Inovalon Results Presentation Deck

Q3 2017 - Continued Sequential Improvement inovalon

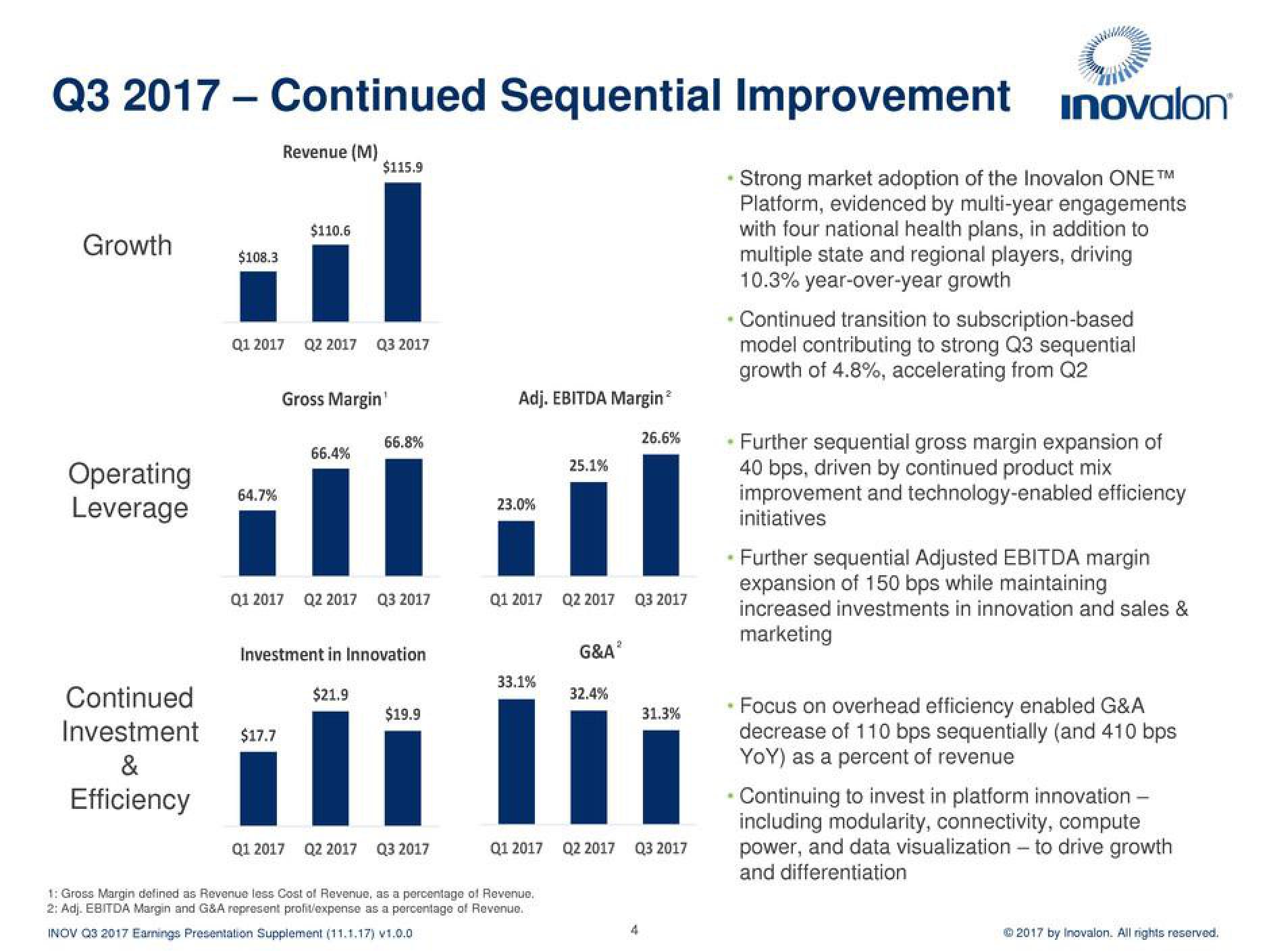

Revenue (M)

Growth

Operating

Leverage

Continued

Investment

&

Efficiency

$108.3

64.7%

$110.6

Q1 2017 Q2 2017 Q3 2017

Gross Margin

$17.7

66.4%

$115.9

Q1 2017 Q2 2017 Q3 2017

66.8%

Investment in Innovation

$21.9

$19.9

Q1 2017 Q2 2017 Q3 2017

Adj. EBITDA Margin²

23.0%

Q1 2017 Q2 2017

33.1%

Q1 2017

25.1%

1: Gross Margin defined as Revenue less Cost of Revenue, as a percentage of Revenue.

2: Adj. EBITDA Margin and G&A represent profit/expense as a percentage of Revenue.

INOV Q3 2017 Earnings Presentation Supplement (11.1.17) v1.0.0

G&AⓇ

32.4%

Q2 2017

26.6%

Q3 2017

4

31.3%

Q3 2017

H

(@

#

Strong market adoption of the Inovalon ONE™

Platform, evidenced by multi-year engagements

with four national health plans, in addition to

multiple state and regional players, driving

10.3% year-over-year growth

Continued transition to subscription-based

model contributing to strong Q3 sequential

growth of 4.8%, accelerating from Q2

Further sequential gross margin expansion of

40 bps, driven by continued product mix

improvement and technology-enabled efficiency

initiatives

Further sequential Adjusted EBITDA margin

expansion of 150 bps while maintaining

increased investments in innovation and sales &

marketing

Focus on overhead efficiency enabled G&A

decrease of 110 bps sequentially (and 410 bps

YoY) as a percent of revenue

Continuing to invest in platform innovation

including modularity, connectivity, compute

power, and data visualization - to drive growth

and differentiation

Ⓒ2017 by Inovalon. All rights reserved.View entire presentation