Trian Partners Activist Presentation Deck

But The Company Has Pulled Back on Organic Growth Investments

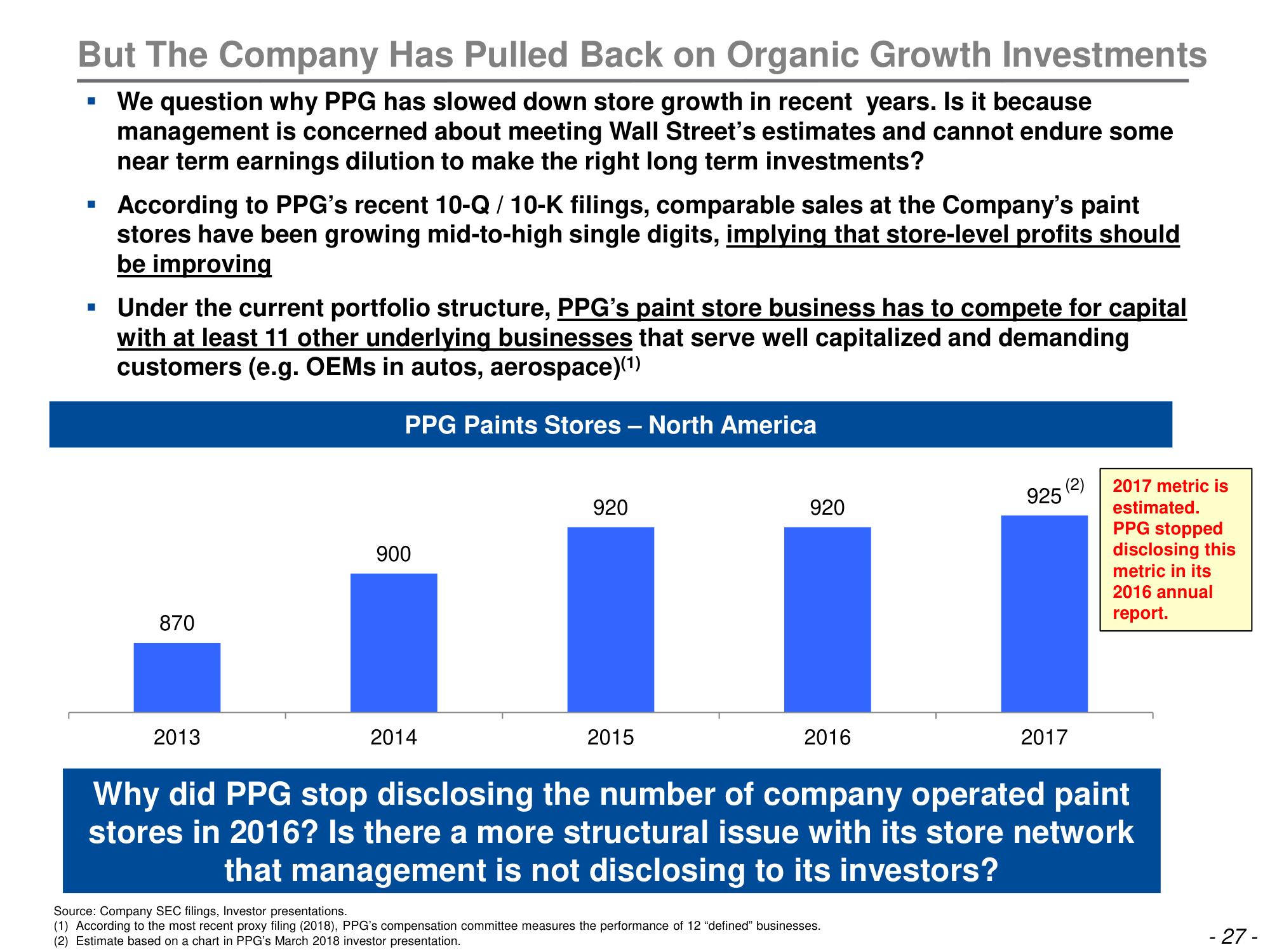

We question why PPG has slowed down store growth in recent years. Is it because

management is concerned about meeting Wall Street's estimates and cannot endure some

near term earnings dilution to make the right long term investments?

■

According to PPG's recent 10-Q / 10-K filings, comparable sales at the Company's paint

stores have been growing mid-to-high single digits, implying that store-level profits should

be improving

Under the current portfolio structure, PPG's paint store business has to compete for capital

with at least 11 other underlying businesses that serve well capitalized and demanding

customers (e.g. OEMs in autos, aerospace)(1)

PPG Paints Stores - North America

870

2013

900

2014

920

2015

920

2016

925 (2)

Source: Company SEC filings, Investor presentations.

(1) According to the most recent proxy filing (2018), PPG's compensation committee measures the performance of 12 "defined" businesses.

(2) Estimate based on a chart in PPG's March 2018 investor presentation.

2017

2017 metric is

estimated.

PPG stopped

disclosing this

metric in its

2016 annual

report.

Why did PPG stop disclosing the number of company operated paint

stores in 2016? Is there a more structural issue with its store network

that management is not disclosing to its investors?

- 27 -View entire presentation