Embark SPAC Presentation Deck

EMBARK 's Technology is Expected to Drive Significant

Value for Carriers

Three Factors Driving Carrier Adoption

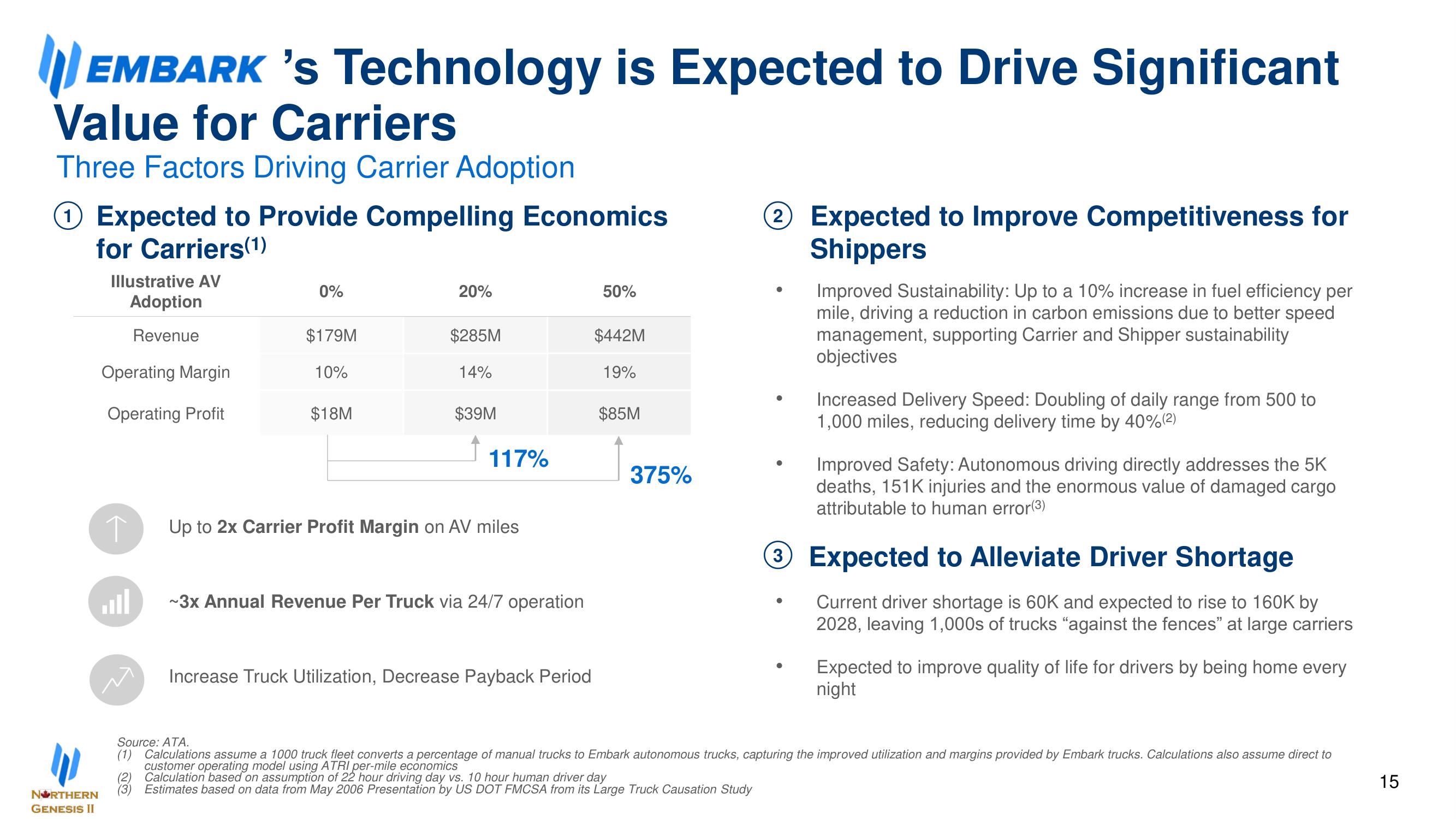

1 Expected to Provide Compelling Economics

for Carriers(1)

Illustrative AV

Adoption

Revenue

"1

NORTHERN

GENESIS II

Operating Margin

Operating Profit

0%

$179M

10%

$18M

20%

$285M

14%

$39M

117%

↑ Up to 2x Carrier Profit Margin on AV miles

~3x Annual Revenue Per Truck via 24/7 operation

Increase Truck Utilization, Decrease Payback Period

50%

$442M

19%

$85M

375%

2 Expected to Improve Competitiveness for

Shippers

●

Improved Sustainability: Up to a 10% increase in fuel efficiency per

mile, driving a reduction in carbon emissions due to better speed

management, supporting Carrier and Shipper sustainability

objectives

Increased Delivery Speed: Doubling of daily range from 500 to

1,000 miles, reducing delivery time by 40% (²)

Improved Safety: Autonomous driving directly addresses the 5K

deaths, 151K injuries and the enormous value of damaged cargo

attributable to human error(3)

3 Expected to Alleviate Driver Shortage

Current driver shortage is 60K and expected to rise to 160K by

2028, leaving 1,000s of trucks "against the fences" at large carriers

Expected to improve quality of life for drivers by being home every

night

Source: ATA.

(1) Calculations assume a 1000 truck fleet converts a percentage of manual trucks to Embark autonomous trucks, capturing the improved utilization and margins provided by Embark trucks. Calculations also assume direct to

customer operating model using ATRI per-mile economics

(2) Calculation based on assumption of 22 hour driving day vs. 10 hour human driver day

(3) Estimates based on data from May 2006 Presentation by US DOT FMCSA from its Large Truck Causation Study

15View entire presentation