Apollo Global Management Investor Day Presentation Deck

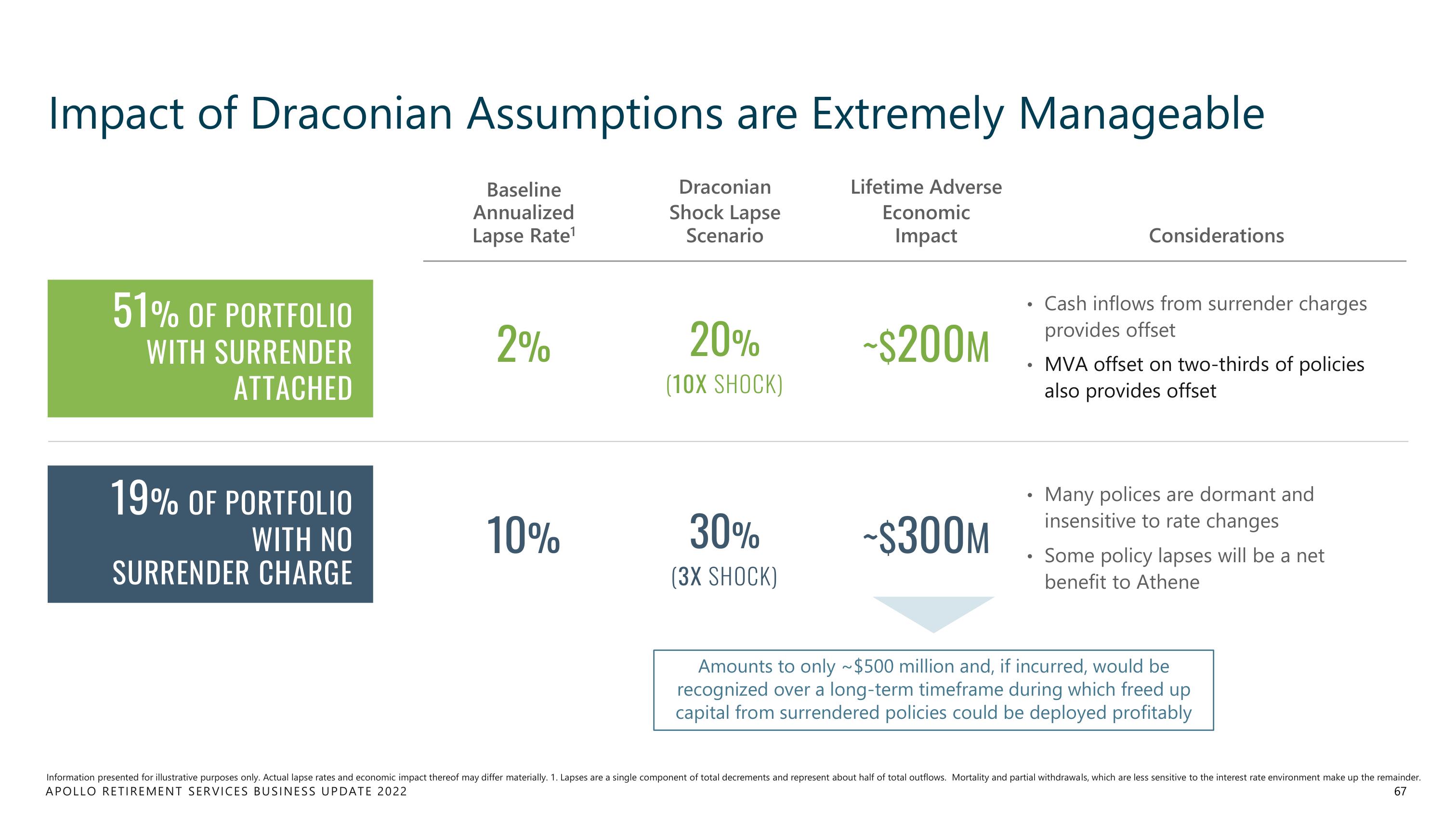

Impact of Draconian Assumptions are Extremely Manageable

51% OF PORTFOLIO

WITH SURRENDER

ATTACHED

19% OF PORTFOLIO

WITH NO

SURRENDER CHARGE

Baseline

Annualized

Lapse Rate¹

2%

10%

Draconian

Shock Lapse

Scenario

20%

(10X SHOCK)

30%

(3X SHOCK)

Lifetime Adverse

Economic

Impact

~$200M

~$300M

●

●

Considerations

Cash inflows from surrender charges

provides offset

MVA offset on two-thirds of policies

also provides offset

Many polices are dormant and

insensitive to rate changes

Some policy lapses will be a net

benefit to Athene

Amounts to only ~$500 million and, if incurred, would be

recognized over a long-term timeframe during which freed up

capital from surrendered policies could be deployed profitably

Information presented for illustrative purposes only. Actual lapse rates and economic impact thereof may differ materially. 1. Lapses are a single component of total decrements and represent about half of total outflows. Mortality and partial withdrawals, which are less sensitive to the interest rate environment make up the remainder.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

67View entire presentation