Vici Investor Presentation

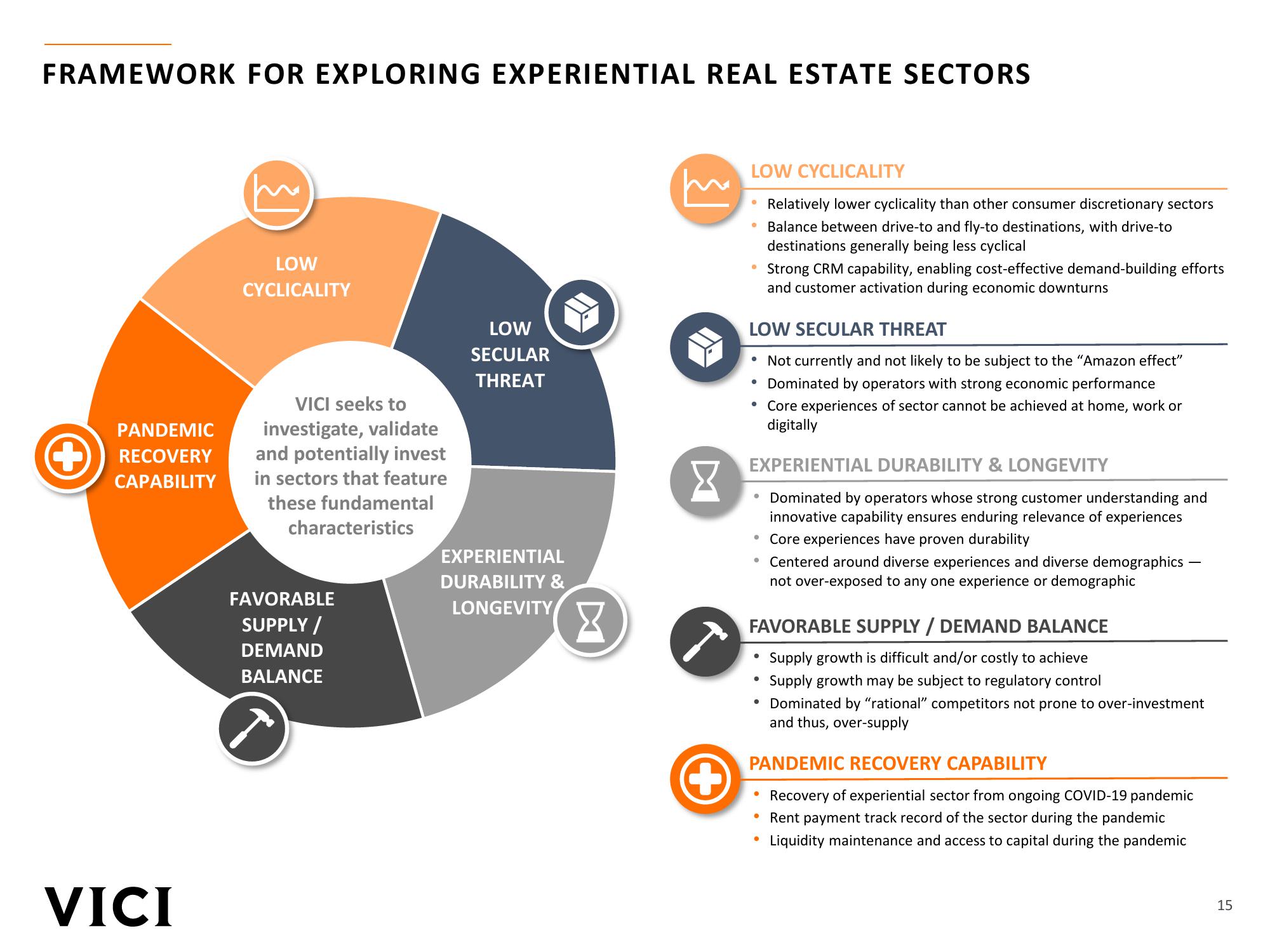

FRAMEWORK FOR EXPLORING EXPERIENTIAL REAL ESTATE SECTORS

PANDEMIC

RECOVERY

CAPABILITY

VICI

}

LOW

CYCLICALITY

VICI seeks to

investigate, validate

and potentially invest

in sectors that feature

these fundamental

characteristics

FAVORABLE

SUPPLY /

DEMAND

BALANCE

LOW

SECULAR

THREAT

EXPERIENTIAL

DURABILITY &

LONGEVITY

X

8

a

LOW CYCLICALITY

Relatively lower cyclicality than other consumer discretionary sectors

Balance between drive-to and fly-to destinations, with drive-to

Ⓡ

●

LOW SECULAR THREAT

• Not currently and not likely to be subject to the "Amazon effect"

Dominated by operators with strong economic performance

• Core experiences of sector cannot be achieved at home, work or

digitally

●

EXPERIENTIAL DURABILITY & LONGEVITY

Dominated by operators whose strong customer understanding and

innovative capability ensures enduring relevance of experiences

Core experiences have proven durability

●

•

destinations generally being less cyclical

Strong CRM capability, enabling cost-effective demand-building efforts

and customer activation during economic downturns

●

FAVORABLE SUPPLY / DEMAND BALANCE

Supply growth is difficult and/or costly to achieve

Supply growth may be subject to regulatory control

•

Centered around diverse experiences and diverse demographics -

not over-exposed to any one experience or demographic

• Dominated by "rational" competitors not prone to over-investment

and thus, over-supply

●

PANDEMIC RECOVERY CAPABILITY

Recovery of experiential sector from ongoing COVID-19 pandemic

Rent payment track record of the sector during the pandemic

Liquidity maintenance and access to capital during the pandemic

15View entire presentation