Evercore Investment Banking Pitch Book

Illustrative Exchange Ratio

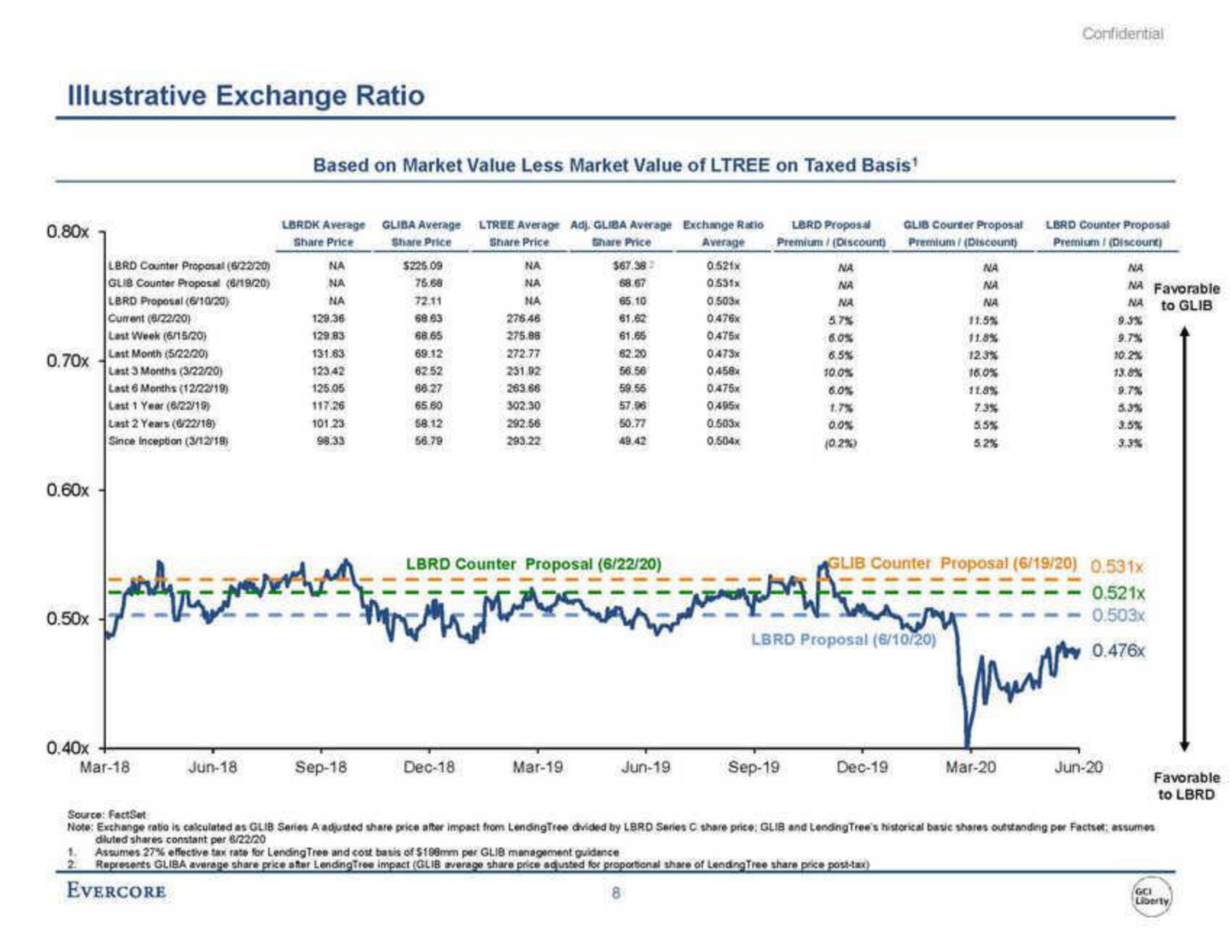

0.80x

0.70x

0.60x

0.50x

0.40x

LBRD Counter Proposal (6/22/20)

GLIB Counter Proposal (6/19/20)

LBRD Proposal (6/10/20)

Current (6/22/20)

Last Week (6/15/20)

Last Month (5/22/20)

Last 3 Months (3/22/20)

Last 6 Months (12/22/19)

Last 1 Year (6/22/19)

Last 2 Years (6/22/18)

Since inception (3/12/18)

Mar-18

Jun-18

Based on Market Value Less Market Value of LTREE on Taxed Basis¹

LBRDK Average

Share Price

NA

NA

NA

129.36

129.83

131.63

12342

125.05

117.26

101.23

98.33

Sep-18

GLIBA Average

Share Price

$225.09

75.68

72.11

68.63

68.65

69.12

62.52

66.27

65.60

58.12

56.79

LTREE Average Adj. GLIBA Average Exchange Ratio

Share Price

Share Price

Average

Dec-18

NA

NA

NA

27646

275.88

272.77

231.92

263.66

302.30

292.56

293.22

$67.38

68.67

LBRD Counter Proposal (6/22/20)

Mar-19

65.10

61.62

61.65

82.20

56.56

59.55

57.96

50.77

49.42

Jun-19

0.521x

0.531x

0.503x

0.476x

0475x

0.473x

0458x

0.475x

0495x

0.503x

0,504x

LBRD Proposal

Premium/ (Discount)

NA

NA

NA

5.7%

6.0%

6.5%

10.0%

Sep-19

6.0%

1.7%

0.0%

(0.2%)

GLIB Counter Proposal

Premium/(Discount)

Dec-19

NA

NA

NA

11.5%

11.8%

12.3%

16.0%

11.8%

7.3%

5.5%

5.2%

Confidential

LBRD Counter Proposal

Premium/ (Discount)

NA

AGLIB Counter Proposal (6/19/20) 0.531x

A

LBRD Proposal (6/10/20)

Мини

Mar-20

NA Favorable

ΝΑ

to GLIB

9.3%

9.7%

10.2%

13.8%

9.7%

5.3%

3.5%

3.3%

Jun-20

0.521x

0.503x

0.476x

Favorable

to LBRD

Source: FactSet

Note: Exchange ratio is calculated as GLIB Series A adjusted share price after impact from LendingTree divided by LBRD Series C share price; GLIB and LendingTree's historical basic shares outstanding per Factset: assumes

diluted shares constant per 6/22/20

1. Assumes 27 % effective tax rate for Lending Tree and cost basis of $190mm per GLIB management guidance

2 Represents GLIBA average share price after LendingTree impact (GLIB average share price adjusted for proportional share of Lending Tree share price post-tax)

EVERCORE

GCI

LibertyView entire presentation