BuzzFeed Investor Presentation Deck

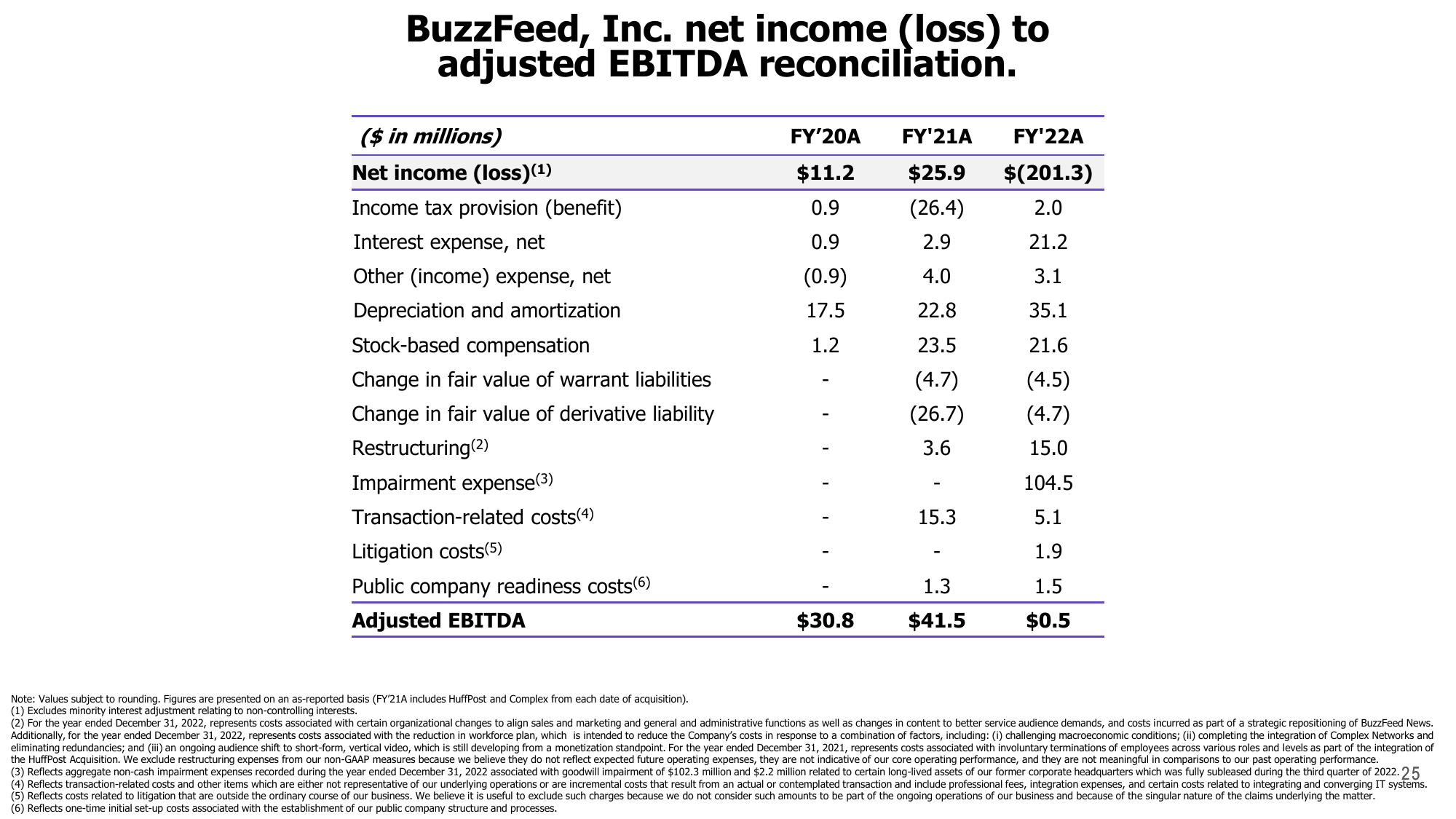

BuzzFeed, Inc. net income (loss) to

adjusted EBITDA reconciliation.

($ in millions)

Net income (loss)(¹)

Income tax provision (benefit)

Interest expense, net

Other (income) expense, net

Depreciation and amortization

Stock-based compensation

Change in fair value of warrant liabilities

Change in fair value of derivative liability

Restructuring (2)

Impairment expense(³)

Transaction-related costs(4)

Litigation costs(5)

Public company readiness costs(6)

Adjusted EBITDA

FY'20A FY'21A

$11.2

0.9

0.9

(0.9)

17.5

1.2

$30.8

FY'22A

$25.9 $(201.3)

(26.4)

2.0

2.9

21.2

4.0

3.1

22.8

35.1

23.5

21.6

(4.7)

(4.5)

(26.7)

(4.7)

3.6

15.0

104.5

5.1

1.9

1.5

$0.5

15.3

1.3

$41.5

Note: Values subject to rounding. Figures are presented on an as-reported basis (FY'21A includes HuffPost and Complex from each date of acquisition).

(1) Excludes minority interest adjustment relating to non-controlling interests.

(2) For the year ended December 31, 2022, represents costs associated with certain organizational changes to align sales and marketing and general and administrative functions as well as changes in content to better service audience demands, and costs incurred as part of a strategic repositioning of BuzzFeed News.

Additionally, for the year ended December 31, 2022, represents costs associated with the reduction in workforce plan, which is intended to reduce the Company's costs in response to a combination of factors, including: (i) challenging macroeconomic conditions; (ii) completing the integration of Complex Networks and

eliminating redundancies; and (iii) an ongoing audience shift to short-form, vertical video, which is still developing from a monetization standpoint. For the year ended December 31, 2021, represents costs associated with involuntary terminations of employees across various roles and levels as part of the integration of

the HuffPost Acquisition. We exclude restructuring expenses from our non-GAAP measures because we believe they do not reflect expected future operating expenses, they are not indicative of our core operating performance, and they are not meaningful in comparisons to our past operating performance.

(3) Reflects aggregate non-cash impairment expenses recorded during the year ended December 31, 2022 associated with goodwill impairment of $102.3 million and $2.2 million related to certain long-lived assets of our former corporate headquarters which was fully subleased during the third quarter of 2022.25

(4) Reflects transaction-related costs and other items which are either not representative of our underlying operations or are incremental costs that result from an actual or contemplated transaction and include professional fees, integration expenses, and certain costs related to integrating and converging IT systems.

(5) Reflects costs related to litigation that are outside the ordinary course of our business. We believe it is useful to exclude such charges because we do not consider such amounts to be part of the ongoing operations of our business and because of the singular nature of the claims underlying the matter.

(6) Reflects one-time initial set-up costs associated with the establishment of our public company structure and processes.View entire presentation