Bridge Investment Group Results Presentation Deck

PERFORMANCE FEE SUMMARY

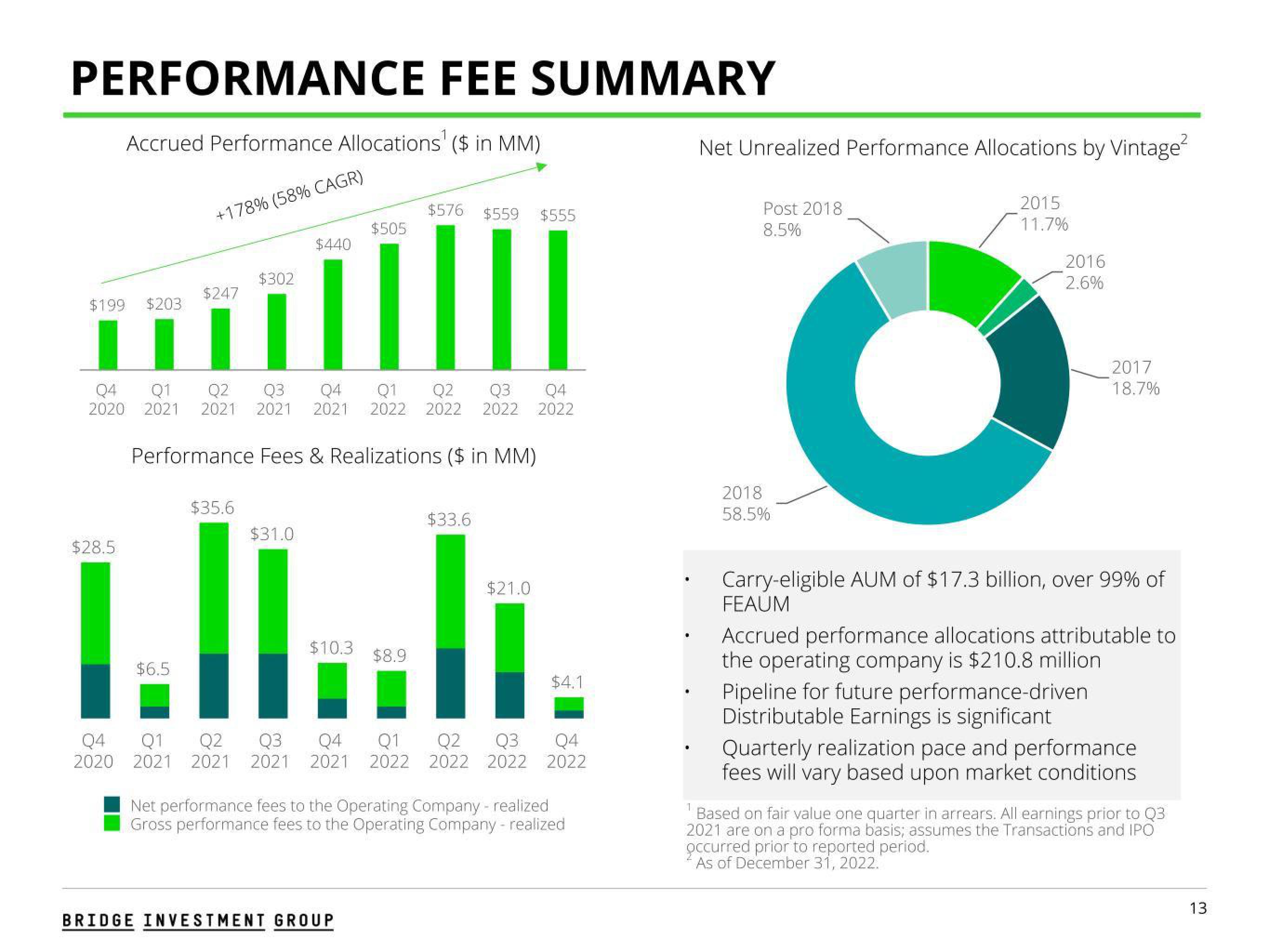

Accrued Performance Allocations ($ in MM)

$199 $203

$28.5

+178% (58% CAGR)

$6.5

$247

$302

$35.6

$440

Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2020 2021 2021 2021 2021 2022 2022 2022 2022

Performance Fees & Realizations ($ in MM)

$31.0

$505

$10.3 $8.9

$576

BRIDGE INVESTMENT GROUP

$559 $555

$33.6

$21.0

Q1 Q2 Q3 Q4 Q1 Q2 Q3

Q4

2020 2021 2021 2021 2021 2022 2022 2022

$4.1

Q4

2022

Net performance fees to the Operating Company - realized

Gross performance fees to the Operating Company - realized

Net Unrealized Performance Allocations by Vintage²

Post 2018

8.5%

2018

58.5%

2015

11.7%

2016

2.6%

2017

18.7%

Carry-eligible AUM of $17.3 billion, over 99% of

FEAUM

Accrued performance allocations attributable to

the operating company is $210.8 million

Pipeline for future performance-driven

Distributable Earnings is significant

Quarterly realization pace and performance

fees will vary based upon market conditions

1

Based on fair value one quarter in arrears. All earnings prior to Q3

2021 are on a pro forma basis; assumes the Transactions and IPO

occurred prior to reported period.

As of December 31, 2022.

13View entire presentation