidated net interest-bearing debt - Net interest-bearing debt at self-financing entities, etc. - Other adjustments

Consolidated net interest-bearing debt: excludes bank deposits and cash position at PayPay Bank Corporation

Net interest-bearing debt at self-financing entities, etc.: the sum of gross interest-bearing debt less the sum of cash positions of self-financing entities, such as SBKK (including its subsidiaries such as Z Holdings Corporation and PayPay Corporation), SVF1, SVF2, LatAm

Funds, and Arm, as well as SB Northstar.

Other adjustments: the sum of adjustments of (i) to (q) below

i) JPY Hybrid Bonds issued in Sep 2016: 50% deducted from interest-bearing debt (to be treated as equity), as the entire amount is recorded as interest-bearing debt in the consolidated financial statements.

-

f) Listed shares: calculated by multiplying the number of shares held by SBG by the share price of each listed share.

g) Unlisted shares: calculated based on the fair value (or the carrying amount in SBG's balance sheet for those not measured at fair value) of unlisted shares, etc. held by SBG.

h) SB Northstar: SBG's share of SB Northstar's NAV plus the value of NVIDIA Corporation shares held by SBG multiplied by its share price.

j) USD Hybrid Notes issued in Jul 2017: 50% added to interest-bearing debt (to be treated as a liability), as the entire amount is recorded as equity in the consolidated financial statements.

k) JPY Hybrid Loan borrowed in Nov 2017: 50% deducted from interest-bearing debt (to be treated as equity), as the entire amount is recorded as interest-bearing debt in the consolidated financial statements.

1) JPY Hybrid Bonds issued in Feb and Jun 2021: 50% deducted from interest-bearing debt (to be treated as equity), as the entire amount is recorded as interest-bearing debt in the consolidated financial statements.

m) Deduction of the financial liabilities related to prepaid forward contracts (floor contracts, collar contracts, and forward contracts) using Alibaba shares.

n) Deduction of the equivalent amount of outstanding liabilities for margin loans using SBKK shares.

o) Deduction of the financial liabilities related to prepaid forward contracts (collar contracts) using T-Mobile shares.

p) Deduction of the financial liabilities recorded as borrowings related to collar transactions using Deutsche Telekom shares.

q) Deduction of the amount equivalent to the outstanding balance of the borrowings made through asset-backed finance using Arm shares.

4. LTV (Loan to Value)

LTV Net debt / Equity value of holdings

5. Other assumptions

Share prices: Closing price as of Mar 31, 2023

FX rate: USD 1= JPY 133.53

SBG = SoftBank Group Corp., Alibaba = Alibaba Group Holding Limited, SBKK = SoftBank Corp., SVF1 = SoftBank Vision Fund 1, SVF2 = SoftBank Vision Fund 2, LatAm Funds SoftBank Latin America Funds, T-Mobile = T-Mobile US, Inc.,

Deutsche Telekom = Deutsche Telekom AG, Arm = Arm Limited

Before considering tax unless otherwise stated

The information herein is based on assumptions made by the Company and is not indicative of the price of SBG's common shares or any securities held by the Company and should not form the basis of any investment decisions.

68View entire presentation