CorpAcq SPAC Presentation Deck

24

2A

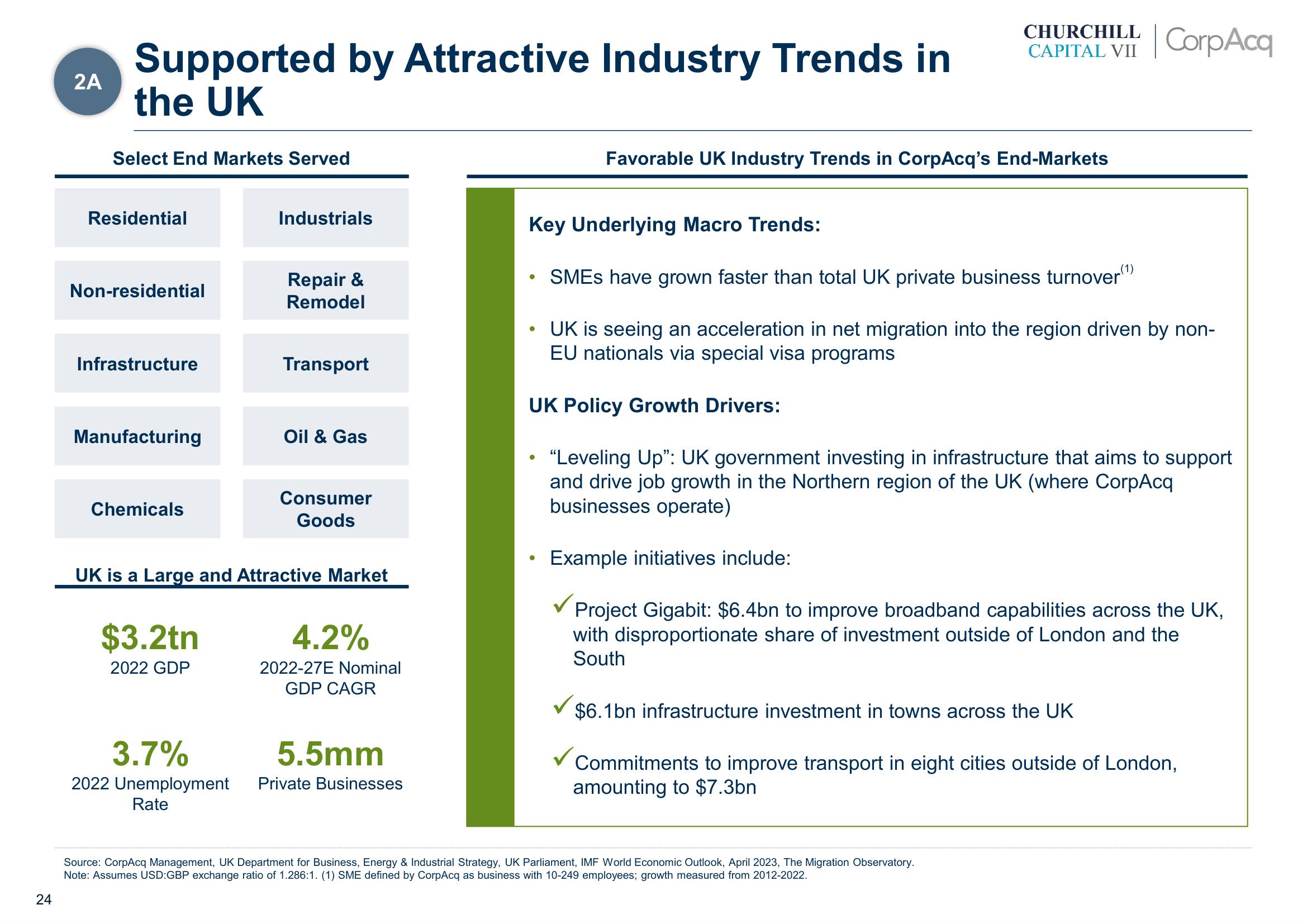

Supported by Attractive Industry Trends in

the UK

Select End Markets Served

Residential

Non-residential

Infrastructure

Manufacturing

Chemicals

Industrials

$3.2tn

2022 GDP

Repair &

Remodel

Transport

Oil & Gas

Consumer

Goods

UK is a Large and Attractive Market

4.2%

2022-27E Nominal

GDP CAGR

3.7%

5.5mm

2022 Unemployment Private Businesses

Rate

●

Key Underlying Macro Trends:

SMEs have grown faster than total UK private business turnover(¹)

Favorable UK Industry Trends in CorpAcq's End-Markets

●

CHURCHILL CorpAcq

CAPITAL VII

UK Policy Growth Drivers:

UK is seeing an acceleration in net migration into the region driven by non-

EU nationals via special visa programs

"Leveling Up": UK government investing in infrastructure that aims to support

and drive job growth in the Northern region of the UK (where CorpAcq

businesses operate)

Example initiatives include:

Project Gigabit: $6.4bn to improve broadband capabilities across the UK,

with disproportionate share of investment outside of London and the

South

$6.1bn infrastructure investment in towns across the UK

Commitments to improve transport in eight cities outside of London,

amounting to $7.3bn

Source: CorpAcq Management, UK Department for Business, Energy & Industrial Strategy, UK Parliament, IMF World Economic Outlook, April 2023, The Migration Observatory.

Note: Assumes USD:GBP exchange ratio of 1.286:1. (1) SME defined by CorpAcq as business with 10-249 employees; growth measured from 2012-2022.View entire presentation