Carlyle Investor Day Presentation Deck

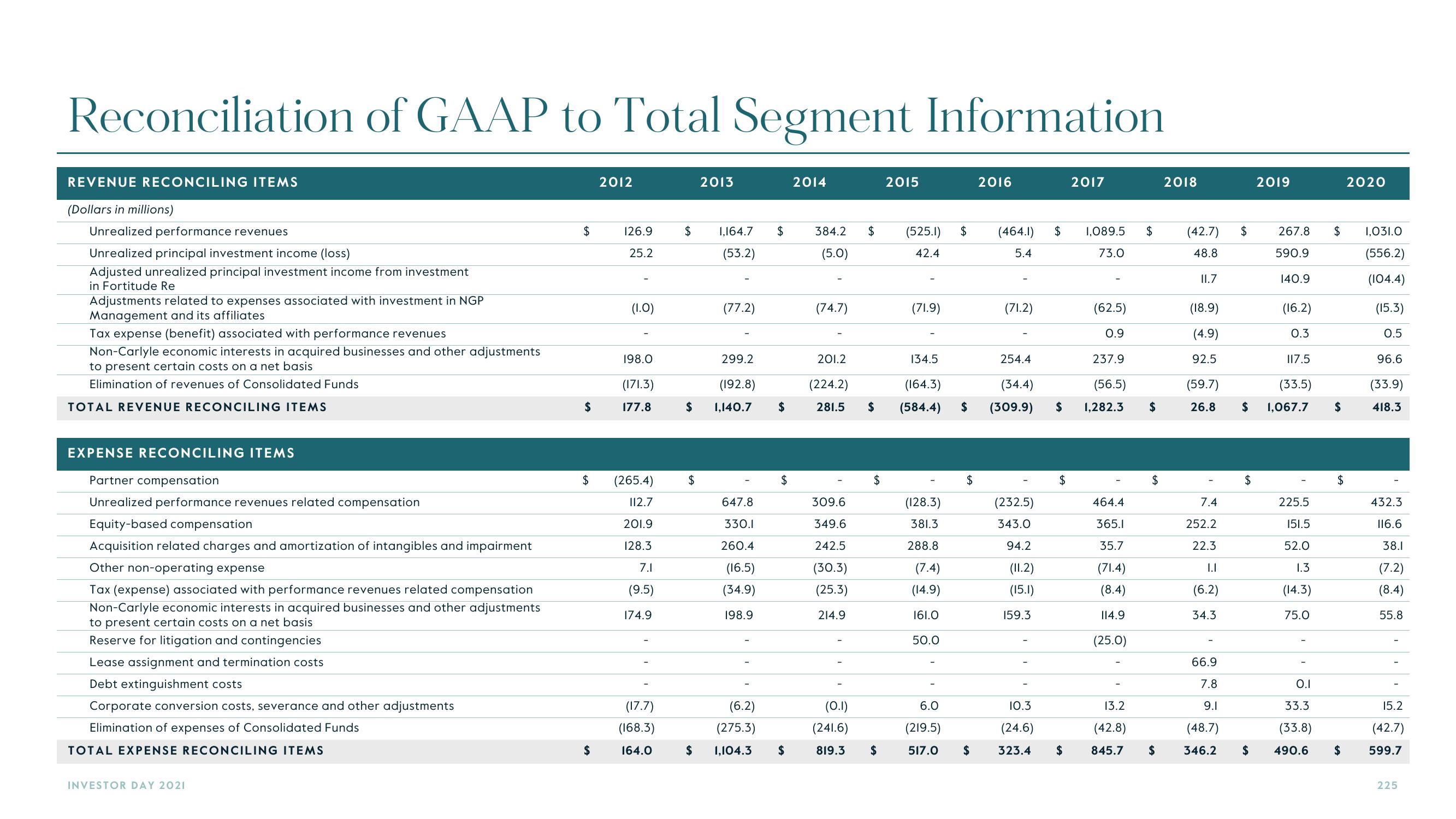

Reconciliation of GAAP to Total Segment Information

REVENUE RECONCILING ITEMS

(Dollars in millions)

Unrealized performance revenues

Unrealized principal investment income (loss)

Adjusted unrealized principal investment income from investment

in Fortitude Re

Adjustments related to expenses associated with investment in NGP

Management and its affiliates

Tax expense (benefit) associated with performance revenues

Non-Carlyle economic interests in acquired businesses and other adjustments

to present certain costs on a net basis

Elimination of revenues of Consolidated Funds

TOTAL REVENUE RECONCILING ITEMS

EXPENSE RECONCILING ITEMS

Partner compensation

Unrealized performance revenues related compensation

Equity-based compensation

Acquisition related charges and amortization of intangibles and impairment

Other non-operating expense

Tax (expense) associated with performance revenues related compensation

Non-Carlyle economic interests in acquired businesses and other adjustments

to present certain costs on a net basis

Reserve for litigation and contingencies

Lease assignment and termination costs

Debt extinguishment costs

Corporate conversion costs, severance and other adjustments

Elimination of expenses of Consolidated Funds

TOTAL EXPENSE RECONCILING ITEMS

INVESTOR DAY 2021

$

$

$

$

2012

126.9

25.2

(1.0)

198.0

(171.3)

177.8

(265.4)

112.7

201.9

128.3

7.1

(9.5)

174.9

(17.7)

(168.3)

164.0

2013

$ 1,164.7

(53.2)

$

(77.2)

299.2

(192.8)

$ 1,140.7 $

647.8

330.1

260.4

(16.5)

(34.9)

198.9

$

(6.2)

(275.3)

$ 1,104.3

$

$

2014

384.2 $ (525.1)

(5.0)

42.4

(74.7)

201.2

(224.2)

281.5 $

309.6

349.6

242.5

(30.3)

(25.3)

214.9

(0.1)

(241.6)

819.3

$

2015

$

(71.9)

134.5

(164.3)

(584.4) $

(128.3)

381.3

288.8

(7.4)

(14.9)

161.0

50.0

6.0

(219.5)

517.0

$ (464.1)

5.4

$

2016

$

(71.2)

(232.5)

343.0

94.2

(11.2)

(15.1)

159.3

254.4

237.9

(56.5)

(34.4)

(309.9) $ 1,282.3 $

10.3

(24.6)

323.4

$ 1,089.5 $

73.0

2017

$

$

(62.5)

0.9

464.4

365.1

35.7

(71.4)

(8.4)

114.9

(25.0)

13.2

(42.8)

845.7

$

$

2018

(42.7) $

48.8

11.7

(18.9)

(4.9)

92.5

(59.7)

26.8

7.4

252.2

22.3

I.I

(6.2)

34.3

66.9

7.8

9.1

(48.7)

346.2

$

$

2019

267.8

590.9

140.9

(16.2)

0.3

117.5

(33.5)

1,067.7 $

225.5

151.5

52.0

1.3

(14.3)

75.0

0.1

33.3

(33.8)

$ 490.6

$ 1,031.0

(556.2)

(104.4)

$

2020

$

(15.3)

0.5

96.6

(33.9)

418.3

432.3

116.6

38.1

(7.2)

(8.4)

55.8

15.2

(42.7)

599.7

225View entire presentation