EVE SPAC Presentation Deck

Risk Factors

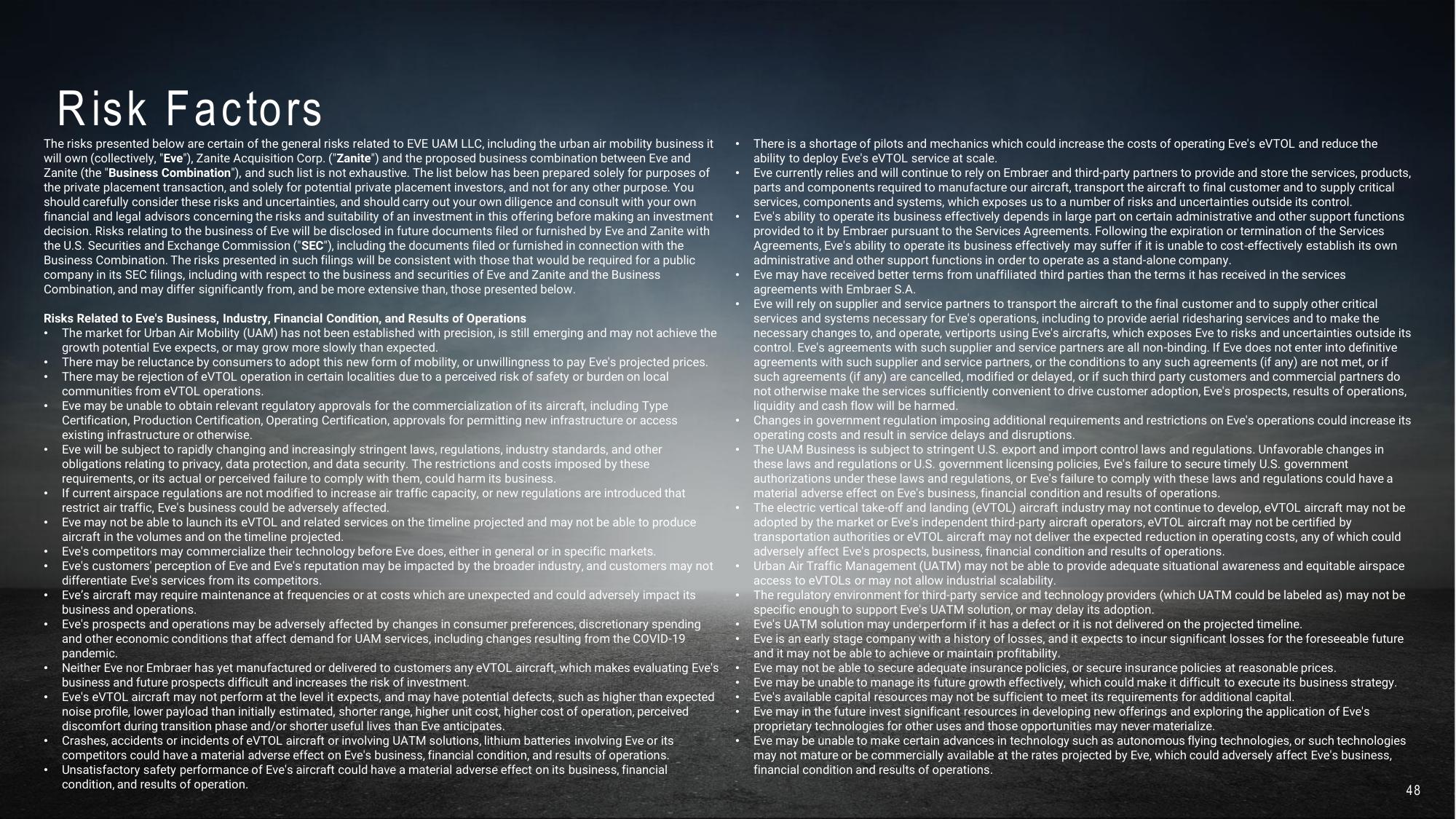

The risks presented below are certain of the general risks related to EVE UAM LLC, including the urban air mobility business it

will own (collectively, "Eve"), Zanite Acquisition Corp. ("Zanite") and the proposed business combination between Eve and

Zanite (the "Business Combination"), and such list is not exhaustive. The list below has been prepared solely for purposes of

the private placement transaction, and solely for potential private placement investors, and not for any other purpose. You

should carefully consider these risks and uncertainties, and should carry out your own diligence and consult with your own

financial and legal advisors concerning the risks and suitability of an investment in this offering before making an investment

decision. Risks relating to the business of Eve will be disclosed in future documents filed or furnished by Eve and Zanite with

the U.S. Securities and Exchange Commission ("SEC"), including the documents filed or furnished in connection with the

Business Combination. The risks presented in such filings will be consistent with those that would be required for a public

company in its SEC filings, including with respect to the business and securities of Eve and Zanite and the Business

Combination, and may differ significantly from, and be more extensive than, those presented below.

Risks Related to Eve's Business, Industry, Financial Condition, and Results of Operations

The market for Urban Air Mobility (UAM) has not been established with precision, is still emerging and may not achieve the

growth potential Eve expects, or may grow more slowly than expected.

There may be reluctance by consumers to adopt this new form of mobility, or unwillingness to pay Eve's projected prices.

There may be rejection of eVTOL operation in certain localities due to a perceived risk of safety or burden on local

communities from eVTOL operations.

Eve may be unable to obtain relevant regulatory approvals for the commercialization of its aircraft, including Type

Certification, Production Certification, Operating Certification, approvals for permitting new infrastructure or access

existing infrastructure or otherwise.

Eve will be subject to rapidly changing and increasingly stringent laws, regulations, industry standards, and other

obligations relating to privacy, data protection, and data security. The restrictions and costs imposed by these

requirements, or its actual or perceived failure to comply with them, could harm its business.

.

.

If current airspace regulations are not modified to increase air traffic capacity, or new regulations are introduced that

restrict air traffic, Eve's business could be adversely affected.

Eve may not be able to launch its eVTOL and related services on the timeline projected and may not be able to produce

aircraft in the volumes and on the timeline projected.

Eve's competitors may commercialize their technology before Eve does, either in general or in specific markets.

Eve's customers' perception of Eve and Eve's reputation may be impacted by the broader industry, and customers may not

differentiate Eve's services from its competitors.

Eve's aircraft may require maintenance at frequencies or at costs which are unexpected and could adversely impact its

business and operations.

Eve's prospects and operations may be adversely affected by changes in consumer preferences, discretionary spending

and other economic conditions that affect demand for UAM services, including changes resulting from the COVID-19

pandemic.

Neither Eve nor Embraer has yet manufactured or delivered to customers any eVTOL aircraft, which makes evaluating Eve's

business and future prospects difficult and increases the risk of investment.

Eve's eVTOL aircraft may not perform at the level it expects, and may have potential defects, such as higher than expected

noise profile, lower payload than initially estimated, shorter range, higher unit cost, higher cost of operation, perceived

discomfort during transition phase and/or shorter useful lives than Eve anticipates.

Crashes, accidents or incidents of eVTOL aircraft or involving UATM solutions, lithium batteries involving Eve or its

competitors could have a material adverse effect on Eve's business, financial condition, and results of operations.

Unsatisfactory safety performance of Eve's aircraft could have a material adverse effect on its business, financial

condition, and results of operation.

There is a shortage of pilots and mechanics which could increase the costs of operating Eve's eVTOL and reduce the

ability to deploy Eve's eVTOL service at scale.

Eve currently relies and will continue to rely on Embraer and third-party partners to provide and store the services, products,

parts and components required to manufacture our aircraft, transport the aircraft to final customer and to supply critical

services, components and systems, which exposes us to a number of risks and uncertainties outside its control.

Eve's ability to operate its business effectively depends in large part on certain administrative and other support functions

provided to it by Embraer pursuant to the Services Agreements. Following the expiration or termination of the Services

Agreements, Eve's ability to operate its business effectively may suffer if it is unable to cost-effectively establish its own

administrative and other support functions in order to operate as a stand-alone company.

Eve may have received better terms from unaffiliated third parties than the terms it has received in the services

agreements with Embraer S.A.

Eve will rely on supplier and service partners to transport the aircraft to the final customer and to supply other critical

services and systems necessary for Eve's operations, including to provide aerial ridesharing services and to make the

necessary changes to, and operate, vertiports using Eve's aircrafts, which exposes Eve to risks and uncertainties outside its

control. Eve's agreements with such supplier and service partners are all non-binding. If Eve does not enter into definitive

agreements with such supplier and service partners, or the conditions to any such agreements (if any) are not met, or if

such agreements (if any) are cancelled, modified or delayed, or if such third party customers and commercial partners do

not otherwise make the services sufficiently convenient to drive customer adoption, Eve's prospects, results of operations,

liquidity and cash flow will be harmed.

Changes in government regulation imposing additional requirements and restrictions on Eve's operations could increase its

operating costs and result in service delays and disruptions.

The UAM Business is subject to stringent U.S. export and import control laws and regulations. Unfavorable changes in

these laws and regulations or U.S. government licensing policies, Eve's failure to secure timely U.S. government

authorizations under these laws and regulations, or Eve's failure to comply with these laws and regulations could have a

material adverse effect on Eve's business, financial condition and results of operations.

The electric vertical take-off and landing (eVTOL) aircraft industry may not continue to develop, eVTOL aircraft may not be

adopted by the market or Eve's independent third-party aircraft operators, eVTOL aircraft may not be certified by

transportation authorities or eVTOL aircraft may not deliver the expected reduction in operating costs, any of which could

adversely affect Eve's prospects, business, financial condition and results of operations.

Urban Air Traffic Management (UATM) may not be able to provide adequate situational awareness and equitable airspace

access to eVTOLS or may not allow industrial scalability.

The regulatory environment for third-party service and technology providers (which UATM could be labeled as) may not be

specific enough to support Eve's UATM solution, or may delay its adoption.

Eve's UATM solution may underperform if it has a defect or it is not delivered on the projected timeline.

Eve is an early stage company with a history of losses, and it expects to incur significant losses for the foreseeable future

and it may not be able to achieve or maintain profitability.

Eve may not be able to secure adequate insurance policies, or secure insurance policies at reasonable prices.

Eve may be unable to manage its future growth effectively, which could make it difficult to execute its business strategy.

Eve's available capital resources may not be sufficient to meet its requirements for additional capital.

Eve may in the future invest significant resources in developing new offerings and exploring the application of Eve's

proprietary technologies for other uses and those opportunities may never materialize.

Eve may be unable to make certain advances in technology such as autonomous flying technologies, or such technologies

may not mature or be commercially available at the rates projected by Eve, which could adversely affect Eve's business,

financial condition and results of operations.

48View entire presentation